Aye Finance has always been good with raising equity and debt capital to fund its business model of lending to small enterprises.

Soon after securing Rs 107 crore in a debt funding round from BlueOrchard, Aye Finance has now bagged an investment of $20 million from venture capital firm A91 Partners through a secondary sale of shares.

Following the deal which was led by Kaushik Anand, India head for Capital G at A91, the firm has acquired the stake of Aye Finance’s early backer Accion.

Importantly, Accion has received a 3X exit in return from its initial investment.

Floated by former Sequoia Capital’s managing directors VT Bharadwaj, Gautam Mago, and Abhay Pandey, A91 had closed its maiden fund at $350 million in May last year to invest on early to growth-stage private companies across consumer, healthcare, financial services, and technology sectors.

While the latest development has taken the primary funding of Aye Finance to $70 million from investors including SAIF Partners, Falcon Edge Capital, Accion and Capital G, it is also preparing for another equity fundraise and is scouting for a banker to run the process, cited in a Press Release.

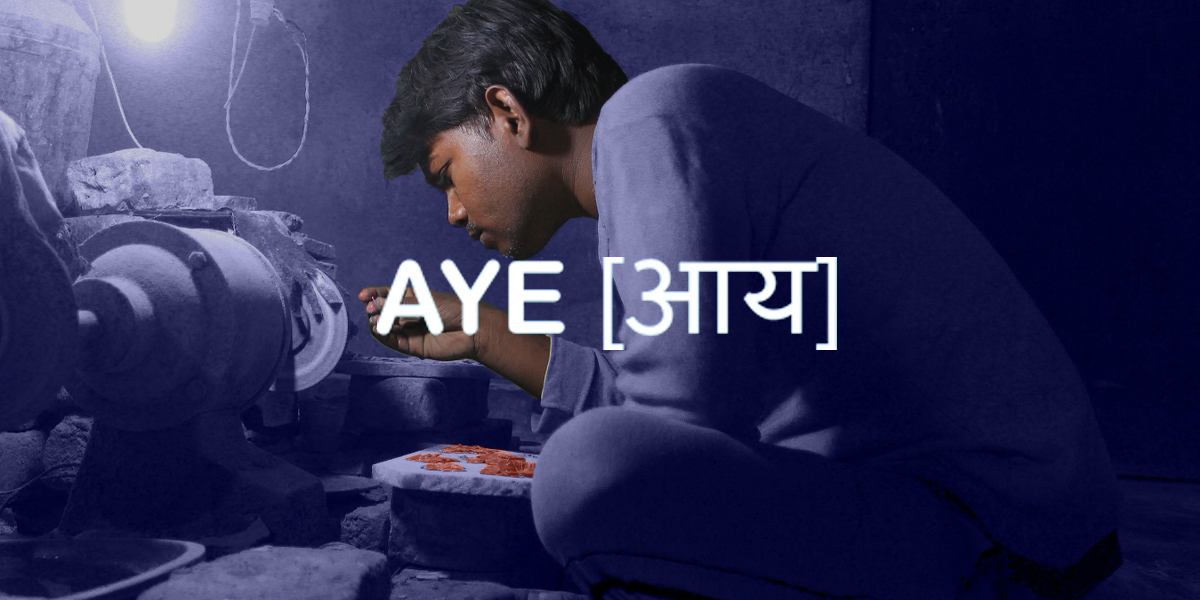

Launched in 2014 by two veteran bankers- Sanjay Sharma and Vikram Jetley – Aye Finance provides customer-centred financial services to micro and small businesses.

With over 100 branches in 11 states across India, it majorly serves segments including manufacturing, trading and service groups among others.

Besides, the company claims to provide Rs 2,700 crore worth of credit to over 1,96,000 grassroots businesses.