The pandemic induced lockdown has eaten up the scale of the majority of hospitality and fitness companies in FY21 and this could be observed from the financial performance of Curefit during the last fiscal year.

The Zomato-backed company had a tumultuous couple of years due to uncertainties and challenges caused by Covid-19 and has gone through several changes in its business model. That the fitness business including gyms have been among the last to get free rein to operate after pandemic inspired restrictions hasn’t helped matters at all.

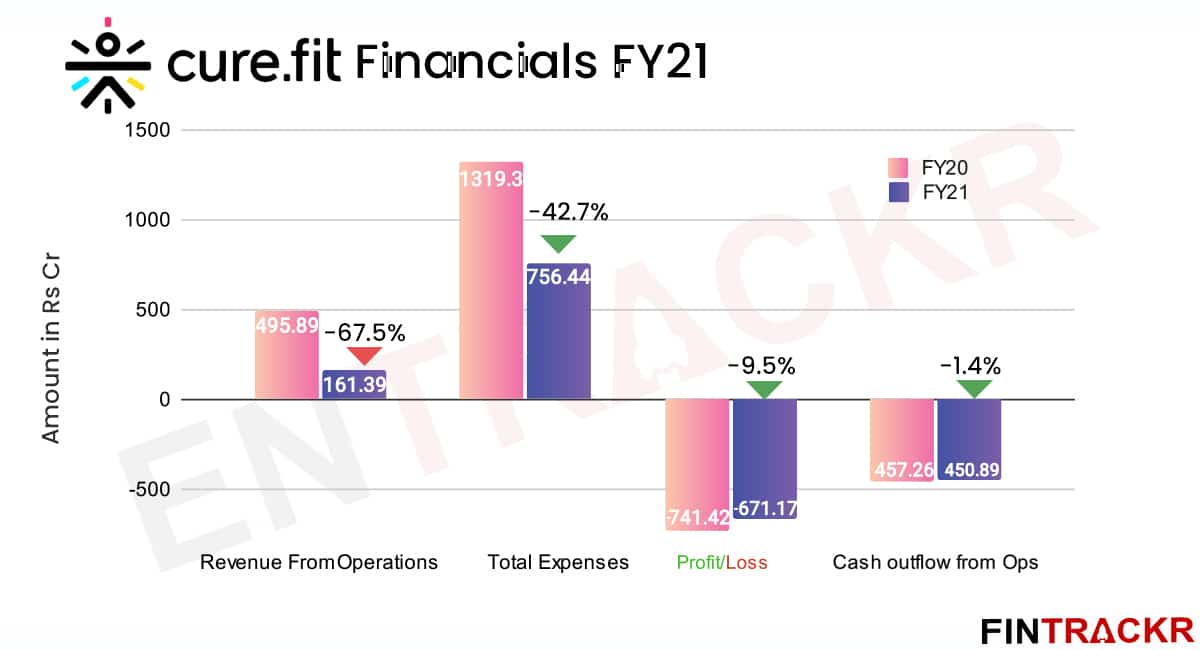

The Mukesh Bansal-led company has finally filed its annual statement for fiscal 2020-2021, during which its operating revenue shrank by 67.5% to Rs 161.4 crore as compared to nearly Rs 496 crore earned during FY20.

Curefit claims to operate more than 350 owned and partnered fitness centres in over 25 cities in India. During countrywide lockdowns in Q1 FY21, the company also launched its online fitness classes, offering paid fitness and nutrition courses to new and existing users.

