Consumer electronics brand boAt had a stellar run during the fiscal ended March 2020, becoming the joint fifth-largest seller of wearable electronics riding on the wave of its popular series of wireless headsets and speakers, as per market intelligence and research firm IDC.

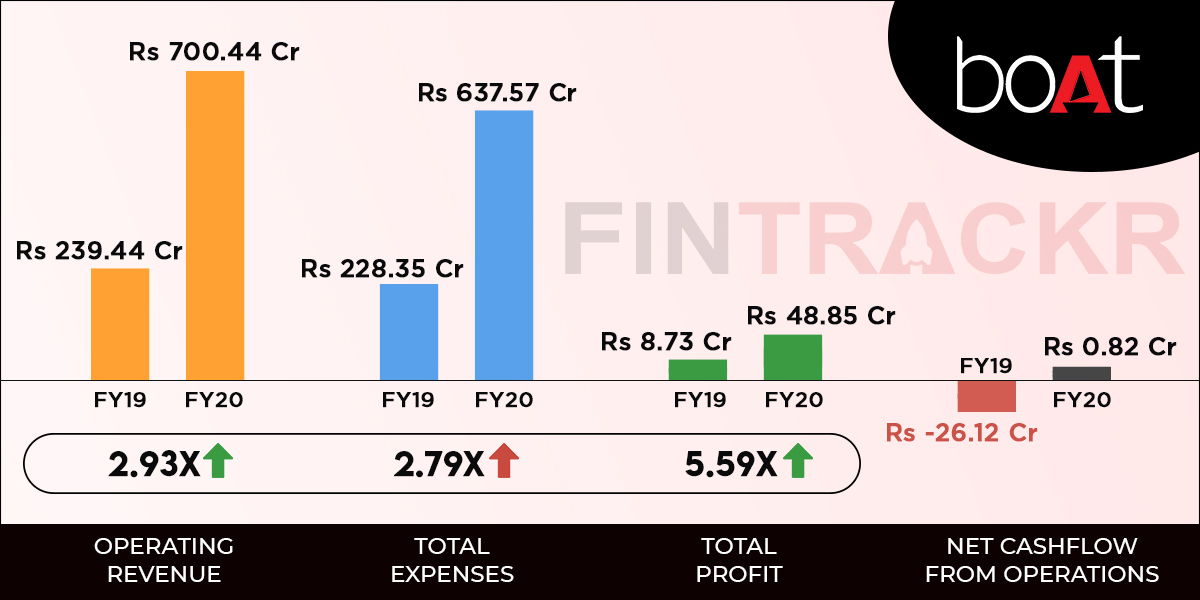

The stupendous growth of boAt was also reflected in its income that crossed the Rs 704 crore mark during FY20, its regulatory filing shows. The five-year-old brand managed to almost triple its earnings from sales to Rs 700.44 crore in FY20 from Rs 239.4 crore in FY19.

The Mumbai based company earned another Rs 3.4 crore through financial instruments during FY20.

