The online classifieds business is a tough one in India as evident from the prolonged struggle of Quikr. While Prosus-owned OLX has been showing profitability on paper for the past five fiscal years, if we exclude the income recorded by offering services to its ultimate holding entity: OLX BV, those profits quickly evaporate into a net loss.

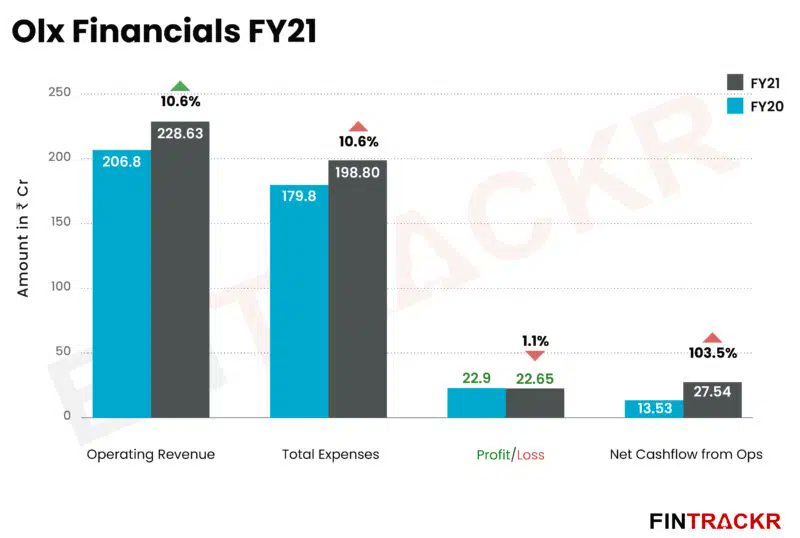

OLX India’s operating revenue increased by 10.6% to Rs 228.63 crore in FY21 from Rs 206.8 crore in FY20, its annual financial statements filed with MCA show. Online classifieds and advertising space were the two income channels from the listing of businesses on its platform.