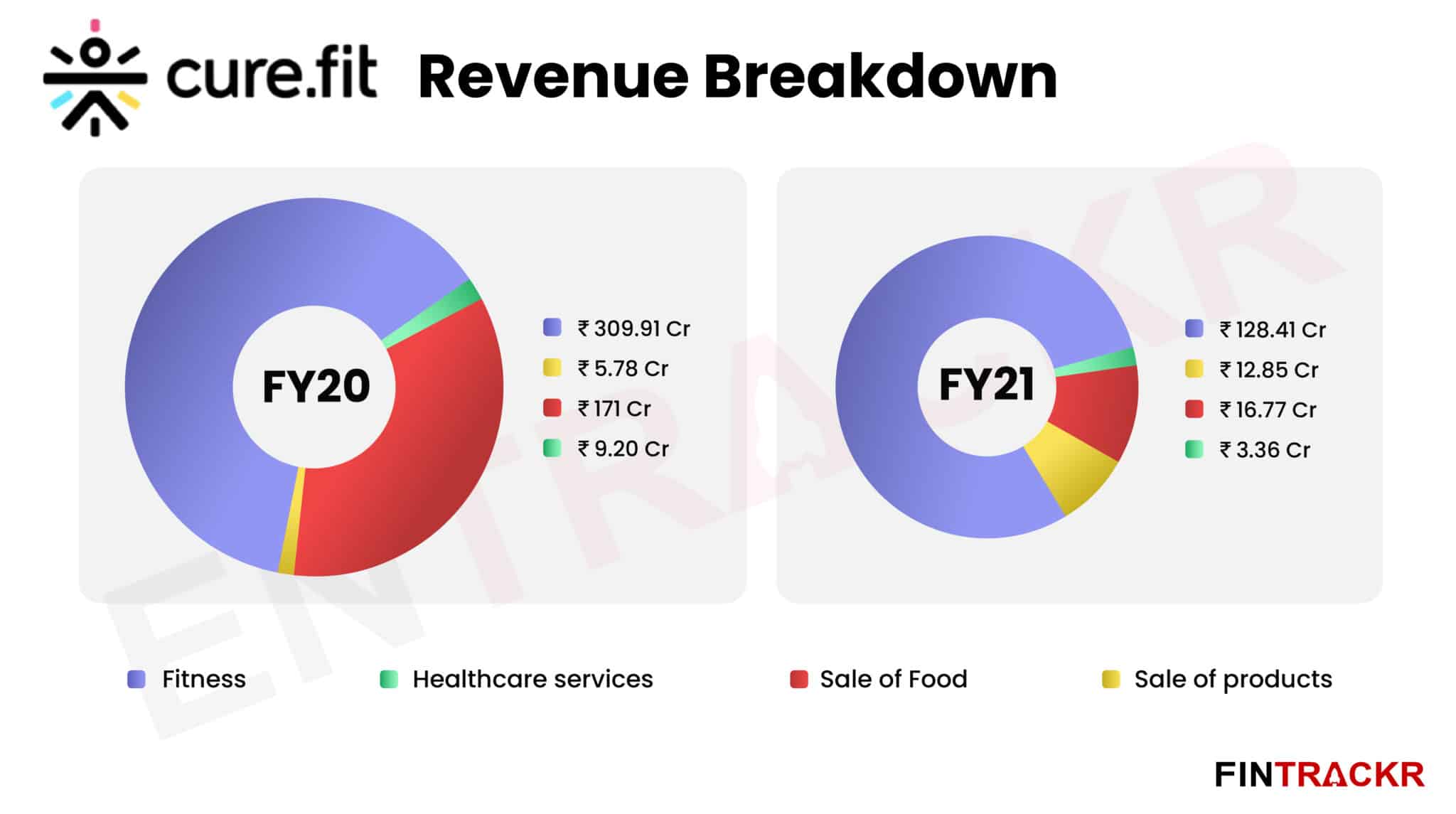

Fitness vertical was the largest revenue driver for the company, generating 80% of its revenues during FY21. The quick online pivot could not save it from a slump though, as collections from the fitness vertical dropped by 59% to Rs 128.41 crore from Rs 310 crore earned in FY20.

Curefit’s food vertical had brought Rs 171 crore to Curefit’s coffers in FY20. It’s worth noting that the company’s food business: EatFit was hived off as a separate entity in October 2020. Revenue from the sale of food was reduced by 90% to only Rs 16.8 crore during FY21.

The company also retails fitness apparel and merchandise under its brand Cultsport and has recently acquired fitness equipment RPM fitness, Fitkit, and Onefitplus and Urban Terrain in a bid to cement itself as a full-stack fitness D2C brand.

Sales of fitness products are the only income segments that showed a jump in revenue, growing 2.2X YoY to Rs 12.85 crore during FY21 as people moved towards at home fitness equipment and merchandise.

Collections from healthcare diagnostics and other related services shrank by 63% to Rs 3.36 crore in FY21 from Rs 9.20 crore in FY20.