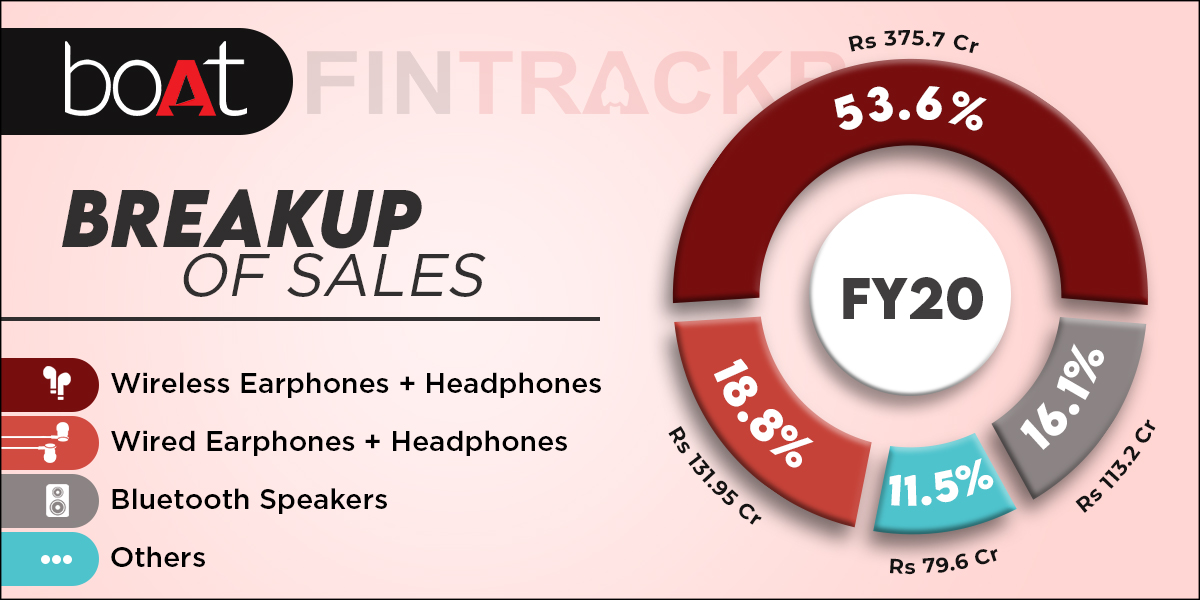

With most smartphone manufacturers deciding to do away with the 3.5 mm jack, sale of wireless earphones and headphones accounted for the largest chunk of its sales. boAt sold wireless headsets worth Rs 375.7 crore in FY20, making up 53.6% of its total sales.

Sale of wired earphones and Bluetooth speakers made up 18.8% and 16.1% of sales respectively.

Other electronic accessories including smartwatches, cables, data banks and chargers accounted for the rest 11.5% of its collections during the last fiscal.

Purchase of merchandise from manufacturers made up 78% of its expenses amounting to Rs 500.2 crore in FY20. The amount spent surged 2.5X from Rs 202.03 crore in FY1.

While most of its stock was sourced from China up until FY20, the company is working towards localising its production in India. It raised $100 million last month from PE major Warnus Pincus to fund the transition and has already announced a partnership with Indian manufacturer Dixon to produce a line of wireless speakers.

During FY20, the company reduced its employee benefit costs by 53% to Rs 6.3 crore from Rs 13.46 crore paid in FY20 and paid an additional Rs 2.43 crore to contract labour in the last fiscal.

On the other hand, boAt spent heavily on its sales and distribution channels across India, paying Rs 60.74 crore for the same in FY20. These costs went up by 500% from FY19 when it had spent Rs 10.2 crore on selling and distribution expenses.

Along with the rise in sales, expenses incurred to provide warranty on its products also shot up. boAt paid Rs 27.3 crore in FY20 for honouring warranty, surging 5.6X from Rs 4.88 crore spent on the same during FY19.

The company also gave discounts costing it Rs 1.8 crore in FY20. Unlike traditional companies, boAt doesn’t have its own service centres and works with third-party vendors.

Advertising and promotional expenses grew by 3.4X to nearly Rs 51 crore in FY20 as the company deployed celebrity-centred advertisements during the last fiscal.

Further, boAt spent Rs 12.52 crore in FY20 on freight and transportation expenses, a jump of 4.4X from FY19 as the number of orders processed also shot up.

Another Rs 1.23 crore were paid for rentals, pushing the total expenses to Rs 637.6 crore in FY20, growing 2.8X from expenses of Rs 228.35 crore in FY19.

