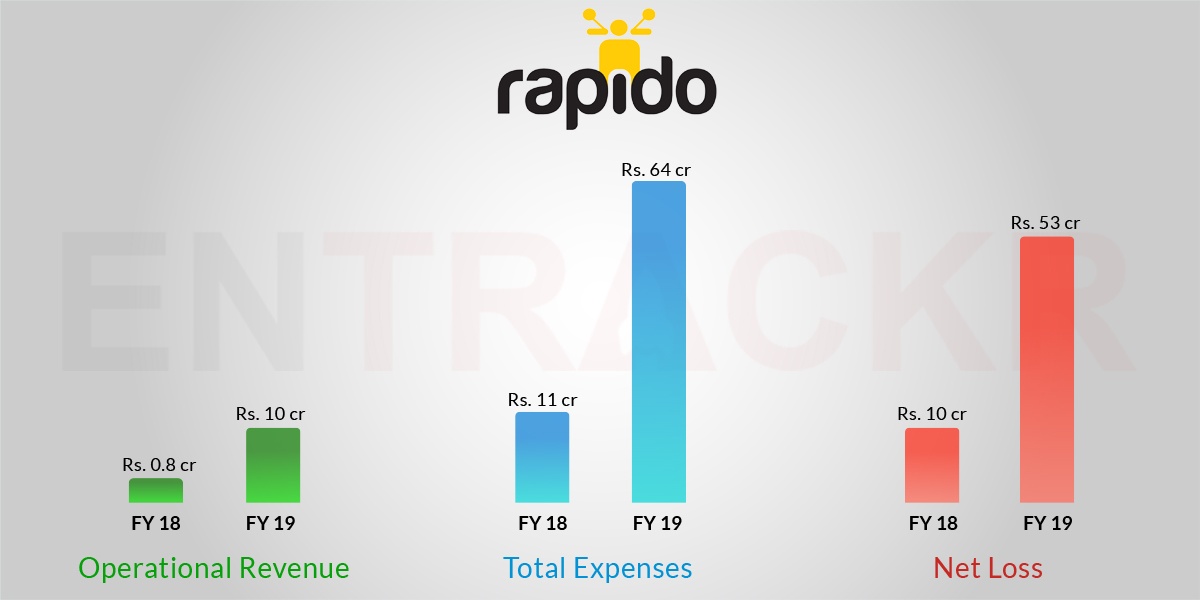

Bike taxi startup Rapido is gaining quick ground in the last-mile commute segment. This reflects in its financials, too. The Bengaluru-based firm registered a 12.5X jump in revenue from operations to Rs 9.82 crore in FY19 from a mere Rs 78.36 lakh the previous fiscal, according to its regulatory filings.

The company’s other income, including discount received, interest income and capital gain on sale of mutual funds, also increased by 53.6 times to Rs 82.59 lakh during the same period.

Founded in 2015 by Rishikesh SR, Pavan Guntupalli and Aravind Sanka, Rapido provides on-demand bike taxi services. It is available across 90 locations, serving over 10 million customers on the back of 5,00,000 riders or captains.

Rapido has become one of the most significantly-funded players in mobility space. This year itself the firm raised $10 million in January from Nexus and Integrated Capital, followed by $50 million in August in a round led by WestBridge Capital.

The company is also in the market to raise another $100 million as it continues to grow at a breakneck speed. Several industry experts say that both Ola and Uber are losing market share to Rapido.

While the revenue from operations grew over 12 times, the firm’s total revenue spiked 13.4 times, amounting to Rs 10.64 crore in FY19 from Rs 79.90 lakh last year. Meanwhile, expenses also shot up, albeit at a relatively smaller pace. Rapido’s expenses in FY19 increased by 5.7 times , to Rs 63.93 crore from Rs 11.14 crore the previous year.

Out of the total expenses, a majority was spent on various components such as legal & professional expenses, operational expenses, rent and marketing expenses, which increased significantly by 7.14 times to Rs 52.21 crore from Rs 7.31 crore the previous year. Of this, marketing expenses formed a high amount of expense coming up to Rs 28.26 crore.

Employee benefit expenses amounted to Rs 11.58 crore this year, up from Rs 3.64 crore the previous year.

Generating an overall revenue of Rs 10.64 crore against an expenditure of Rs 63.93 crore resulted in 5X increase in net losses to Rs 53.29 crore in FY19.

Given that Rapido has expanded its operations as a result of back to back funding rounds in 2019, the scenario will be far different in the next fiscal. The firm had also fought legal battles with a couple of state governments over its operations.

This is perhaps reflected in the legal and professional expenses of Rs 1.03 crore incurred during the FY19, up from Rs 10 lakh in FY18.

Backed by the likes of WestBridge Capital, BAce Capital and several bluechip angels such as Rajan Anandan, Pawan Munjal, Anupam Mittal, Harish Bahl, Ankit Nagori and others, Rapido’s recently-concluded Series B round valued the firm at over Rs 1,000 crore.

As far as competition is concerned, Rapido finds direct competition from ride-hailing giants Ola and Uber. In the meantime, Google-backed hyperlocal delivery startup Dunzo has been exploring this segment in selected cities of India.