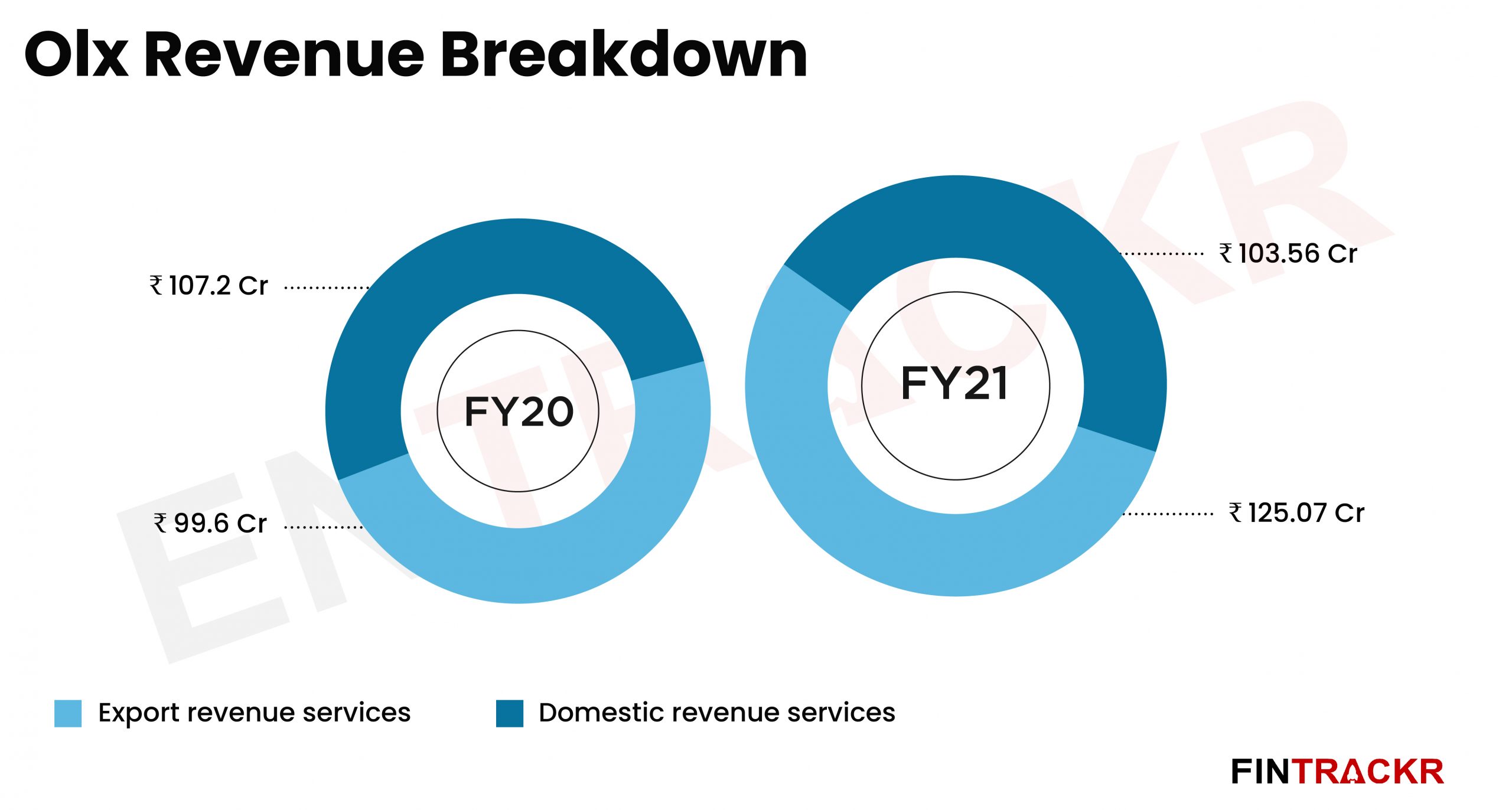

The income from these two channels slipped 3.40% to Rs 103.56 crore in FY21 from Rs 107.2 crore in FY20. This income was 45.3% of the total operating income made by OLX’s local entity in FY21.

Income from export services billed by OLX India to Amsterdam-based OLX BV stood at Rs 125.07 crore in FY21. This income grew 25.6% in the last fiscal from Rs 99.6 crore in the preceding financial year (FY20). If we exclude this income which hasn’t come from local operations, OLX India was in loss in FY21.

