As edtech companies continue to garner investor interest, Eruditus, a platform that offers executive courses, has raised $93 million in a Series D round co-led by Naspers and Leeds Illuminate Global Fund. Chan Zuckerberg Initiative (CZI), Sequoia Capital and Ved Capital Evergreen Private Equity also participated in the round.

The South African media conglomerate and Leeds have infused $30 million of primary capital each, show regulatory filings in Singapore. Facebook founder and CEO Mark Zuckerberg and wife Priscilla Chan’s philanthropic organisation had forwarded $15 million debt to Eruditus in May. This debt has now been converted into preference shares.

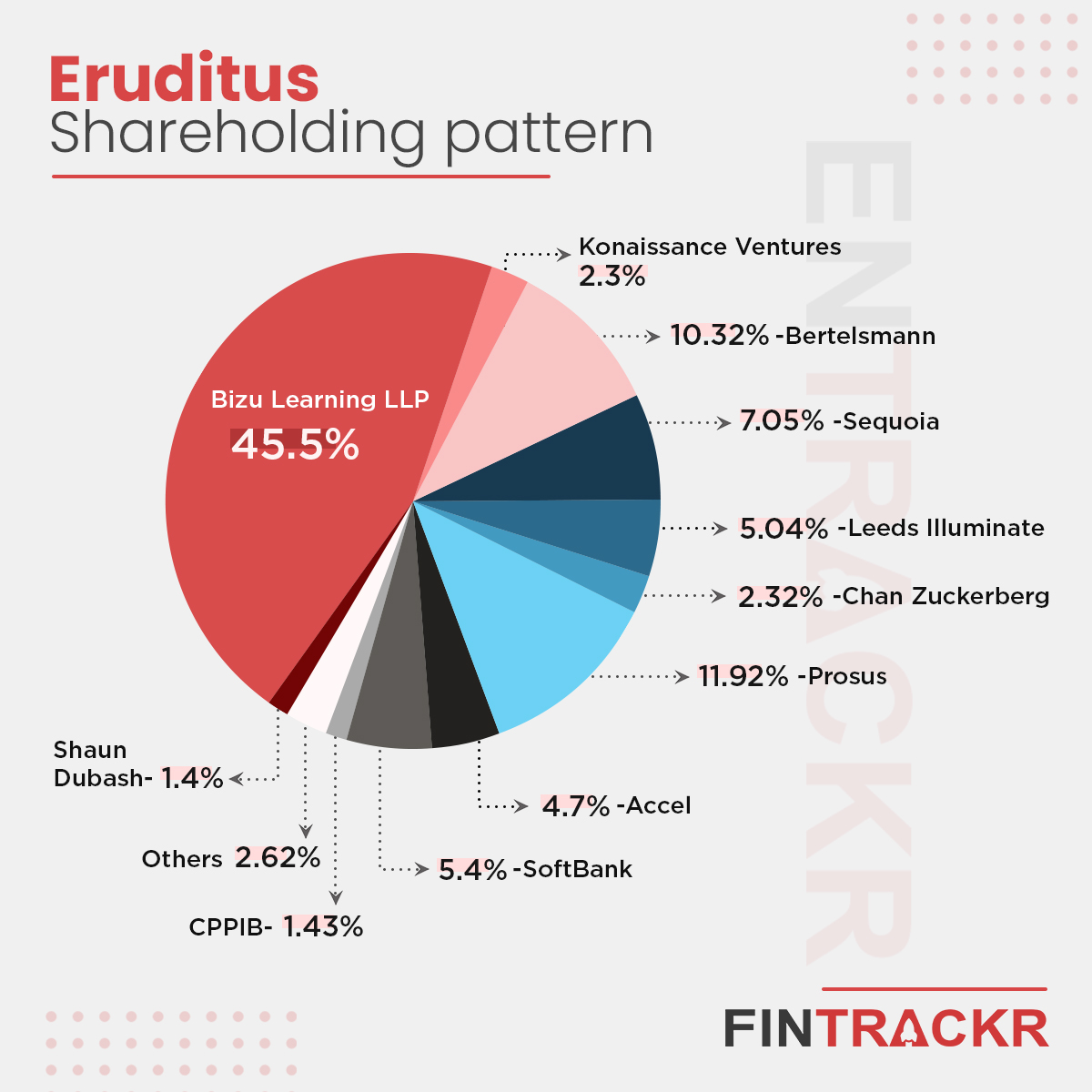

Sequoia also invested $3 million debt at that time which has now been converted into preference shares. Importantly, Naspers and Leeds also bought $14 million worth shares in a secondary transaction. Naspers picked up $4.67 million and $4.62 million worth shares from Eruditus’ senior director and business head Shaun Dubash and Konaissance Ventures LLP(controlled by co-founder Chaitanya Kalipatnapu and associate director Emmanuelle Perraud.

Eruditus’ co-founder ND Ventaka, P Vaidyanathan and Balagopal Vissa also offloaded holdings worth $284K, $243K and $162K respectively to Naspers. Leeds, on the other hand, bought $2.02 million and $1.98 million worth shares from the Mumbai-based Konaissance and Dubash.

Fintrackr estimate shows that Eruditus has been valued $695 to 705 million in the fresh financing round.

A decade-old startup led by Chaitanya Kalipatnapu and Ashwin Damera, Eruditus offers executive courses for working professionals in partnerships with MIT, Columbia, Harvard, Cambridge, INSEAD, Wharton, UC Berkeley, IIT, IIM and others. The firm has launched more than 100 courses in multiple languages, including Spanish, Portuguese and Mandarin.

As per Fintrackr’s calculations, Bizu Learning an LLP controlled by Co-founder Damera is the largest shareholder controlling 55.09% stake worth $374.3 million followed by Erste WV GMBH, which controls 16.2% holding worth $110 million in the company.

While existing investor Sequoia has 8.54% stake in Eruditus worth $58 million, lead investor Naspers has acquired a 5.8% stake amounting to $40 million.

At present, about half of Eruditus’s consumers are from the US and India while Europe, Latin America and South-East Asia contribute the rest. It claims to enrol over 50,000 students in the last 12 months.

Last week, Damera told ET that Eruditus had been profitable in the April-June quarter, and expects to post a “substantial profit” in its fiscal year ending June 30, 2021. According to him, the startup had clocked $100 million in revenues in last year and aims to double in the current year.

The ongoing Covid-19 pandemic has also hit the company’s business as 25% of its revenue comes from online plus offline courses.

Moneycontrol first reported that CZI was in talks to invest in Eruditus.