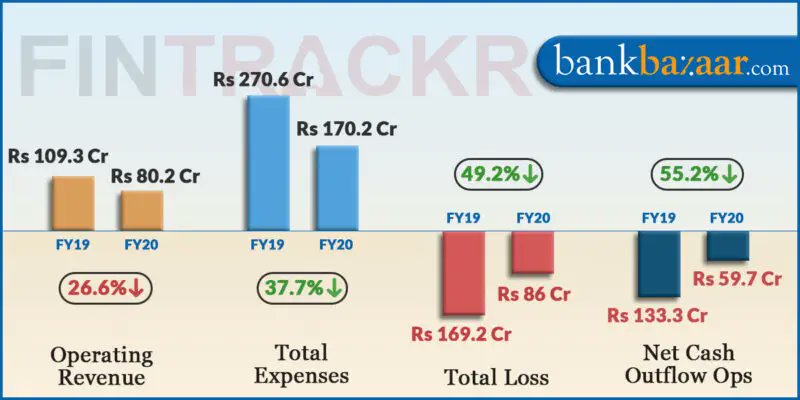

All isn’t well with financial marketplace BankBazaar that deals in credit cards and loan products. The company’s scale has shrunk by about 27% in FY20 as it ended the last fiscal with Rs 80.2 crore in operating revenue.

The overall operations have scaled down significantly which was evident by perusing through the company’s expenses sheet. Analysis of its financial statement filed with the Ministry of Corporate Affairs or MCA hint that the Chennai-based company was aggressively working towards cutting down its costs and conserving capital in FY20.

BankBazaar’s expenditure on employee benefit has turned out to be the single largest cost factor for the twelve-year-old company, making up 61.7% of the total costs incurred by the company during FY20. These expenses have been reduced by 27.3% to Rs 105 crore during FY20 from Rs 144.5 crore in FY19.

The Amazon-backed company acts as an intermediary for financial institutions and banks, selling their financial products and generating leads through online traffic and calling potential customers. The reduced rate of calls and leads can be identified by the immediate drop in communication expenses, which reduced by 72.5% from Rs 16.7 crore in FY19 to Rs 4.6 crore in FY20.

BankBazaar has reduced its physical footprint as well, letting go of office spaces to reduce costs in FY20. Rental expenses have reduced by 88.2% to only Rs 1.5 crore in FY20 from Rs 12.7 crore. Further, there was a heavy slashing of expenditure on advertisement and promotion by the management.

Such costs dropped by 58.1% from Rs 65.4 crore in FY19 to only Rs 27.4 crore.

The overall cost sheet has reduced in size because of conscious efforts by the management to curb costs and conserve cash reserves in the company. Total expenditure during the fiscal ended in March 2020 has reduced by 37.1% to Rs 170.2 crore as compared to Rs 270.6 crore it spent in FY19.

The company spent Rs 2.12 to earn a single rupee of operating revenue in FY20 as compared to Rs 2.47 and EBITDA margins improved slightly from -168.11% in FY19 to -135.6% in FY20.

Due to the company-wide austerity measures, BankBazaar has managed to reign in its losses, which dropped by 49.2% to Rs 86 crore in FY20 from Rs 169.2 crore it lost during FY19. The company’s big problem still stands tall in the form of outstanding losses of more than Rs 658 crore on its balance sheet as on 31st March 2020.

BankBazaar has also written off and sold a chunk of its assets and the total assets have dropped by 44.5% to Rs 84.2 crore at the end of FY20 as compared to Rs 151.8 crore in FY19. During the same time, asset turnover improved from 0.781 times in FY19 to 1.001 in FY20.

BankBazaar’s financial performance in FY20 has not been up to the mark. Its revenue should have gone upwards, however, its topline shrunk by over one-fourth. While the control in losses is a good sign, it appears that the company requires to raise more capital and explore new revenue channels. Since the ongoing fiscal has been severely hit by Covid-19 pandemic, BankBazaar’s topline may take a hit in FY21, too.