News aggregator InShorts has more fuel for its hyperlocal video app Public. Unlike DailyHunt’s Josh and ShareChat’s Moj, Public aggregates videos related to news and events happening in a particular location and city. All these apps, along with Glance from InMobi and others, came up to fill the time and mind space vacated by the ban on Chinese apps in India in June last year, especially short video format leader, TikTok.

Public has started well for the Singapore-incorporated company and has drawn significant appetite from top tier investors. InShorts has positioned Public as the anchor product to raise back to back rounds worth $100 million.

After raising $41 million in March, Inshorts had announced a $60 million fundraise in July. While the company didn’t disclose details including the break-up of the round, secondary component, valuation and its earnings, Fintrackr has sifted through its regulatory filings in Singapore to decode it.

InShorts has allotted shares worth $59 million to raise the amount from several investors.

Vy Capital has led the round with $35 million whereas Addition participated by adding $12.5 million. Existing investors SIG Global and A91 Emerging Fund have invested $7.5 million and $2.5 million respectively.

Singapore-based Tanglin Venture has also joined the latest round, which appears to be Series E, with $1.5 million. According to Fintrackr’s estimate, InShorts has been valued anywhere between $450-470 million (post-money).

Importantly, the company has passed a special resolution to implement a buyback of shares from existing shareholders, separate regulatory filings show. InShort has bought back 5,340 shares worth $7.34 million from eight shareholders including three co-founders.

InShorts’ early institutional investor Rebright Partners has sold out its partial holding to the tune of $1.4 million. Its seed investors: Gaurav Bhatnagar, Ankush Nijhawan, Arjun Nijhawan and Manish Dhingra have offloaded $472K, or around Rs 3.50 crore worth shares each.

InShorts’ co-founders Azhar Iqbal and Anunay Pandey have diluted $1.7 million worth stake each while Deepit Purkayastha has made $722K by selling his partial holding.

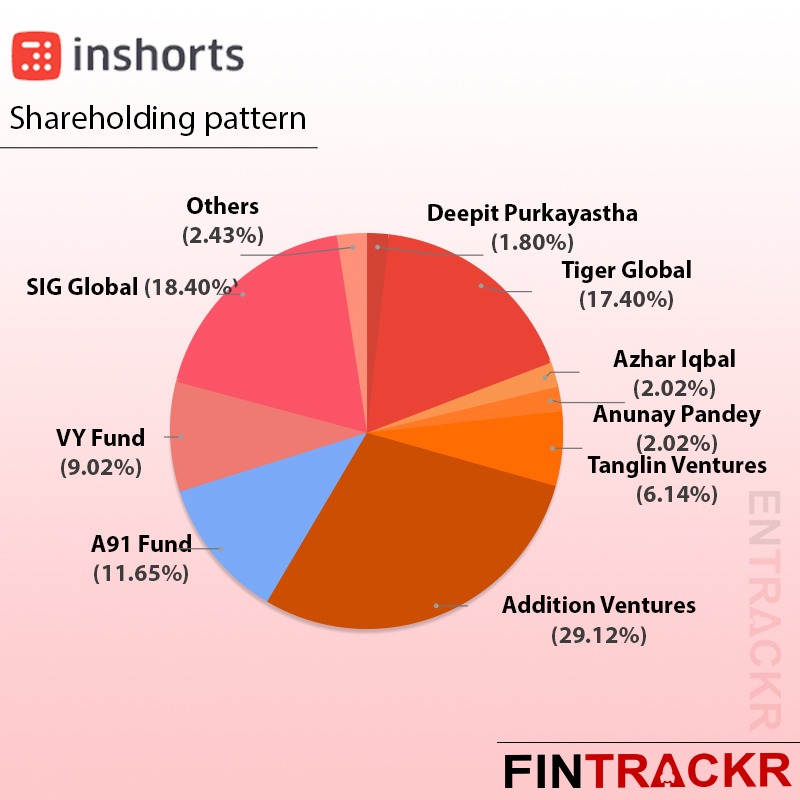

Following the fresh round, Lee Fixel’s fund Addition has emerged as the largest stakeholder in InShorts with 29.12%. SIG Global and Tiger Global own 18.40% and 17.40% stake respectively. A91 Partners shares an 11.65% ownership in the Iqbal-led firm and Vy Capital has 9.02% after leading the new round.

