Bounce, which pivoted to become an electric scooter manufacturer at the start of the ongoing fiscal (FY22) with the acquisition of 22Motors was a scooter rental platform in FY21. The pivot and the pandemic on fiscal year (FY21) has wiped out its scale.

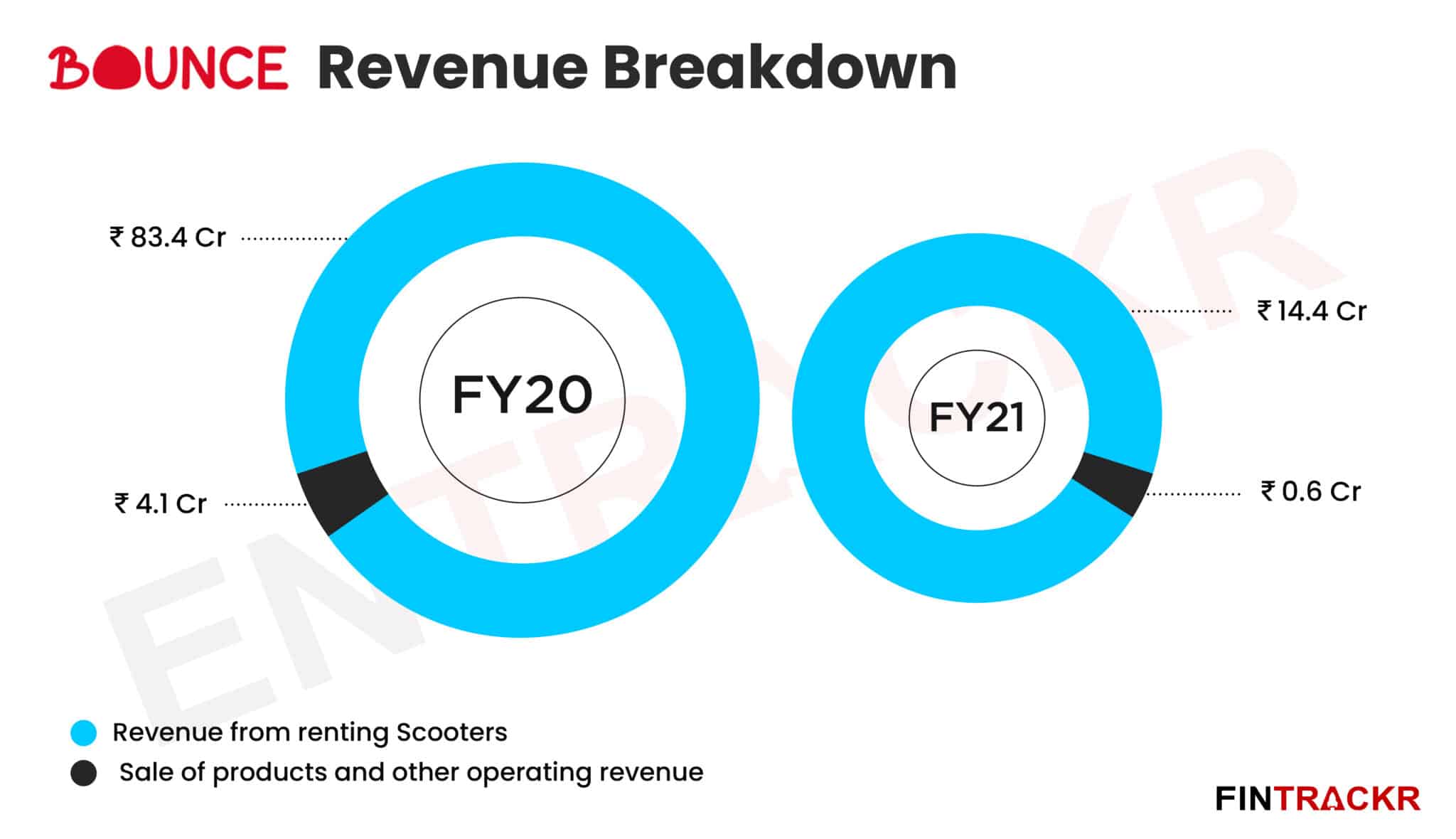

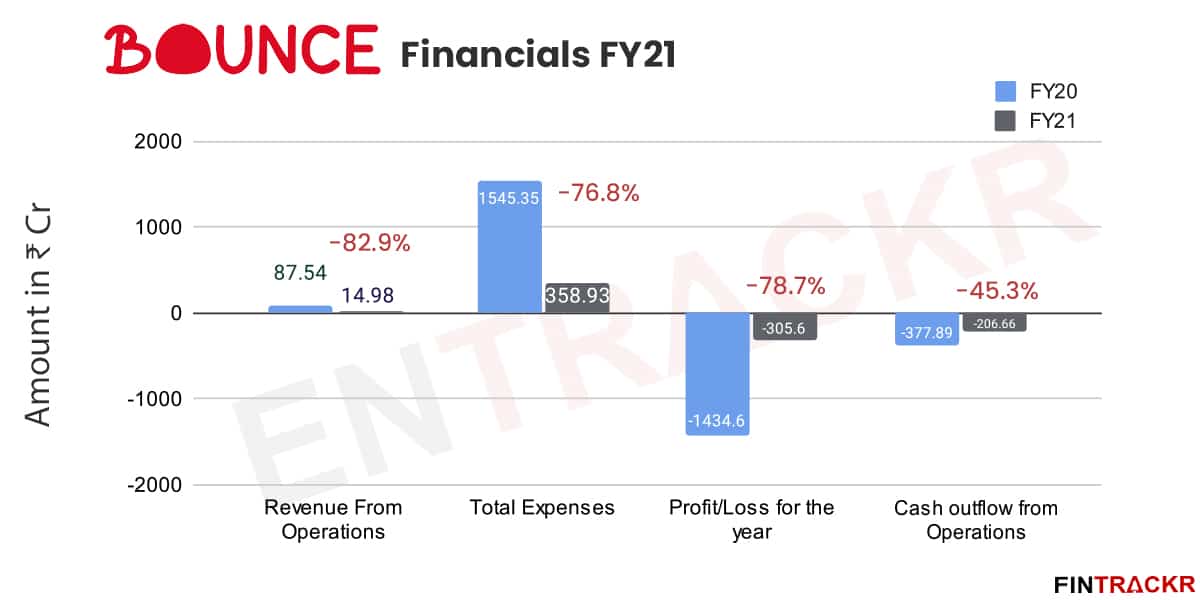

During the year, Bounce’s operating revenue shrank by 83% to around Rs 15 crore in FY21 from Rs 87.5 crore earned in FY20.

Around 96% of the company’s operating revenue came from rentals of motorcycles and bicycles within the six cities in which it currently operates. This revenue was reduced by 83% to Rs 14.4 crore in FY21 from Rs 83.4 crore it made in FY20.

The remaining 4% revenue originated from the sale of products(safety kit, helmets, electric power packs et al) and other ancillary services which dropped by 87% to only Rs 60 lakhs in FY21 from Rs 4.1 crore in FY20.

The Bengaluru based company also collected finance income of 38.34 crore in FY 21, 65% more as compared to Rs 23.22 crore in FY20. The firm had raised a series D round of $105 m in Jan 2020.