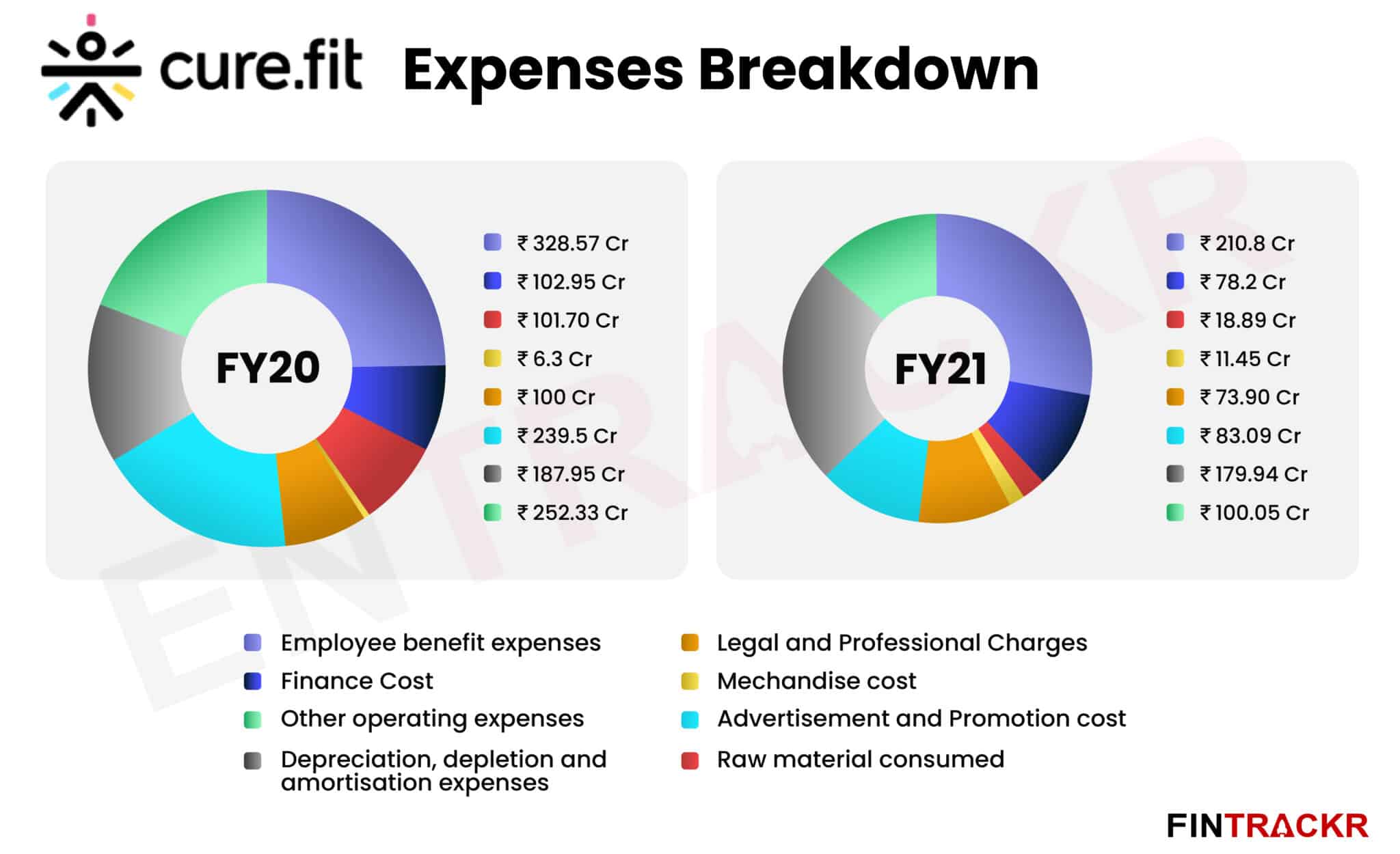

The services-led business has employee benefit payments as the largest single cost, accounting for 28% of its annual expenditure. Right at the start of Q2 FY21 the company had to let go over 1200 employees including fitness trainers, operations staff at CultFit centres and Eat.Fit cloud kitchens in an effort to cut back on the cash burn.

As a result, these payments were reduced by 36% from Rs 328.57 crore paid in FY20 to Rs 210.8 crore in FY21. Importantly, around 26.2% of these payments i.e. Rs 55.2 crore were share-based payments(ESOP) in FY21 as compared to being only 14% of employee costs in FY20.

The austerity measures employed by the management was clearly visible in its customer acquisition operation as the advertisement costs for the company were cut back by 65% YoY to Rs 83.09 crore in FY21 from Rs 239.5 crore spent in FY20.

The company has lease financing agreements in place for the physical centres it operates and its total finance costs were reduced by 24% YoY to Rs 78.2 crore in FY21 due to the closure of several fitness centres across the country.

