Sridhar Vembu-led Zoho, best known for its eponymous online office suite, has delivered another year of stupendous growth in 2021 with profits surging over two-fold during the fiscal year ending March 2021.

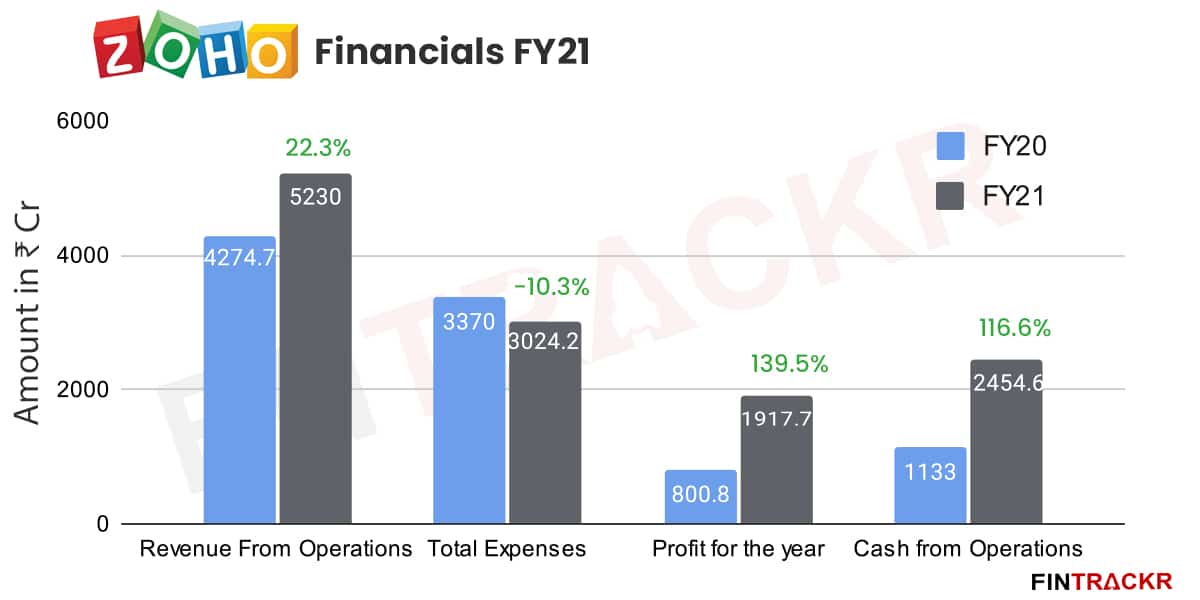

Its revenue from operations climbed 22.3% to around Rs 5,230 crore ($697 Mn) during FY21 from Rs 4,274 crore ($570 Mn) in FY20, the company’s annual financial statements filed with the RoC show.

In comparison, its closest competitor, US-based Hubspot’s revenue grew by 47% YoY to $1.3 billion in 2021, compared to 2020. Freshworks, which was listed on NASDAQ in September 2021, reported $371.0 million (Rs 2,756 crore) in revenue in CY21. It reported a loss from operations of $204.8 million (Rs 1,521 crore), compared to $56.1 million(Rs 416 crore) in 2020.

