The quick grocery delivery has been garnering a lot of investor attention. Last month, Zepto, a 10-minute grocery delivery startup firm announced a $60 million fundraise without disclosing more details.

Fintrackr has decoded the round breakup and complete shareholding pattern through the company’s regulatory filings sourced from Singapore. As of now, Zepto’s holding entity: Kiranakart Pte has raised $42.57 million from nine investors.

The remaining amount of around $18 million of the total $60 million is likely to hit the company’s account in a few weeks.

Glade Brooks has led the Series B round with $22.5 million whereas Nexus Ventures and Lachy Groom have put in $7.3 and 6.7 million, respectively. Contrary Capital has invested $2.12 million while Global Founders Capital participated with $2.5 million.

Ravi Inukonda and Nilam Ganenthiran have collectively infused $15K. According to Fintrackr’s estimate, the Mumbai-based company has been valued at $227 million (post-money).

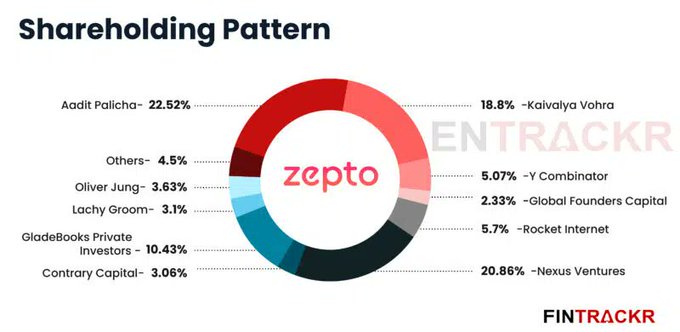

Following the Series B round, the co-founders’ stake has been diluted to 40.60%. Zepto’s chief executive Aadit Palicha holds 22.52% whereas chief technology officer Kaivalya Vohra commands an 18.8% stake.

Among investors, Nexus Venture Partners is the biggest stakeholder with a 20.86% stake. GladeBooks holds 10.43% while Y Combinator owns 5.07%. The complete shareholding of Zepto can be seen in the pie chart below.

According to separate regulatory filings by Zepto’s holding entity, the company has appointed Paul Hudson and Vohra as directors. It’s worth noting that the company has reduced its employee stock option (ESOP) pool by 35% to 125K options.

Started from Mumbai, Zepto delivers grocery and fast-moving consumer goods (FMCG) within ten minutes. The company has expanded operations to more cities including Bengaluru and Gurugram. However, its service has been limited to select locations in the two cities.

While Zepto had raised funds only last month, it’s in conversations with new and existing investors to mop up $100-125 million at a valuation of over $500 million. Entrackr had exclusively reported this on November 11.