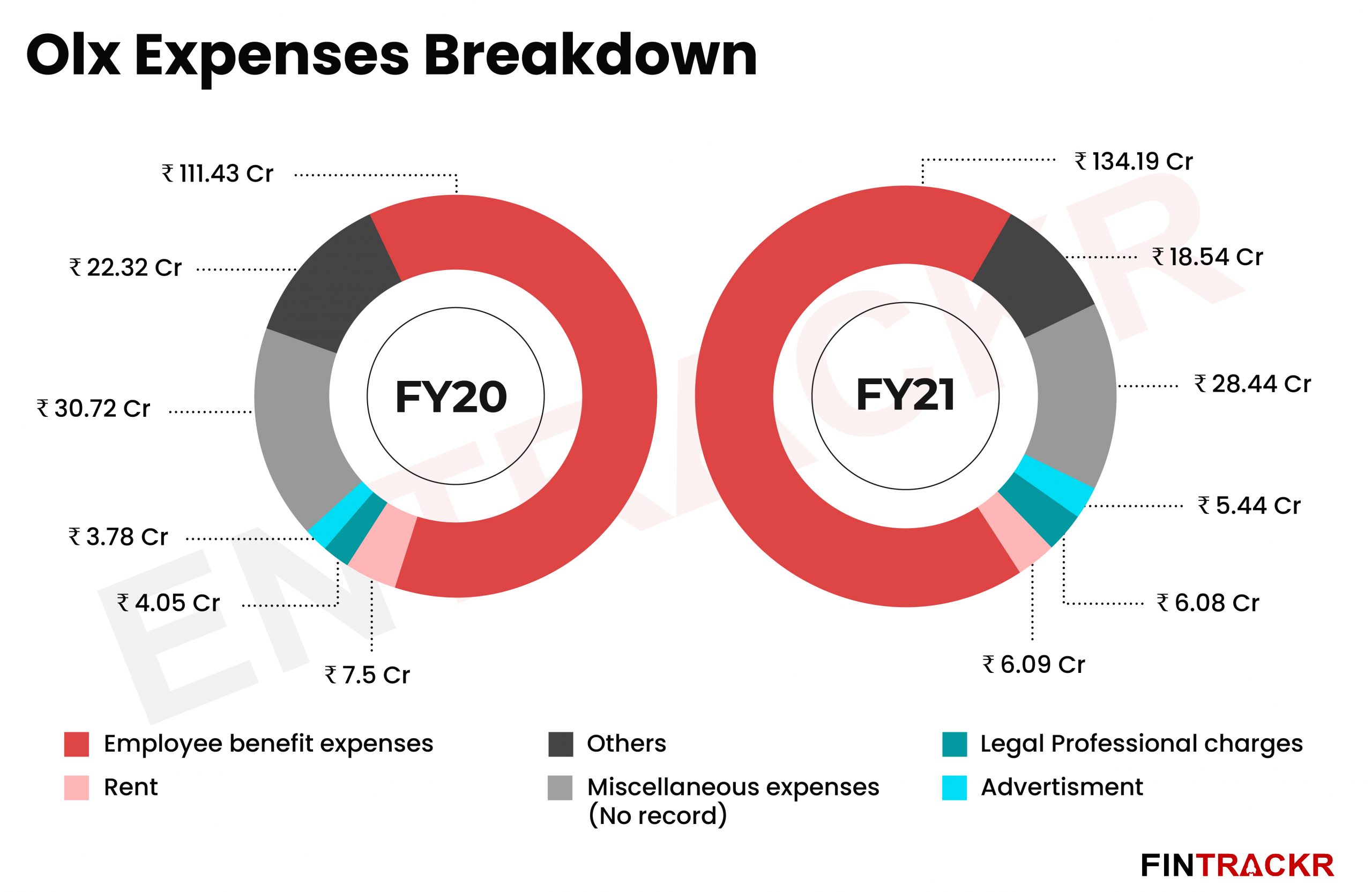

On the lines of revenue, OLX India’s expenses also increased 10.6% to Rs 198.8 crore in FY21 from Rs 179.8 crore in FY20. Employee benefit accounted for 67.5% of its total expenditure in FY21 which jumped 20% to Rs 134.19 crore from Rs 111.43 crore during FY20.

Meanwhile, legal and professional fees climbed 50% to Rs 6.08 crore during FY21 from Rs 4.05 crore in the previous financial year. Advertisement cost also moved 44% to Rs 5.44 crore during the period from Rs 3.78 crore in FY20.

OLX India has also booked a cost of Rs 28.44 crore as miscellaneous expenses. However, no bifurcation of this expense has been recorded in the financial statements.

Overall, profits of the company in FY21 have been similar to FY20. It recorded a dip of 1% to Rs 22.65 crore in FY21 from Rs 22.9 crore in FY20. Cash inflows of OLX India took a leap of 103% to Rs 27.54 crore in FY21 from Rs 13.53 crore in the previous fiscal year (FY20).

