On first glance, Google Pay India’s annual results look stellar as the company managed to achieve a 6.5X growth in its profits for the year which grew from Rs 5.1 crore in FY19 to nearly Rs 33 crore in FY20 while also improving its EBITDA margin from 3.49% in the previous fiscal to 5.02% this year.

These numbers look impressive for any company operating in India as the second largest UPI payment platform controlling 39.5% of the market, but there’s more to it as we look closer.

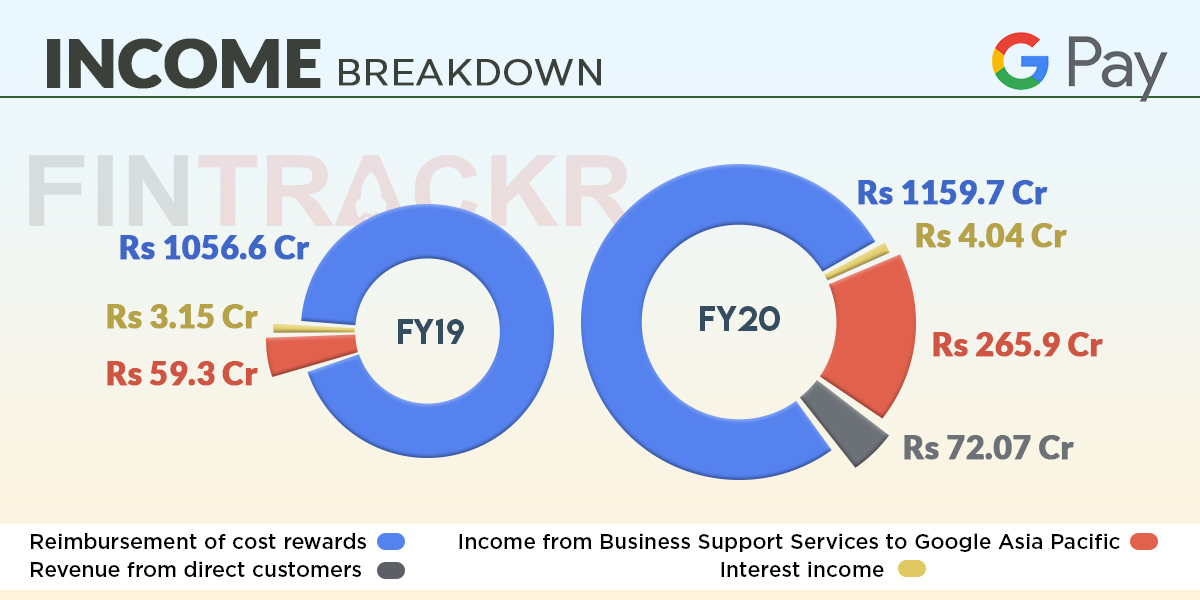

While the company’s total income grew 34.2% from Rs 1,119 crore in FY19 to Rs 1,501.7 crore in FY20, 80.5% of the topline i.e Rs 1,173.4 crore was actually reimbursements received from the holding entity Google Asia Pacific recorded as revenues.

Breaking down the collections further, we see 77.2% of the total income was reimbursement for rewards given to users on its platform which amounted to Rs 1,159.7 crore during FY20. Another Rs 265.9 crore were collected from the Singapore based parent for the business support services provided during the fiscal ended in March 2020.

Interestingly, revenue from direct customers stood at Rs 72.07 crore, making up 4.8% of Google Pay’s topline during FY20.

These numbers come to fore at a time when none of the companies in the UPI space have been able to make any money. Players in the space such as Paytm and PhonePe have been deep into losses due to high marketing and cashback spends.

And even though Google Pay seems to have recorded a book profit, it appears to be more of clever accounting because over 80% of its revenue has come as reimbursement from its Singapore-based holding entity rather than from actual operations.

Moving over to the expense sheet, we see how the company’s cash burn stacked up in FY20. At Rs 1,132.43 crore, cost of the rewards given to its users made up 77.7% of the total expenditure incurred by the payments firm in FY20. Such expenses grew by 10.1% as compared to Rs 1,028.3 crore spent on the same in FY19.

Advertisement costs ballooned 135X to Rs 46.3 crore in FY20 from only Rs 34.3 lakhs in FY19. Notably, legal expenditure also rose 2.3X to Rs 79.4 crore during FY20 from Rs 34.6 crore in Fy19. Other operating expenditure also saw a surge during the last financial cycle as the company vied for the top spot among other UPI players like PhonePe, Paytm BharatPe .

Google Pay shelled out Rs 39.05 crore on processing fees during FY20, spending roughly 52X more as compared to fees amounting Rs 74 lakhs paid in FY19. Further, contract service payments also grew 50X to Rs 94.04 crore in FY20.

Interest costs amounting to Rs 31.3 crore pushed Google Pay’s total expenditure to Rs 1,457.63 crore in FY 2019-20, which rose by 31.2% from Rs 1,111.31 crore during FY19.