Salaries , ESOPs and SARs payments went up 11.1%

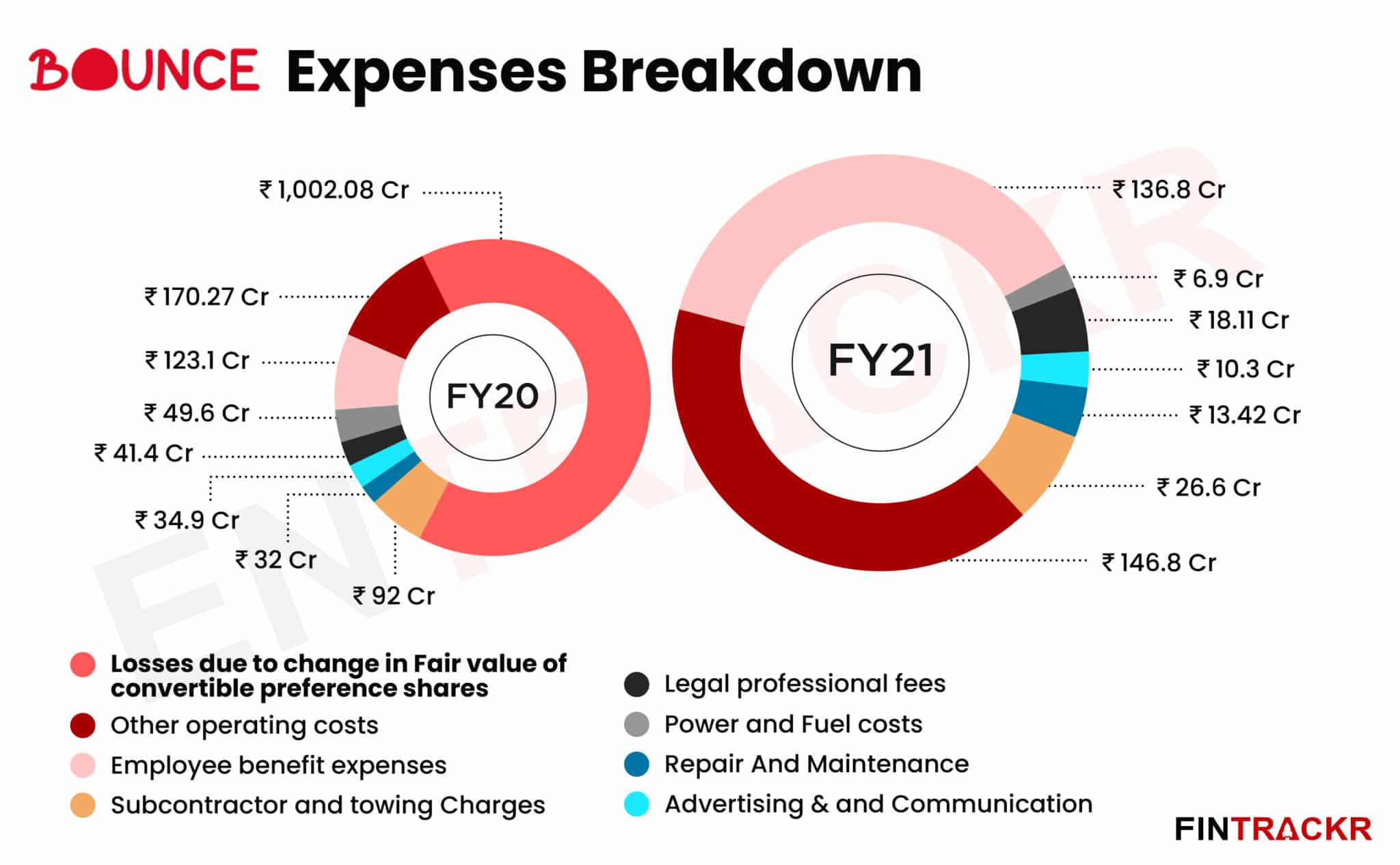

Moving over to the expenses sheet, we observe that employee benefit payments were the largest cost center for Bounce, accounting for 38% of the annual expenses. This cost grew by 11% from Rs 123.09 crore in FY20 to Rs 136.8 crore during FY21 including ESOP and stock appreciation right (SARs) expenses of Rs 26.13 crore. Importantly, ESOP and SAR payments made up 19.1% of the employee benefits in FY21 as compared to only 4.7% during FY20.

Operating costs cut back to sustain with reduced scale.

Apart from employee costs, austerity measures employed by the management during the last fiscal were clearly evident throughout the rest of operating expenses by Bounce during FY20-21.

Advertising and communication expenses went down by 70.5% YoY to Rs 10.3 crore while legal and professional fees were cut by 56.3% YoY to Rs 18.11 crore during the fiscal ended in March 2021.

