Amidst uncertainty and absence of regulation over the operations of cryptocurrency companies in India, CoinDCX has grown to be a unicorn with its $90 million Series C round led by former Facebook co-founder Eduardo Saverin’s B Capital Group.

While CoinDCX did not disclose details about the transaction, Fintrackr has gone through its regulatory filings in Singapore to decode the crypto exchange’s latest funding round, current shareholding structure and its exact valuation.

CoinDCX has allotted 2,243 preference shares to six investors to raise $90 million. Existing backer Polychain has spearheaded the round with $35 million followed by new investor B Capital which poured in $25 million. Block.one Investments has put in $21.1 million in the company with Coinbase, Uncorrelated Fund and Jump Capital bringing in the remaining amount.

Fintrackr estimates that the company has reached a post-money valuation of $1.1 billion. Thus, even as Binance-owned WazirX is on the verge of becoming a unicorn, CoinDCX becomes one of the fastest startups from the cryptocurrency space to attain the feat.

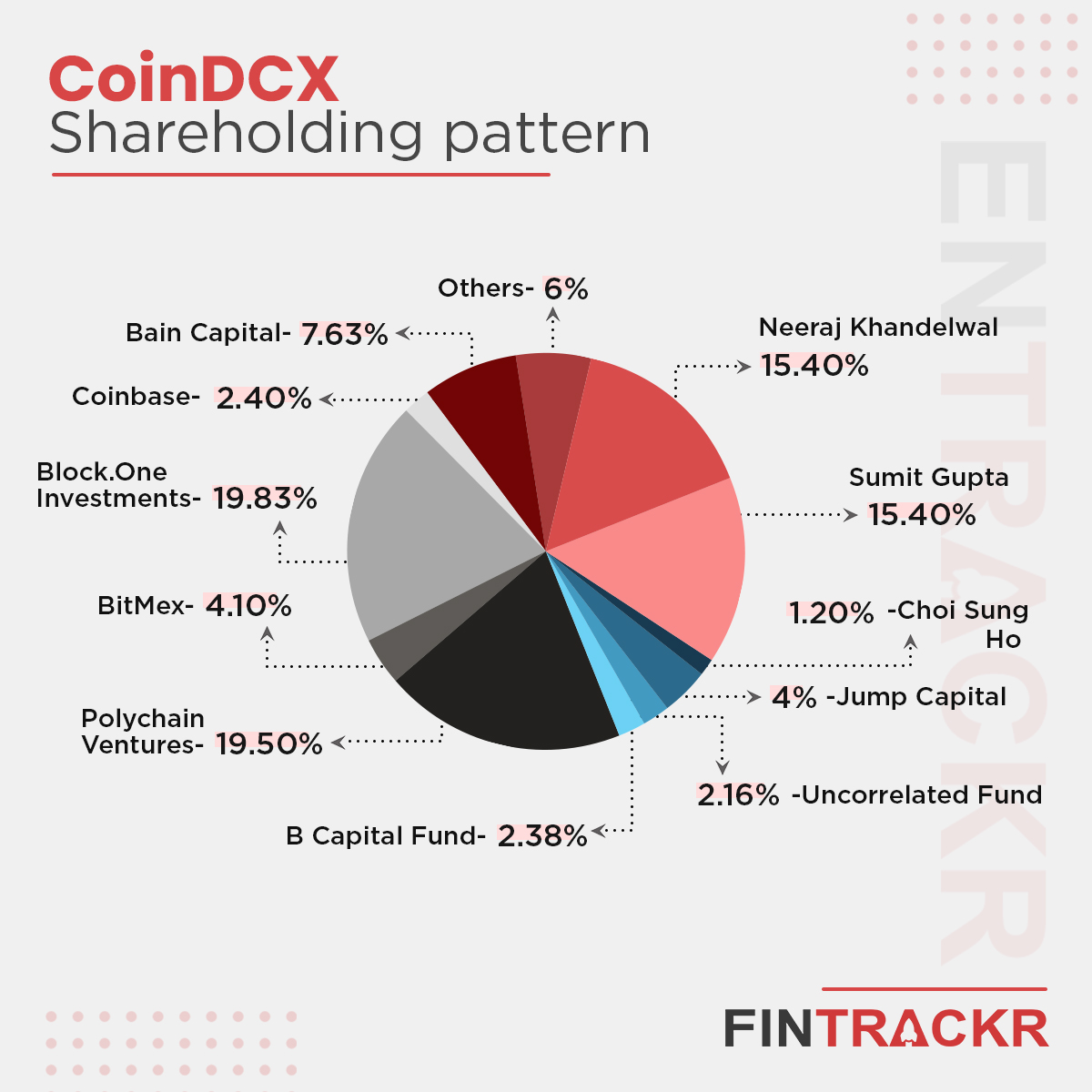

Following the fresh allotment of shares, CoinDCX’s promoters — Neeraj Khandelwal and Sumit Gupta — have diluted their collective equity in the company to 30.80%. Lead investor B Capital has acquired 2.38% in the company whereas existing backer Polychain has emerged as the largest stakeholder in the company with 19.50%. The complete shareholding can be seen below.

Three-year-old CoinDCX is a cryptocurrency exchange and liquidity aggregator having operations across the world. The company has instant deposit and withdrawal facilities with a suite of crypto-based financial products and services.

CoinDCX has raised $109 million to date. Besides WazirX, the company also counts ZebPay and CoinSwitch Kuber as its direct competitors.

According to a Bloomberg report based on data from Pitchbook, venture capital funds have pumped $17 billion into the crypto space during the first half of H1 of this year. While Indian startups in this segment are far behind global companies in terms of fundraising, a couple of investments and interest from overseas companies have been able to keep the momentum in the country.

In April, cryptocurrency investment platform CoinSwitch Kuber had scooped up $25 million from Tiger Global Management. Mudrex, a crypto asset management platform also raised $2.5 million in a seed funding round led by Nexus Venture Partners.

Meanwhile, US-based Coinbase is looking to ramp up its team in India. The $64 billion valued cryptocurrency platform had hired Pankaj Gupta, a former Google Pay executive as the vice president of engineering and site lead for India. Moreover, Dubai-based crypto investment fund FD7 Ventures had launched a $250 million micro-fund in India in March. According to the company, it will invest in altcoin projects like Polkadot and Cardano.