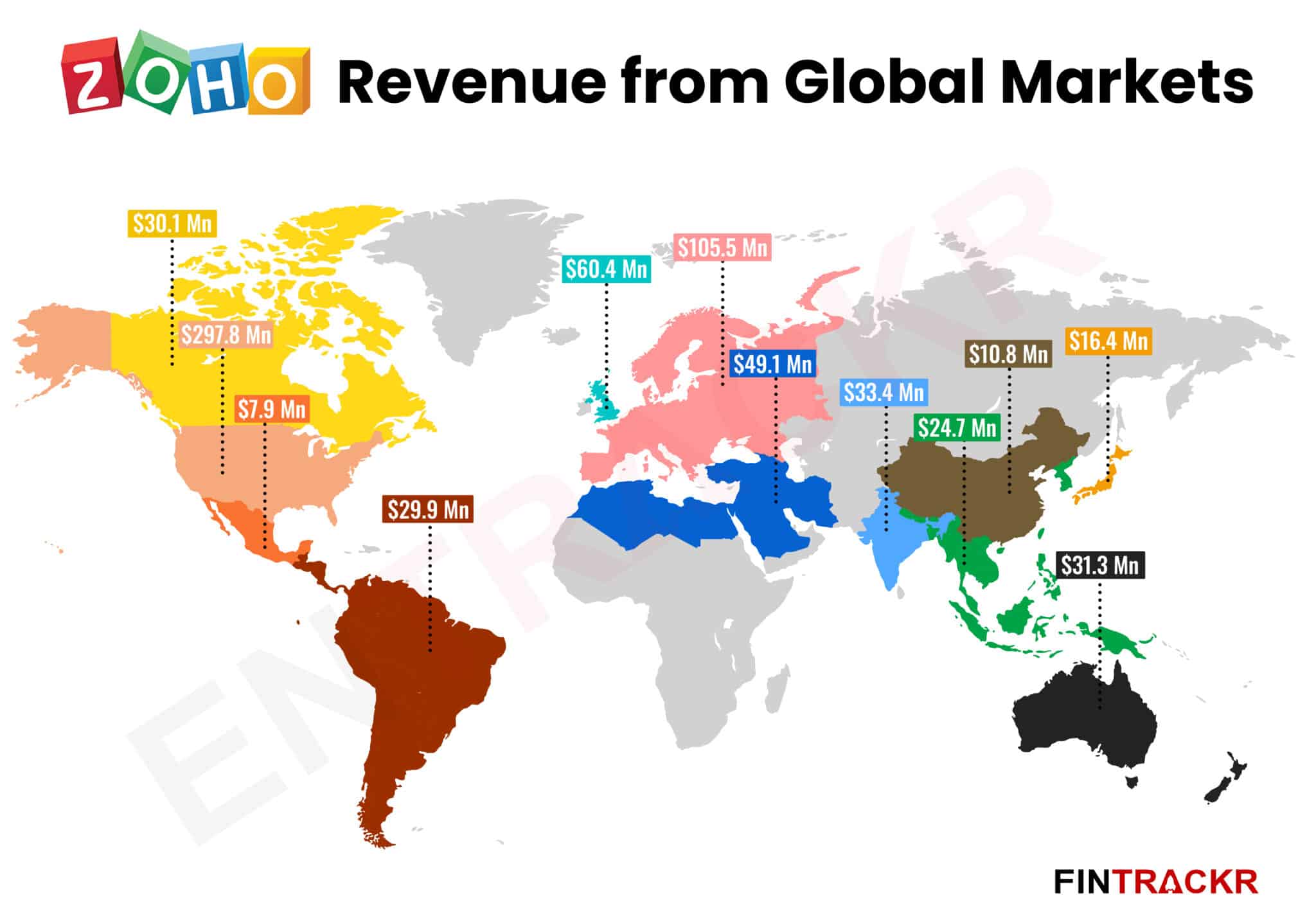

Chennai-based Zoho generates majority of its revenues through the sale of its cloud software suite licenses and software subscription fee collected from its clients across 12 geographies around the world.

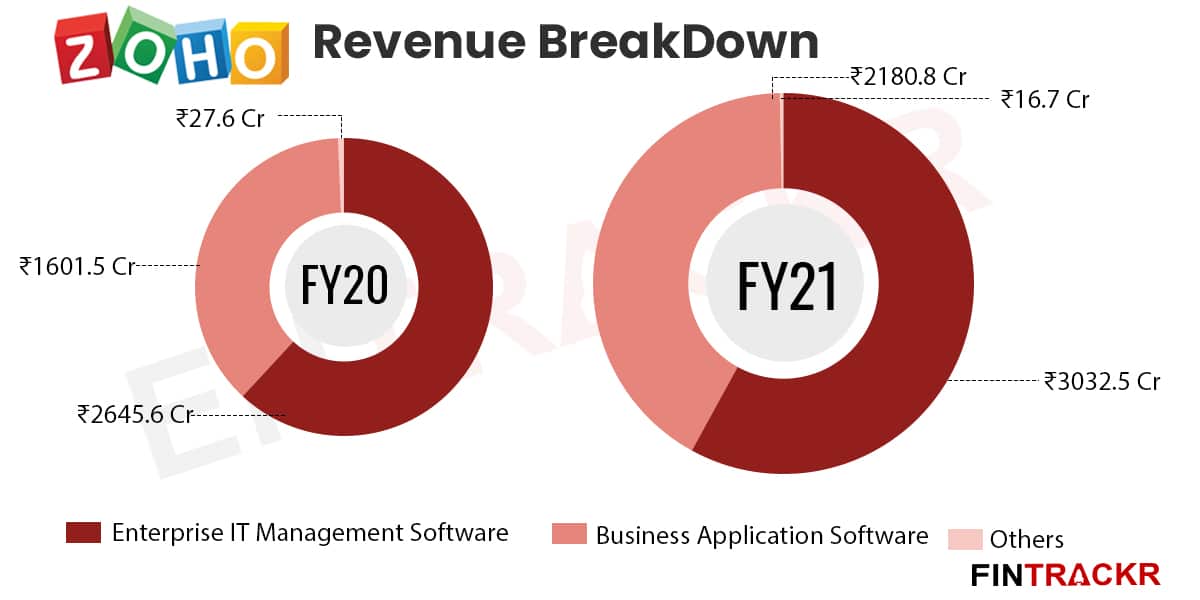

Enterprise IT Management Software is the largest operating segment for the firm in terms of collections, accounting for 58% of the annual revenues. Such revenues grew 14.6% to Rs 3,032.5 crore in FY21 from Rs 2645.6 crore from the same segment in FY20.