Significantly, co-founders’ collective stake has slipped below 6%. Iqbal and Pandey own 2.02% each while Purkayastha is left with only 1.80%. Other shareholders including ESOPs own just 2.02% in the seven-year-old firm.

Entrackr’s detailed queries to InShorts’ co-founders on late Thursday didn’t elicit any response until the publication of this story. We will update the story in case they respond.

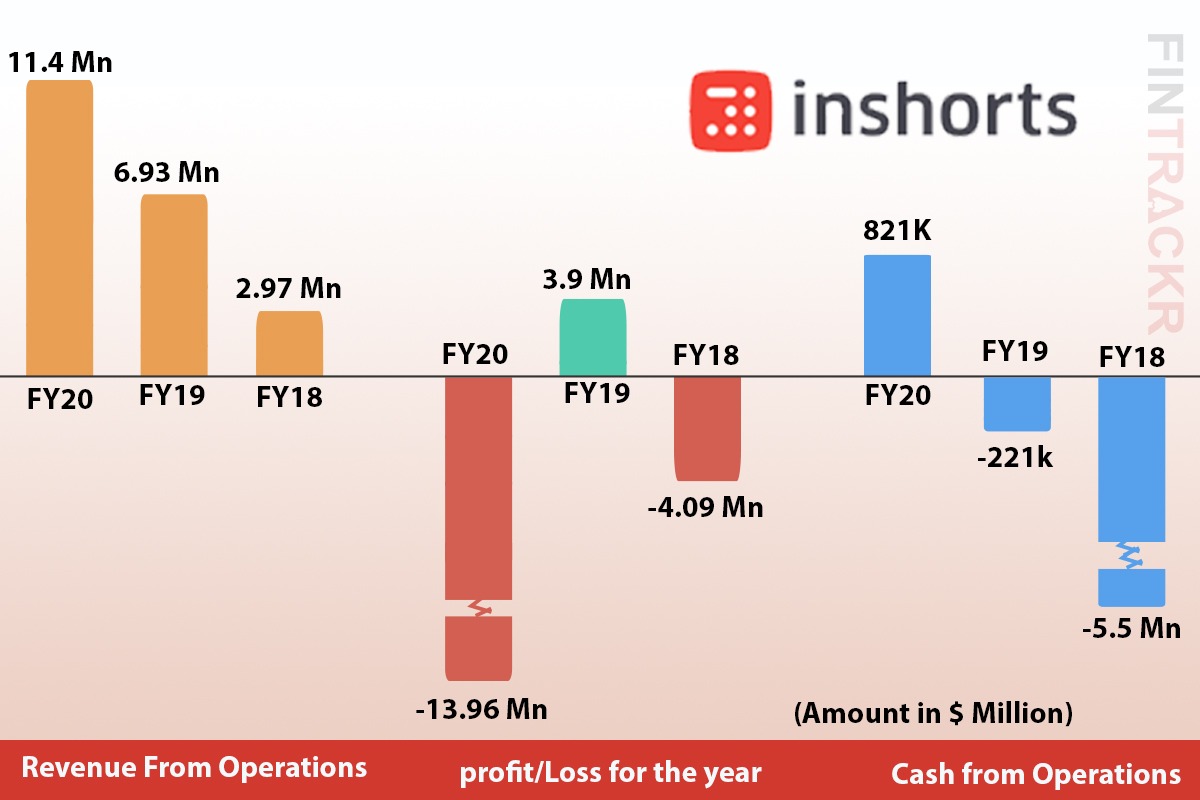

InShorts was profitable in FY19, but it posted a significant loss in FY20 primarily because of Public. According to a separate filing, the company’s revenue recorded a 64.11% jump to reach $11.4 million in FY20 from $6.93 million in FY19.

While the revenues have swelled up, InShorts spent extensively to build and scale Public.

As a result, its margins suffered extensively and losses blew up to nearly $14 million in FY20 from the profit of $3.9 million in FY19. Its operating margins degraded from 1.93% in FY19 to -91.5% in FY20.