The premium smartphone market in India has changed a lot in the past three-four years. While Samsung, Micromax and Apple used to dominate until the first half of FY16, the local smartphone brand took a beating in the following years when Xiaomi along with Opp-Vivo started cannibalising Micromax’s market share.

According to the latest IDC report, Xiaomi has captured a 28.9% share of the Indian smartphone market, and Samsung has a 22.4% market share. And the trio of Xiaomi, Oppo and Vivo have wiped out Micromax from the market. This has also allowed OnePlus to take the pole position in the premium smartphone segment.

While Oppo, Vivo and OnePlus are yet to disclose their annual financial statements, Apple India, Samsung, and Xiaomi had reported their financial healths in the year ending March 2019.

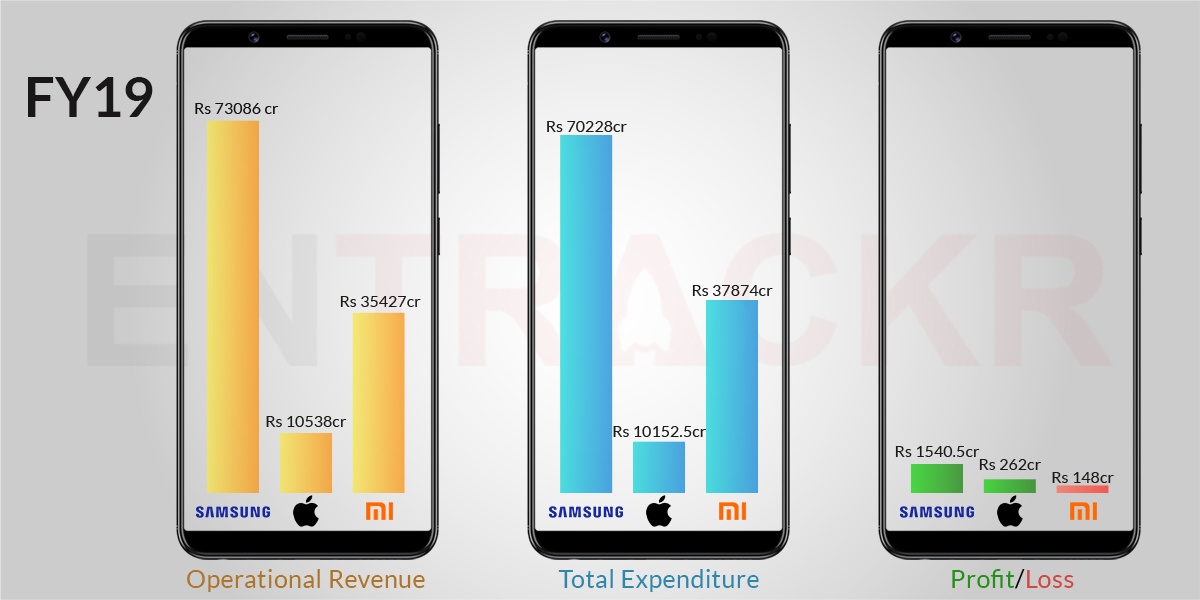

Analysis of the filing reveals that the Korean phone maker Samsung’s Indian arm has generated the highest revenue of Rs 73,085.9 crore in FY19. It recorded a 19.7% increase in revenue during the last fiscal as compared to Rs 61,065.6 crore in FY18.

Xiaomi outnumbered every other player by registering 54% revenue growth in FY19. Its total revenue during FY19 stood at Rs 35,426.92 crore. Importantly, Apple India’s revenue took a hit of 19% in FY19 and remained a distant third player with Rs 10538.2 crore revenue.

Adoption of OnePlus and exorbitant prices of fresh iPhone models were the reasons for Apple’s declining market share as well as revenue in India.

Samsung has recorded the most expenses among the three with Rs 70,227.8 crore. The company witnessed a rise of 27% in overall expenditure in FY19. In the end, it posted a net profit of Rs 1,540.5 crore.

Xiaomi and Apple India spent Rs 37,874.1 crore and Rs 10,152.5 crore respectively in FY19.

Apple India posted a profit of Rs 262.27 crore while Xiaomi has incurred a net loss of Rs 148.48 crore in 2018-19. Xiaomi had made a profit of Rs 301.62 crore in FY18.

The financial health of the three major smartphone makers shows that Xiaomi registered the highest revenue growth in FY19. However, unlike other manufacturers, it works on wafer-thin margin, and this is reflected on its balance sheet. On the other hand, Samsung continues to thrive, albeit at a slow pace.

Exorbitant pricing by Apple and the availability of high-performance premium phones at a lower price such as OnePlus and some models of Samsung made a dent on Apple’s revenue during FY19. However, the company is likely to bounce back in the ongoing fiscal with the opening-up of FDI in single-brand retail.