Zoho’s business application software segment recorded the strongest growth, making up 41.7% of its operating revenues. Income from this segment grew by over 36.2% to Rs 2,180.8 crore during FY21 as compared to Rs 1,601.5 crore earned from the segment in FY20.

Other operating revenues which include the rental income collected by Zoho from its IT Parks, were reduced by 39.5% to Rs 16.7 crore from Rs 27.6 crore earned during the pre-Covid period of FY20.

The United States remains its largest geographical market, generating 42.7% of the sales i.e. Rs 2,233.3 crore ($297.8 Mn) followed by Continental Europe which brought in 15. 12% of the sales. India is amongst Zoho’s smallest markets with only 4.7% i.e. Rs 250.5 crore ($33.4 Mn) of its operating revenues coming from here.

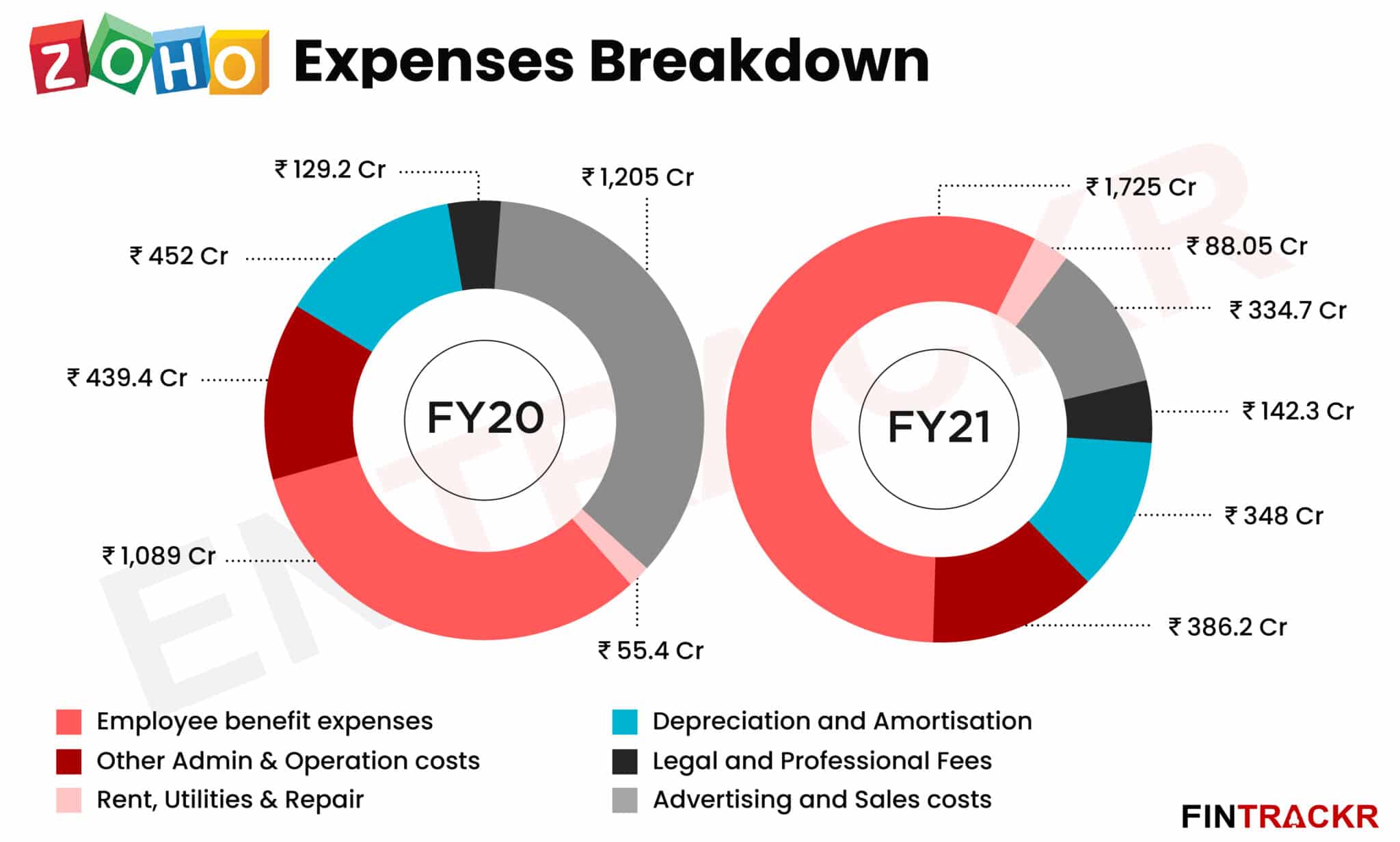

Moving onto the expense sheet, employee benefit expenditure is the largest cost centre for the company, accounting for 57% of its annual expenses. Zoho increased its employee base to handle increased operational scale which showed in the staff costs that grew by 58.4% to Rs 1,725 crore during FY21 from Rs 1,089 crore paid out in FY20.

Zoho’s management restricted its customer acquisition activities during the fiscal year affected by the pandemic. As a result, advertising/promotion costs were brought down by a whopping 72.2% to Rs 334.7 crore in FY21 as compared to Rs 1,205 crore in FY20. These costs made up around 36% of annual expenditure in FY20 which was restricted to 11% in FY21.