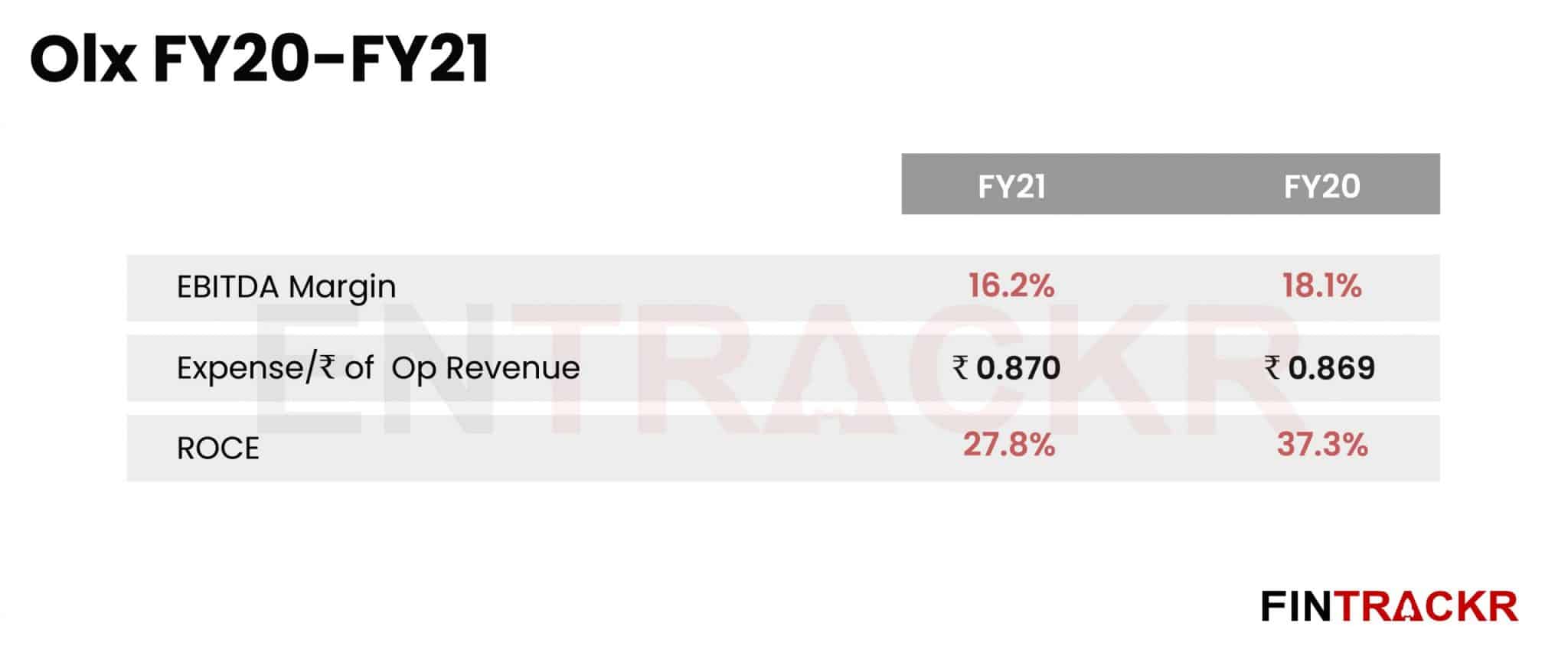

On a unit level, the company has spent Rs 0.87 to make a rupee.

As we said, OLX India financials look very ordinary if we exclude the revenue from outsourced services to OLX BV. Its domestic revenue from local operations during FY21 stood at Rs 103.56 crore only. It is highly likely that the company is not able to book profits on domestic revenue. The revenue from providing support services to the parent entities makes up nearly 55% of the annual revenue of OLX India, without this related party income its finances might actually be in the red.

With no significant return of any momentum in the current FY, it seems fair to say that the business is at an impasse, and the next level of growth is not visible. The firm has been a ‘victim’ of social media in more ways than one, with not only many transactions shifting, but also amplification of the frauds and attempts to cheat that have become an endemic to classified platforms. That seems to have put off a significant segment of users. Even attempts to ramp up with its high-value segments like autos and properties have met with very limited success with entrenched competitors, with the platform not figuring anywhere among the leaders at all.

With no significant return of any momentum in the current FY, it seems fair to say that the business is at an impasse, and the next level of growth is not visible. The firm has been a ‘victim’ of social media in more ways than one, with not only many transactions shifting, but also amplification of the frauds and attempts to cheat that have become an endemic to classified platforms. That seems to have put off a significant segment of users. Even attempts to ramp up with its high-value segments like autos and properties have met with very limited success with entrenched competitors, with the platform not figuring anywhere among the leaders at all.