E-commerce-focused logistics has grown multi-fold in the past decade and this could be observed from the growing scale of Delhivery, Ecom Express and Shadowfax. Delhivery turned into the largest supply-chain company in India by outpacing BlueDart in terms of revenue in FY21. Its operating income grew by 31% to Rs 3,646 crore during the fiscal year ending March 2021.

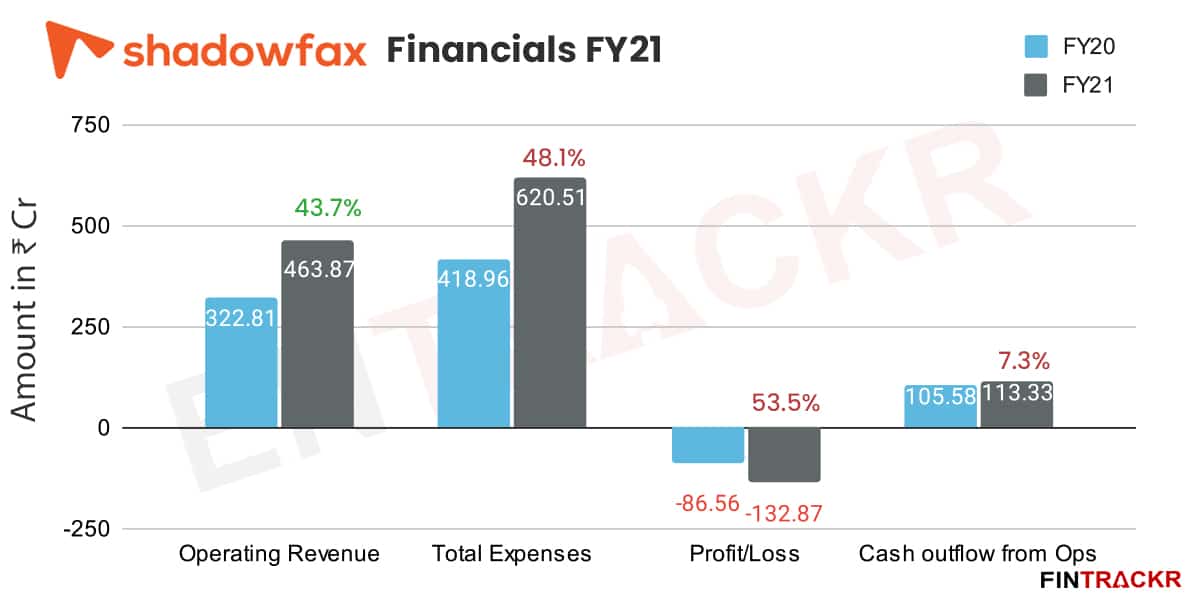

While Ecom Express is yet to file annual financial statements for FY21, Shadowfax has demonstrated strong growth with a 43.7% increase in its operating revenue.

