Till date, Flipkart has been the flag bearer of success in the Indian startup ecosystem. It created a path-breaking moment for everyone when Walmart acquired a 77% stake in the Bengaluru-based company for a whopping $16 billion in 2018, valuing the firm at $22 billion.

Three years later, Flipkart is still making records, raising $3.6 billion privately, a sum that no other consumer internet company operating has come close to. Flipkart announced this fundraise last week but didn’t disclose details such as a break up of the new financing round. Until now, that is.

Fintrackr has decoded these crucial details from the firm’s regulatory filing sourced from Singapore. Flipkart has allotted 1.9 crore ordinary shares at an issue price of $189.1 per share to raise $ 3.6 billion.

Canada Pension Plan has led the round with $800 million whereas SoftBank Vision Fund, Walmart and Waverly have put in $500 million each.

Gamvest has invested $350 million while Aceville and Omega Oryx have invested $300 and $200 million respectively. Tiger Global has infused $18 million and INQ Holdings (Tencent Singapore) participated in this round with $150 million.

Significantly, Tiger Global, SoftBank and Tencent have returned to back Flipkart after its acquisition by the world’s largest retailer. Tiger was an early backer of Flipkart and made a killing when Walmart acquired Flipkart.

According to Fintrackr’s estimate, Tencent now owns over $2 billion worth of stake in Flipkart whereas Tiger’s stake is worth over $1.5 billion.

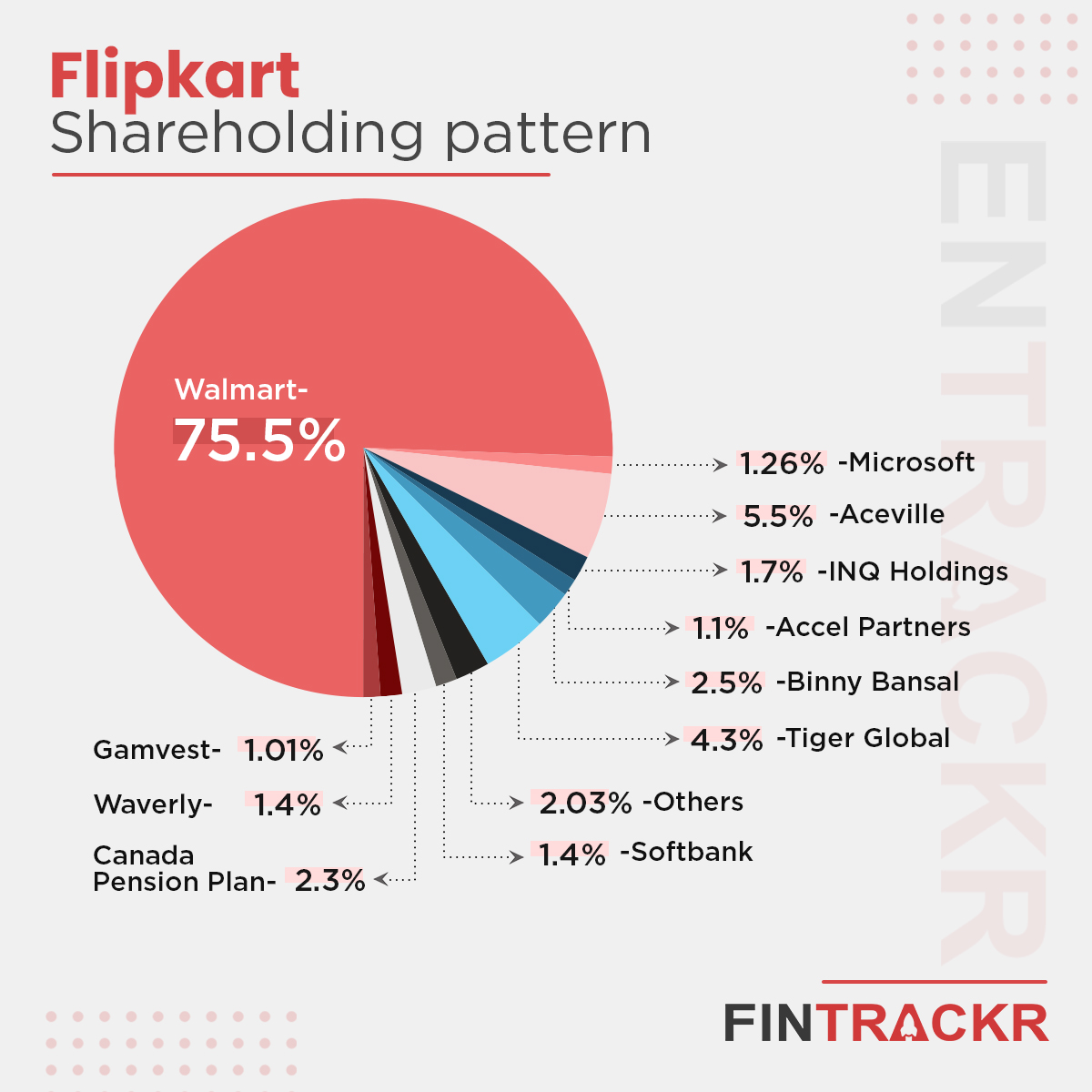

Post this new round, Tencent and Tiger own a 5.5% and 4.3% stake in Flipkart respectively. The company’s co-founder Binny Bansal still retains his 2.5% stake. Please refer to the pie chart (below) for complete shareholding.

Azteca Partners, WCH Q3 and Antara Capital have also participated in this round with $50 million each. Pantai Remis and Franklin Templeton have put in $48.5 and $45 million respectively while Palomino Masters and Jadoff SPV collectively invested $35.3 million.

While Fintrackr couldn’t ascertain the valuation of Flipkart in this round as relevant regulatory documents are yet to be filed, the company had claimed to be valued at $37.6 billion. This investment round is likely to be the last privately funding event for Flipkart as the company is set to debut on a US stock exchange later this year. According to industry watchers, this round seems to be the last pre-IPO round we will see from the e-com major, as it’s investors look forward to a significant jump when it goes public.

Update: The previous version of the story said that Tiger Global invested $180 million in Flipkart which is actually $18 million. We regret the error.