Digital bookkeeping space was a hot proposition for top-tier venture capitals over the past three years. Top two players – OkCredit and Khatabook, who digitize traditional khata-bahi, have mopped up over $170 million from the likes of Tiger Global, B Capital, Falcon Edge and Lightspeed.

The large infusion into these two companies also triggered a race to scale quickly and acquire customers at a very high price. As a result, OkCredit and Khatabook have together lost close to Rs 282.6 crore in FY20.

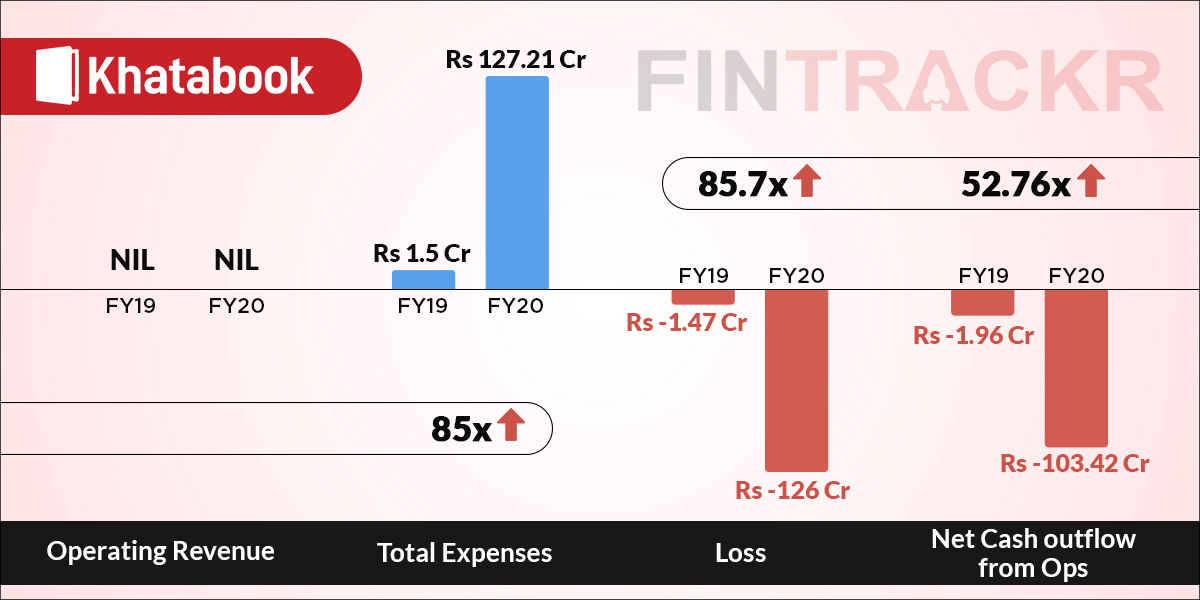

While OkCredit posted an annual loss of Rs 156.6 crore with nil operating revenue, Khatabook has lost Rs 30 crore less without any income. According to Khatabook’s filings analysed by Fintrackr, the company has lost Rs 126 crore in FY20.

Working towards digitizing the accounts of the 60 million small-medium business, Khatabook claims to have reached around 700 districts in India. This was made possible by its extensive marketing spends across various media platforms using a mix of television commercials (TVCs), digital advertising and social media marketing.

The company spent 74.2% of its total expenditure on advertising and promotions to reach its customer base during the fiscal ended in March 2020. These costs shot up 590X from barely Rs 14 lakhs in FY19 to around Rs 94.4 crore during FY20.

Its biggest competitor, Lightspeed backed OkCredit had a similar marketing strategy and spent 71% of the annual costs amounting to around Rs 111 crore on advertising in FY20.

Khatabook also ramped up hiring to acquire the talent pool needed to harness the growth in scale and develop products for its target customer base. Employee benefit expenses grew nearly 153X to Rs 10.52 crore in FY20 from only Rs 69 lakhs in FY19.

Khatabook even developed its own QR code to process payments for the business owners on its platform. It spent around Rs 7.8 crore on payment gateway expenses and QR code charges.

Further, costs related to information technology (IT) and communications also ramped up in line with its customer base jumping nearly 242X to Rs 33.84 crore during FY20 from a little over Rs 14 lakh spent in FY19.

Another Rs 1.92 crore was incurred on legal fees, pushing total expenditure to grow 85x from only Rs 1.5 crore in FY19 to Rs 127.21 crore spent during FY20. In comparison, Okcredit spent a little over Rs 157.5 crore during the same period.

The Bengaluru based company is incurring high customer acquisition costs to gain access to the small-medium enterprises and onboard them on the Khatabook platform. As a result, its annual losses have reached to Rs 126 crore in FY20, up 85.7X from the losses of Rs 1.47 crore in FY19.

The financial health of Khatabook is in deep red and is still a pre-revenue making company. The company would need to optimise cost and figure out avenues to earn revenue in the coming fiscals. Since the company recently launched two separate apps: MyStore by Khatabook and Pagarkhata and is also marketing them heavily, it’s likely to post bigger losses in FY21.

*Update: Khatabook has reached out to Entrackr, explaining cash inflows from the US-based holding entity to its Bengaluru based ADJ Utility Apps Pvt Ltd, we have made changes to the report accordingly.

During the fiscal ended in March 2020, Khatabook’s Indian entity received Rs 142.21 crore from its US-based parent Kyte Technologies, Rs 117.7 crore through allotment of shares and the rest Rs 24.4 crore were booked as revenues received from its parent entity.