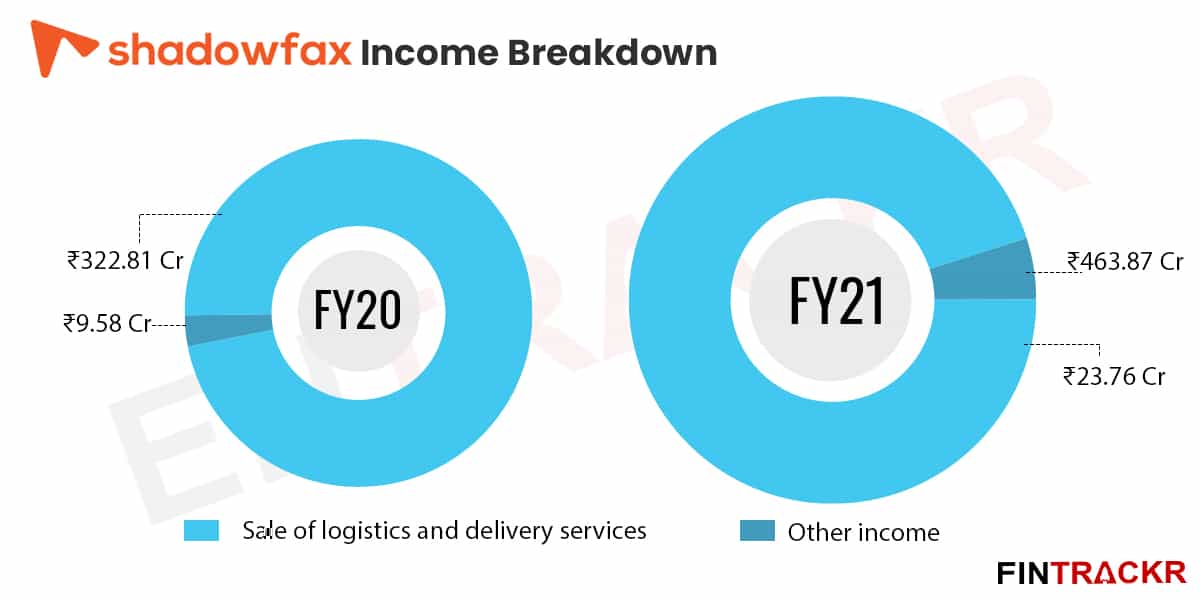

As per its annual filings, the company’s revenue stood at nearly Rs 464 crore for FY21 as compared to Rs 323 crore it collected in FY20. For perspective, Shadowfax revenue had grown by 93% during FY20.

The Bengaluru based company provides logistics and delivery services in over 700 cities in India and claims to work with over 100 brand partners.

The Flipkart-backed company also earned Rs 23.76 crore from its financial assets during FY21, registering a 148% growth in non-operating income.

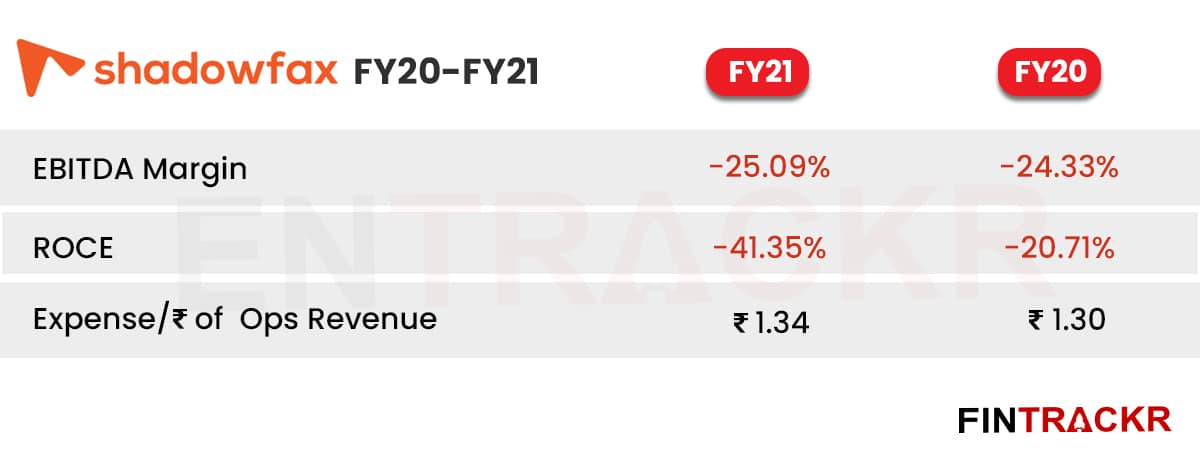

Keeping in line with the income, the total expenses of the company also grew by 48.1% to Rs 620.51 crore during FY21 from Rs 418.96 crore spent in total in FY20. Shadowfax has spent Rs 1.34 to earn a single rupee of operating revenue, remaining fairly stable during the fiscal ended in March 2021.