The company’s spending on legal professional fees went up by 10.1% YoY to Rs 142.3 crore while bank charges paid during the year grew by 27.5% to Rs 72.7 crore during FY21.

Miscellaneous expenditure (including server and IT costs) amounted to Rs 203.6 crore while rental, repair and utility payments grew by 60% to Rs 88 crore in FY21. Zoho’s tax expenditure surged 2.3X to nearly Rs 501 crore and it spent another Rs 14 crore on corporate social responsibility initiatives during the fiscal year ending in March 2021.

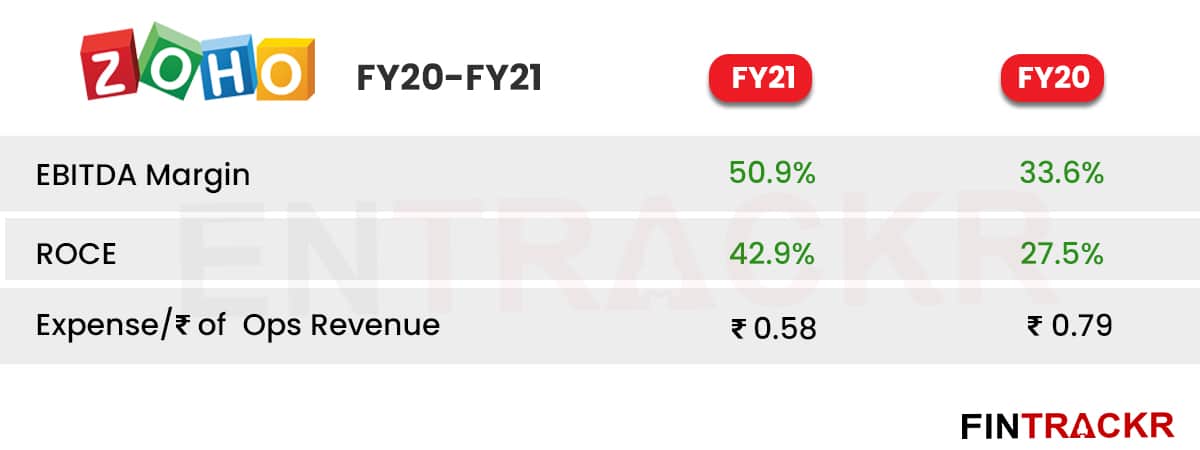

Even with the growth in scale, the company has managed to bring down its aggregate annual expenditure by 10.3% to Rs 3,024.2 crore during FY21 from Rs 3,370 crore spent in FY20. Zoho spent Rs 0.58 to earn a single rupee of revenue with an EBITDA margin reaching nearly 51% for the fiscal ended in March 2021.

Riding the wave of scaled growth and improved margins, Zoho has managed to increase annual profits by 2.4X to nearly Rs 1,918 crore ($255.7 Mn) during FY21 as compared to profits of Rs 800.8 crore ($106.8 Mn) in FY20.

Riding the wave of scaled growth and improved margins, Zoho has managed to increase annual profits by 2.4X to nearly Rs 1,918 crore ($255.7 Mn) during FY21 as compared to profits of Rs 800.8 crore ($106.8 Mn) in FY20.

While this profit growth has been driven primarily by the cut back on advertising and promotion costs, it remains to be seen if the firm has stumbled on a model where it can rein in the same costs on a long term basis to maintain such high margins.