One of the fastest-growing digital payments products across the world, UPI (Unified Payments Interface) has continuously been in the limelight since its inception in 2016. The initiative by NPCI (National Payments Corporation of India) to bring digital payments under a single umbrella is now ticking all boxes for creating a hassle-free platform for over 100 million users in India.

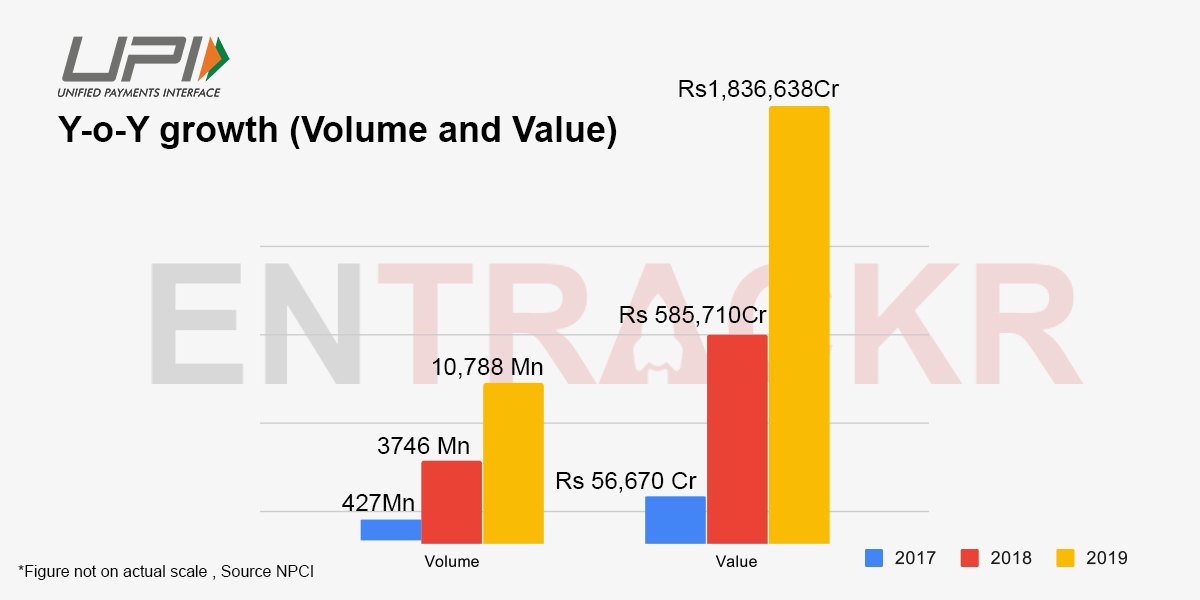

In its three years of operations, UPI has seen tremendous growth on the back of the presence of homegrown as well as overseas players in the segment. If we compare the number of transactions UPI processed on a year-on-year basis (2018-19), it has recorded 187% or ~ 3X jump aggregating 10,787.54 million or 10.8 billion transactions in 2019, according to data sourced from NPCI.

Not only volume but the value of transactions has also broken all previous records with 1.3 billion transactions worth Rs 2 trillion clocked just in December.

On a year-on-year basis, the value of transactions soared over 3X from Rs 5 trillion (or Rs 585,710.45 crore) in 2018 to Rs 18 trillion (or Rs 1,836,638.18 crore) in 2019.

While UPI had officially kicked off operations in August 2016, it started gaining momentum from early-2017. That was the time when UPI-based payment apps like PhonePe, Paytm and BHIM became popular due to demonetisation just a few months prior.

In 2017, UPI registered 426.7 million transactions worth Rs 56,670.1 crore — a small but significant number given that online money transfer for the mass audience was limited to internet and phone banking.

Rise of PhonePe, Google Pay and Paytm while BHIM lost the plot

The rapid rise in UPI’s adoption is the result of seamless digital payment services offered by the top three firms — Paytm, PhonePe and Google Pay.

As these three firms were rapidly climbing the UPI charts, BHIM, launched by the government, has almost gotten out of the race in terms of volume and value. This has further resulted in the reduction of the government-owned UPI app’s market share to a single digit.