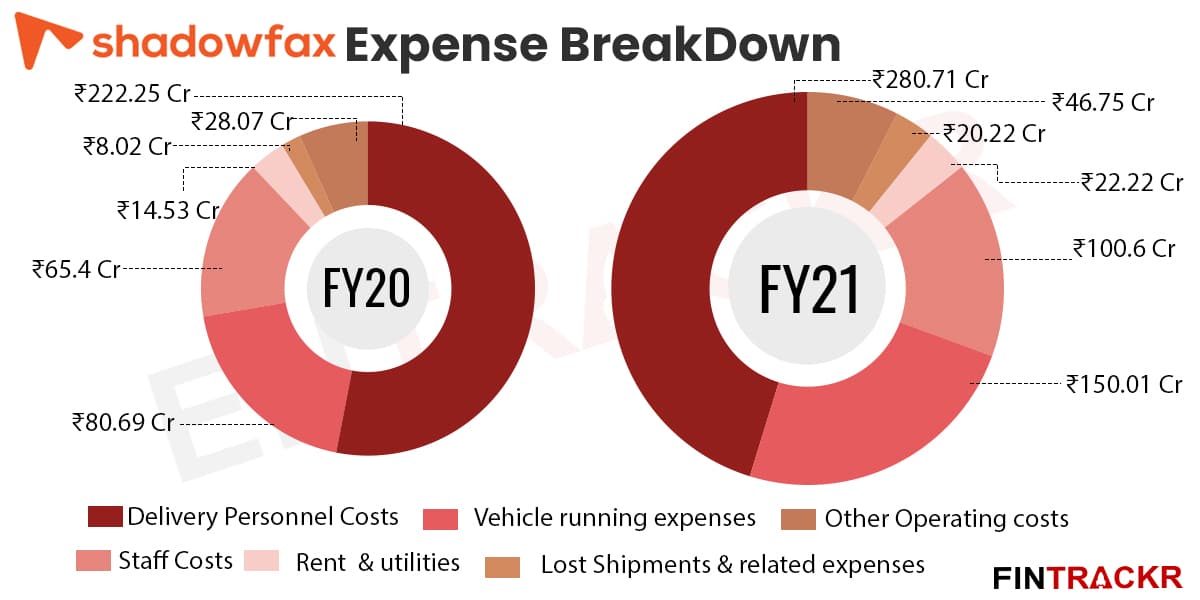

Payments made to delivery personnel is the largest cost centre for the logistics company, accounting for 45.2% of the annual costs during the last fiscal. These expenses grew by 26.3% to Rs 280.71 crore during FY21 from Rs 222.25 crore in FY20.

Payments made to delivery personnel is the largest cost centre for the logistics company, accounting for 45.2% of the annual costs during the last fiscal. These expenses grew by 26.3% to Rs 280.71 crore during FY21 from Rs 222.25 crore in FY20.

Expenditure incurred on running delivery vehicles was the second biggest line item in the expenses sheet, making up 24.2% of the company’s total costs. Such expenses grew nearly 86% to a little over Rs 150 crore in FY21 as compared to Rs 80.7 crore spent in the preceding fiscal.

Shadowfax’s expenditure on employee benefits has ballooned 53.8% to Rs 100.58 crore in FY21 from Rs 65.4 crore during FY20. These staff costs also included stock option payments of around Rs 24 crore( i.e 24% of total staff costs) made during FY21.

While there is evident growth in scale, the company is yet to improve its margins on collections and is continuing to burn cash. Annual losses have climbed 53.5% YoY to nearly 133 crore during FY21 while outstanding losses stood at Rs 334.6 crore at the end of March 2021.

The management has taken steps to increase its operational scale, disinvesting nearly Rs 143 crore from financial assets which were utilised for procurement of plant and machinery(warehouse expansion & equipment) and operational expenditure.

Shadowfax has grown at a strong clip during FY21 but growth seems to be slowing when compared to the momentum it had from FY20, which is quite surprising as the demand for e-commerce had peaked during the pandemic hit fiscal year (FY21). Of late, Shadowfax has been scaling up its hyperlocal logistics services which it offers to the likes of Zomato, Swiggy and quick commerce companies. This vertical is likely to grow substantially apart from its core e-commerce focused logistics business and they may help the company to grow further in the ongoing fiscal year (FY22).