With the contraction of the scale of its Eat.fit food vertical, the cost of raw materials consumed was also reduced by 81% to only Rs 19 crore in Fy21 from Rs 101.7 crore in FY20. As the demand for fitness merchandise increased during the COVID year fiscal, procurement cost for equipment and apparel grew by 82% YoY to Rs 11.5 crore in FY21.

The Bengaluru based company also employs health and fitness professionals to design its fitness and nutrition programs. Payments made to professionals and legal fees saw an overall reduction of 26% to Rs 73.90 crore in FY21 whereas IT expenses increased by 19% YoY to Rs 20.45 crore as the company increased its virtual presence.

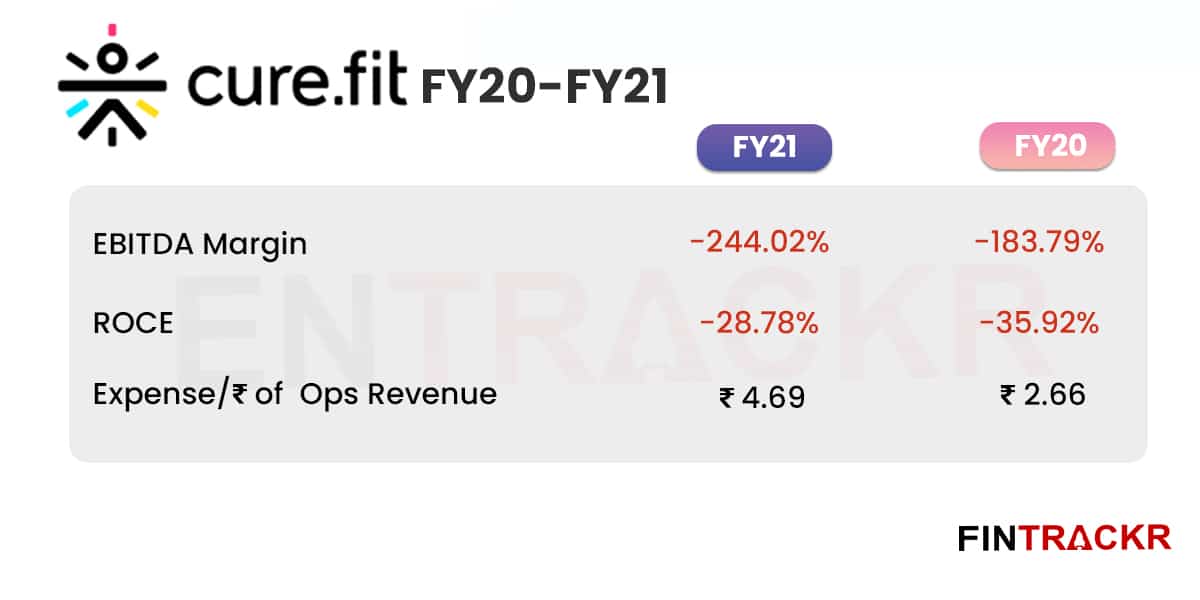

With efforts to curtail costs across all verticals, management at Curefit managed to bring down its annual expenditure by 42.7% to Rs 756.4 crore from Rs 1319.3 crore spent in total during FY20. On a unit level, the company spent Rs 4.69 to earn a single rupee of revenue and managed to stay afloat during the pandemic hit fiscal 2020-2021.

Even with restricted cash burn and offloading of the Eat.Fit business, the company lost Rs 671.7 crore during FY21 due to severe contraction in the scale of operations.

EBITDA margins worsened from -183.85 in FY20 to -244.02% during FY21 as the company revamped its business model and went from a growth stage company with high cashburn to changing its business model in an effort to survive the pandemic.

The company has received more than $175 million from Tata Digital and Zomato in 2021, which funded a series of acquisitions including fitness equipment brands and legacy fitness chains( Golds’ Gym) to revive its brand offering full-stack fitness solutions.

If there ever was a sour spot, as opposed to a sweet spot in a situation, Curefit found itself in it for all of FY21. The damage it has suffered has wiped out a huge amount of money and effort that had been invested previously, in the push to create and lead a category. Curefit’s best hope now is to hope for a full return to normalcy, as it seeks to make the most of the cards it has been dealt. An unexpected advantage is the reduced competitive scenario, as thousands of smaller fitness centres and gyms shut down, many for good. Curefit, with its privileged access to a cap table of marquee investors, knows that it is lucky to have survived. The question is, can it make the most of the new market realities, especially as further fundraises will surely be more difficult?