Direct-to-consumer (D2C) brands have been witnessing a surge in their scale during FY21 despite the pandemic. A barrage of new brands have flooded the market and the ones that were already around are seeing massive growth. For instance, Juicy Chemistry, an organic skincare brand had its operating revenue grow 5X growth during FY21.

On similar lines, plant-based D2C nutrition brand OZiva’s operating revenue has recorded a 3.43X jump to Rs 72.11 crore in FY21 from Rs 21.02 crore in FY20, show its regulatory filings. Significantly, it made all the revenue from sales of health and nutrition products.

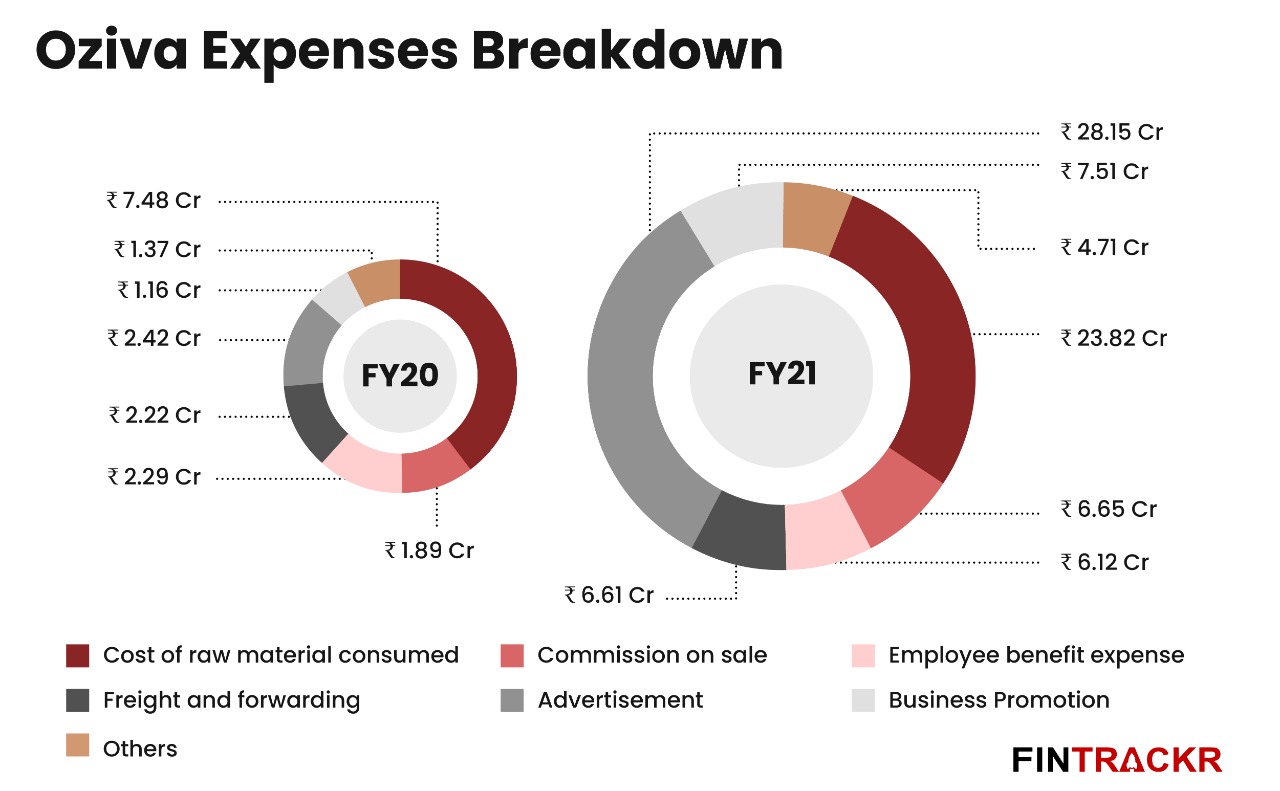

The scale also comes at the cost as Oziva’s expenses shot up 4.43X to Rs 83.57 crore in FY21 from Rs 18.83 crore in the preceding fiscal year (FY20). The company has splurged on advertising to fuel growth and these costs blew 11.63X to Rs 28.15 crore in FY21 from Rs 2.42 crore in FY20.

Advertising costs alone formed 33.68% of its total expenditure in FY21.

As the sales increased, the cost of material was the second major expenditure followed by advertisement costs, which rose 3.18x to Rs 23.82 crore in FY21 from Rs 7.48 crore when compared to fiscal year 20.

During FY21, the company also expanded its employee base and as a result, employee benefit expenses rose 2.67X to Rs 6.12 crore in the last fiscal from Rs 2.29 crore in FY20. Oziva has paid out Rs 6.65 crore in commission to distribution channels such as Flipkart and Amazon in FY21.

A spurt in overall expenses has pushed Oziva’s cash flow from the operations into negative to 17.99 crore in FY21 from a positive cash flow of Rs 3 crore in FY20. In the end, the company booked a loss of Rs 9.77 crore in the last fiscal against a profit of Rs 1.59 crore in FY20. On a unit level, Oziva has spent Rs 1.66 to make a single rupee in FY21.

Akin to most of the growth-stage startups, Oziva’s financial performance in FY21 is not in a healthy state. However, it has managed to scale during the pandemic and it’s a good sign as the company is prioritizing growth and investing in marketing to create awareness about the benefits of vegan and plant-based protein.

On the lines of FY21, Oziva is likely to register similar growth in scale in the ongoing fiscal as it has access to capital. The company had raised a $12 million Series B round at a valuation of $80 million in June this year and may end up raising more in FY22.