Social media platform ShareChat has emerged as one of the largest funded startups in India in the past couple of years. The Bengaluru-based firm recently concluded an extended $145 million Series F round by Temasek, Moore Strategic Ventures and Mirae-Naver Asia Growth Fund.

Apart from the valuation figure i.e. $2.88 billion, ShareChat did not disclose the details of the transaction in its public disclosure. That had us sending Fintrackr to fetch some exclusive details such as round breakup and shareholding structure from the company’s regulatory filings.

The company has allotted 1387 Series F2 preference shares at an issue price of Rs 23,32,343.86 per share and 2101 Series F3 preference shares at an issue price of Rs 30,41,503.08 per share to raise around Rs 962.5 crore or $130 million. ShareChat is likely to receive the remaining amount in the announced round soon.

Moore Strategic Partners led the round with Rs 577.52 crore or $78 million followed by Temasek and Mirae Asset which invested $31 million and $20.8 million respectively.

It’s worth noting that six-year-old ShareChat has raised a total of $911 million to date of which $690 million was raised in the past year and close to $800 million came in the past two years. The funds have come on the back of a 350% jump in its valuation as compared to August 2019 when it was valued at $650 million after raising a $100 million Series D round led by Twitter.

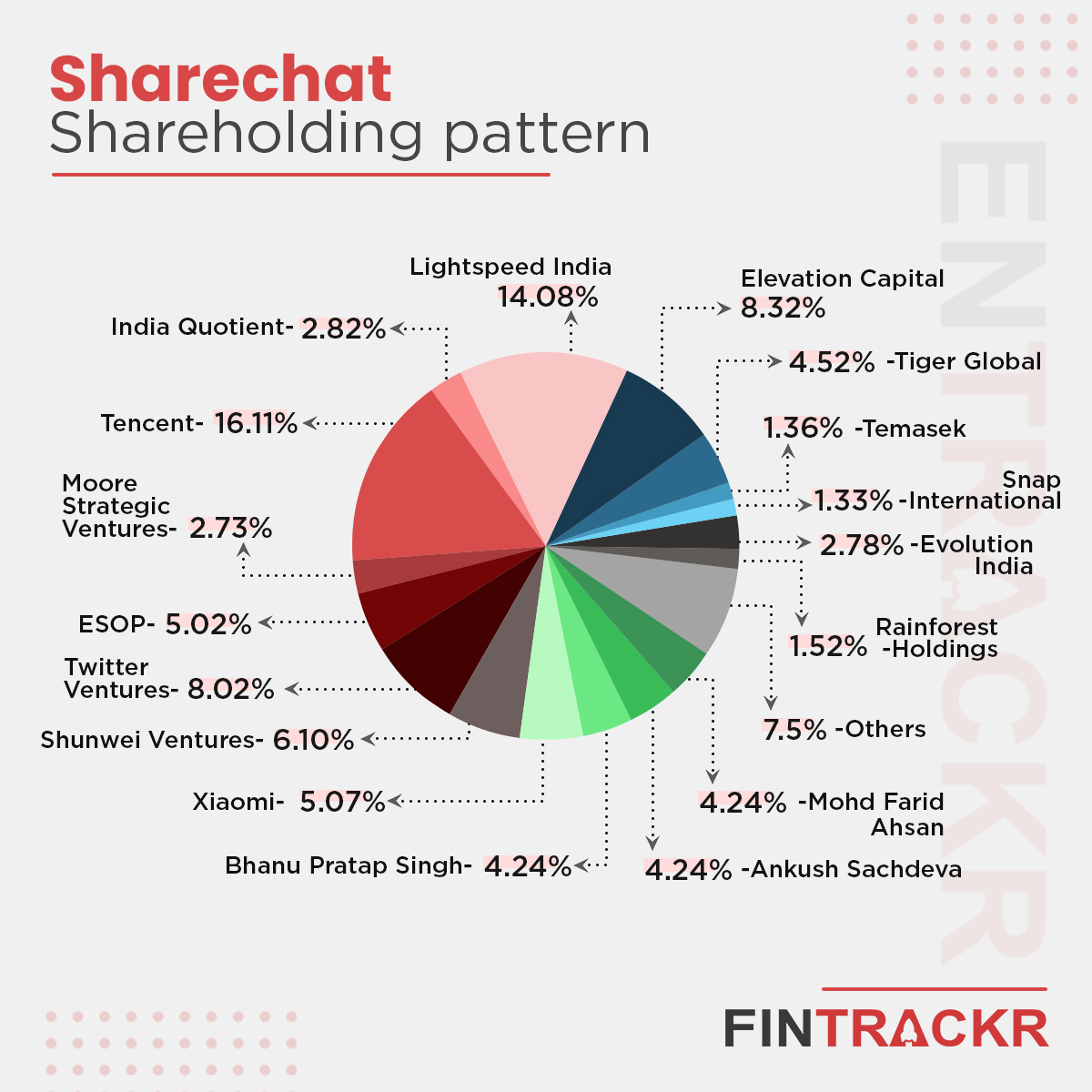

Following the new round, Tencent has emerged as the largest stakeholder with 16.11% whereas Lightspeed and Elevation own 14.08% and 8.32 respectively. Twitter Venture owns 8.02% while Shunwei and Xiaomi together own 11.17%. The current shareholding of founders and other investors can be seen below.

Queries sent to ShareChat did not elicit an immediate response. We’ll update the post in case they do.

Besides the equity round, ShareChat has also raised one of the largest debt rounds by an Indian startup this year. The company had picked up $225 million debt during its $502 million fundraising which also made the company a unicorn.

On the revenue front, ShareChat’s performance hasn’t been impressive. However, the company has recorded revenue from operations for the first time in the financial year 2020. According to Fintrackr, it registered Rs 9.4 crore in revenue against Rs 715 crore expense and Rs 676 crore loss during the fiscal. The annual financial report for FY21 is yet to come. At Rs 329.4 crore, marketing and business development turned out to be the biggest cost centre for the company in FY20.

Last year, ShareChat also entered the short video sharing space with a separate app Moj. Since its inception in July 2020, Moj has been among the top three players in terms of downloads. According to Sensor Tower data, Moj has recorded 201 million downloads to date whereas its closest competitors MX TakaTak and Dailyhunt’s Josh had 204 million and 180 million downloads respectively.

However, ShareChat’s Moj is leading in terms of monthly active users or MAU by a decent margin as of June 2021. According to App Annie data, Moj has 75 million MAUs as compared to MX TakaTak and Josh’s 63 million and 34 million MAUs respectively.