Neobanking startup epiFi has raised $12 million in a Series A round from its existing investors at a 3X premium in valuation from its seed round 17 months ago.

The board of epiFi has approved the allotment of 159,494 Series A1 preference shares at an issue price of Rs 5,530 per share to raise Rs 88.4 crore or $12 million from Ribbit Capital and Sequoia Capital, regulatory filings show.

Ribbit and Sequoia have invested Rs 44.2 crore each. The round appears to be an ongoing one and the company may end up raising more money.

Founded by former Google Pay executives Sujith Narayanan and Sumit Gwalani, the two-year-old startup provides millennial-focused digital banking solutions including saving accounts and debit card facilities.

The proceeds will likely help the company strengthen its technology and expand offerings against well-funded rivals including NiYO, Juno, P10 and yet to be launched Jupiter.

According to Fintrackr’s estimates, epiFi has reached the post-money valuation of Rs 1,170-1,200 crore or $160-165 million. This is a more than 3X jump in the startup’s valuation which was valued at around $50 million during its $13.2 million seed round in January 2020.

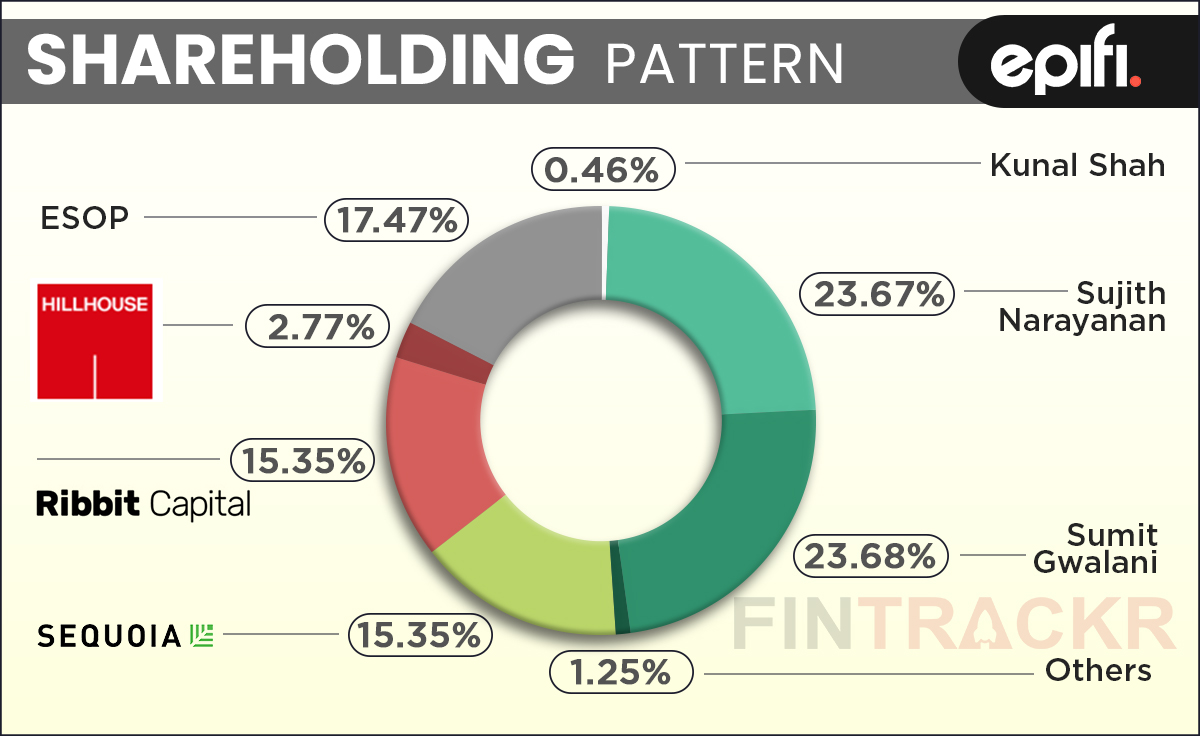

Post this round, the collective shareholding of founders Narayanan and Gwalani will be reduced to 47.35%. Among the investors, Sequoia and Ribbit hold 15.35% stake each while Hill House has 2.77% stake.

The complete shareholding can be seen below.

epiFi has also filed its annual financial report for FY21. According to Fintrackr, the company’s operating revenue grew by 69% from Rs 66.84 lakh in FY20 to Rs 1.13 crore in FY21. During the period, its losses grew by 257.5% from Rs 8.8 crore in FY20 to Rs 30.51 crore in FY21. These figures for FY21 are up until 15 march 2021.

It’s worth noting that epiFi had raised one of the largest seed rounds in the Indian startup ecosystem from Hong Kong-based Hillhouse Capital which manages close to $70 billion in investments, along with angels David Velez and Kunal Shah.