Business-focused industrial goods marketplace Moglix had turned unicorn with a $120 million funding round led by Falcon Edge Capital and Harvard Management Company in May. While the company only disclosed primary infusion, there is a secondary component in the round where three of its early backers have offloaded a part of their holdings.

Accel, IFC and Tanglin’s partial exit

Accel, IFC and Tanglin Venture Partners have pocketed $15 million, regulatory filings filed by Moglix in Singapore show. Tanglin is the largest beneficiary in the secondary deal by offloading 8,314 shares worth $10 million to Alpha Wave Incubation (AWI).

International Finance Corporation (IFC) also sold 3,325 shares which are valued at $4 million to Sequoia Capital. AWI also picked up 831 shares worth $1 million from Accel.

According to Fintrackr’s estimate, Moglix has been valued at $820-850 million (post-money) in this transaction. This essentially means that this secondary transaction has been executed at par with the primary one.

While Moglix had claimed over $1 billion valuation in May, Fintrackr’s estimate showed that it was valued in the range of $820-850 million.

Moglix’s ownership structure

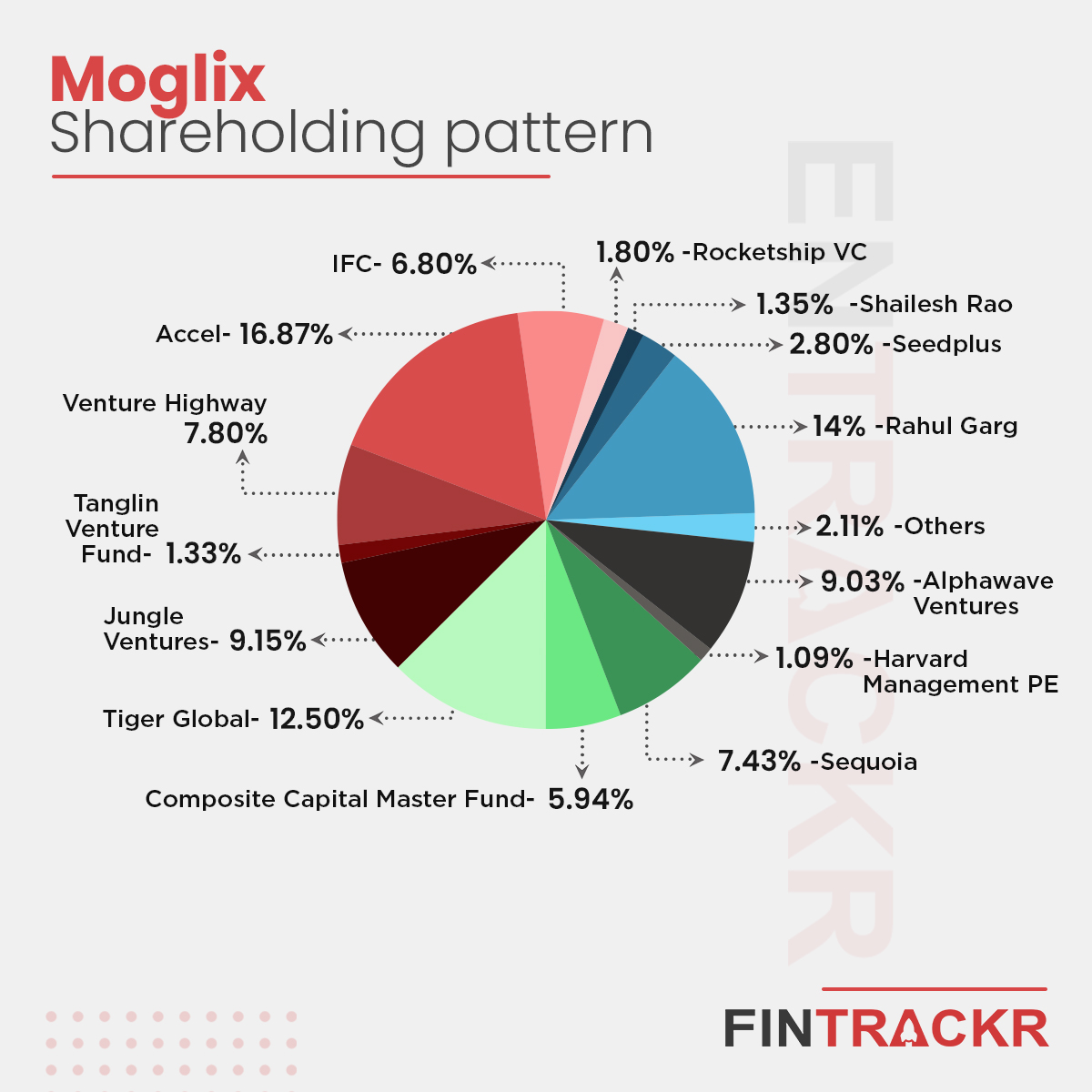

Following the secondary deal, Accel emerged as the biggest stakeholder with 16.87% whereas Moglix’s founder Rahul Garg commands 14%. Tiger Global owns 12.50% while Jungle Ventures and AWI hold 9.15% and 9.03% respectively.

Venture Highway (7.80%) and Sequoia (7.43%) together own 15.23%. See the pie chart below for the full picture.

This is the second secondary transaction at Moglix in the past two years. In October 2019, Garg had divested part of his holding stake worth $227,000 to Tanglin and Venture Highway.

Queries sent to Moglix didn’t elicit any immediate response. We will update the story in case they respond

Traction and competition

Moglix caters to both large and SME players in the manufacturing industry and claims to have more than 150,000 clients in addition to over 250 enterprises and corporations. Besides India, Moglix has presence in overseas markets including Singapore, the UK and UAE.

To fortify its Indian operations, the company recently acquired Vendaxo.

According to the company, it has 3,000 manufacturing partners across India, Singapore, the UK and the UAE. It competes with Industry Buying and a few others in the space now.