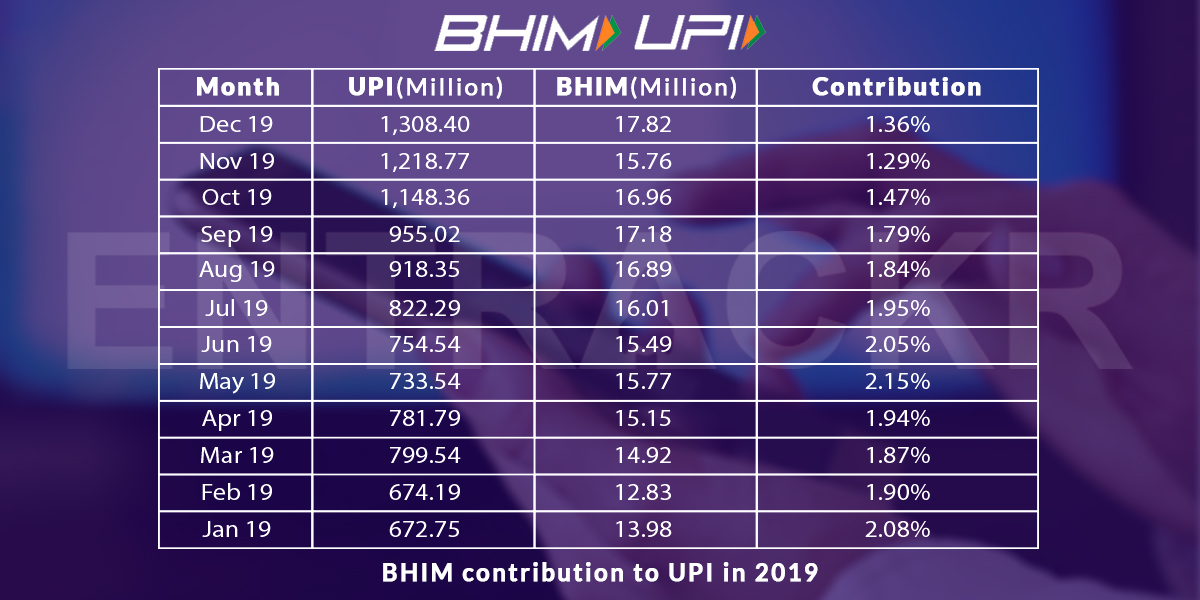

On a month-on-month comparison, the contribution of BHIM witnessed a new low of 1.29% in November 2019 and it ended the year with a mere 1.36% to the overall UPI market share.

For the whole year, BHIM’s UPI market share was recorded at 1.74%.

BHIM’s overall UPI transactions in 2019 were 188.76 million, way below PhonePe or Google Pay’s single-month volume.

To put things in perspective, as of July 2019, PhonePe registered 335 million UPI transactions, whereas Google Pay and Paytm clocked around 300 million and 133 million, respectively.

Since then, the three firms haven’t disclosed their breakdown of monthly transactions via UPI.

According to industry experts and sources tracking this space, PhonePe, Google Pay, and Paytm control over 90% market share in the UPI ecosystem and PhonePe is leading the pack followed by Google Pay.

Contemplating saturation level in peer-to-peer (P2P) UPI payments, Paytm had pivoted itself to merchant-focused payments. The Alibaba-backed company is also mulling over incentivising peer-to-merchant (P2M) payments system.

Recently, Paytm launched an all-in-one QR code payments feature with no MDR (merchant discount rate) on transactions made through UPI and Rupay card.

In P2M payments, Paytm and PhonePe are market leaders followed by the new entrant and rapidly growing BharatPe.

Road ahead for UPI

To further onboard 500 million customers or more than one-third of the country’s current population under the UPI ecosystem in the next three years, the government-owned entity has been trying to make best possible efforts like waiving off MDR charges, onboarding more banks, enabling recurring payments. It is also looking at foraying into international markets.

With the intention of making it more appealing and ramp up use cases, various banks are thinking about introducing UPI-enabled cash withdrawal for their customers. Besides, NPCI is also planning to collaborate with the income tax department of India to enable tax payments using UPI.

In the coming months, Facebook-owned WhatsApp is likely to join the UPI bandwagon fully, which will see a further increase in the number of customers on the unified payments railroad.

If all goes well within the time frame, UPI is bound to set an example of an ideal product-market fit in the digital payments space for a global audience.