Other operating costs also shrank in step with reduced scale of operations. For instance, power and fuel expenses shank 86.1% YoY to Rs 6.9 crore and repair/maintenance costs were slashed by 58.1% YoY to Rs 13.42 crore during FY21.

Further, payments to subcontractors and towing agents were reduced by 71.1% to Rs 26.6 crore from Rs 92 crore paid out in FY20.

The magic of accounts and presentation

Prima facie, it seems that the management at Bounce did a fantastic turnaround and managed to bring down aggregate annual expenditure by 76.8% to Rs 358.93 crore in FY21 from Rs 1,545.35 crore spent during FY20.

But there’s more to this.

Under “other expenses”, the company has booked Rs 1,002.08 crore on account of “change in fair valuation of preference shares” for the fiscal ended in March 2021. As per IAS 32, compulsorily convertible preference shares (primarily used by the startup to raise funds) with buyback clause are considered as debt rather than equity.

Bounce’s preference shares have significantly appreciated in value and that change was booked as a non-cash expense retroactively in the restated accounts for FY19 and FY20. Hence, the company’s actual expenses for FY20 stood around 543.3 crore sans the non-cash regulatory expense of Rs 1,002.08 crore.

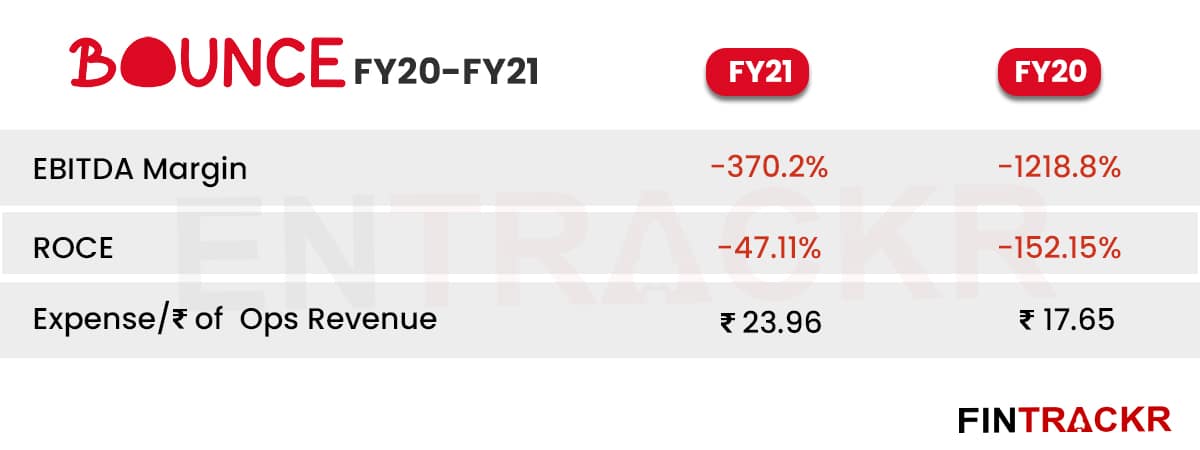

To understand the operational expenses better, we can look at the net cash outflow from operations, which reduced by 45.3% to Rs 206.7 crore in FY21 from outflows of Rs 378 crore during FY20. On a unit level, Bounce spent Rs 23.96 to earn a single rupee of operating revenue.

Taking in consideration the above mentioned non-cash expenses and reduced scale, the company’s annual losses were reduced by 78% to Rs 305.6 crore in FY21 from Rs 1,434.6 crore in FY20. With the abysmal EBITDA margin of -370.24% during FY21, Bounce’s balance sheet sported outstanding losses of Rs 2,152.2 crore at the end of March 2021.

With its Infinity E1 scooter just launched, the firm will be counting on the model and its swappable batteries option to charge up the numbers again. Swappable batteries has brought down the cost of the purchase to as low as Rs 36,000 for a buyer, and Bounce’s success with this model will be watched with great attention.