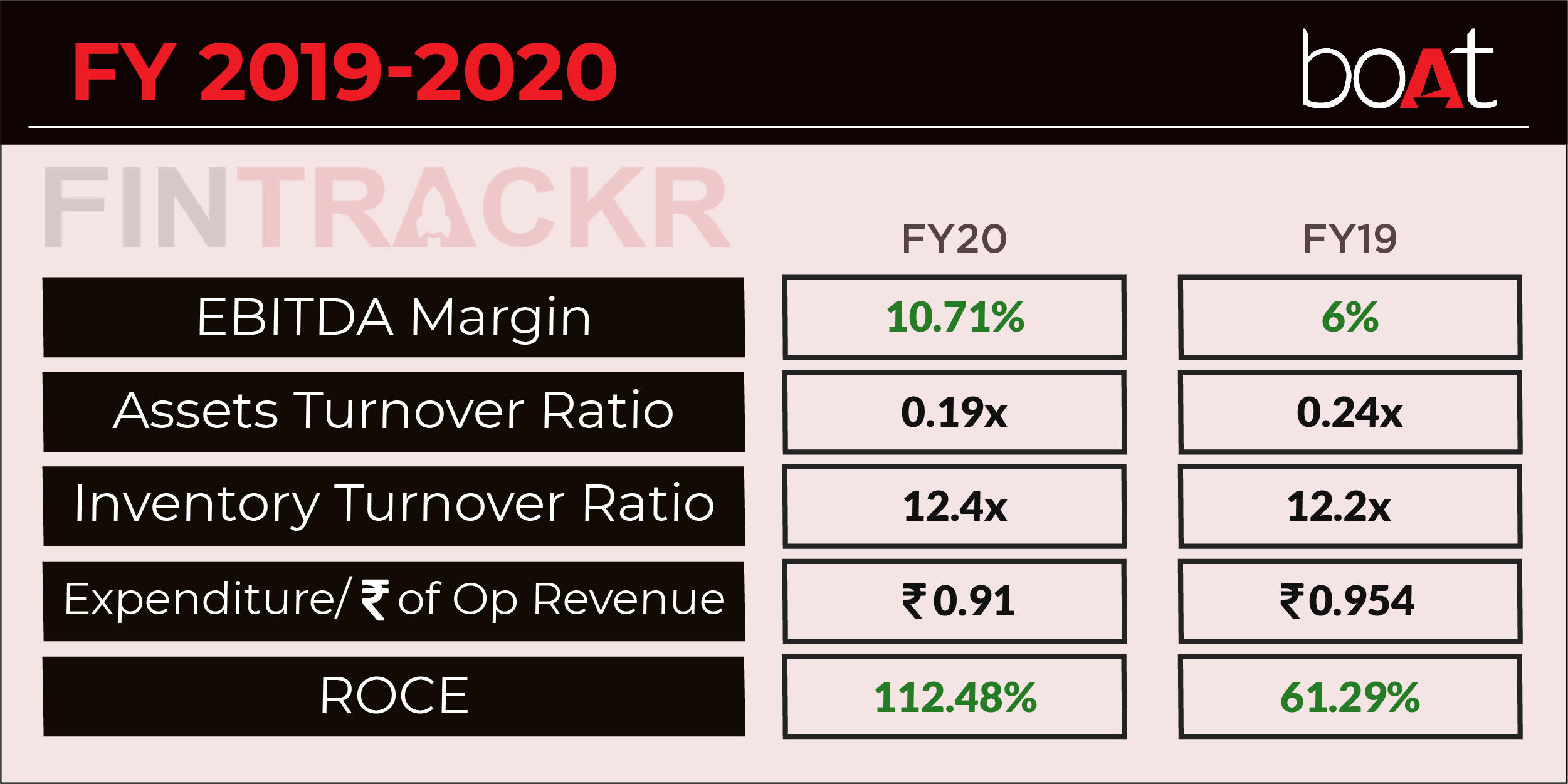

boAt spent Rs 0.91 to earn a single rupee of operating revenue in FY20 and its EBITDA margins improved by 471 BPS to 10.71 during the same period.

As a result of ballooning sales and improved operational margins, boAt registered an impressive 460% growth in profit during the last fiscal, generating a profit of Rs 48.85 crore in FY20 as compared to a profit of Rs 8.73 crore in FY19.

The numbers above show how good the going has been for boAt in FY20. A 5.6X jump in profit with three-fold growth in operating revenue sets it apart from startups of its age. Unlike aggregation and asset-light models, D2C brands across niche segments appear scalable with sound unit economics.

Fashion apparel brand Bewakoof, cosmetic brands Nykaa, Sugar Cosmetics, Purple and MamaEarth have posted superb growth with improvement in their unit economics. With the Make in India sentiment at an all-time high, boAt appears set to grow its top line and profits in FY21 as well.