Gone are the days when there used to be a lot of questions raised on startups by investors on whether their investment will bring them a good return. Now startups in India are attracting investors from all over the world with large outcomes.

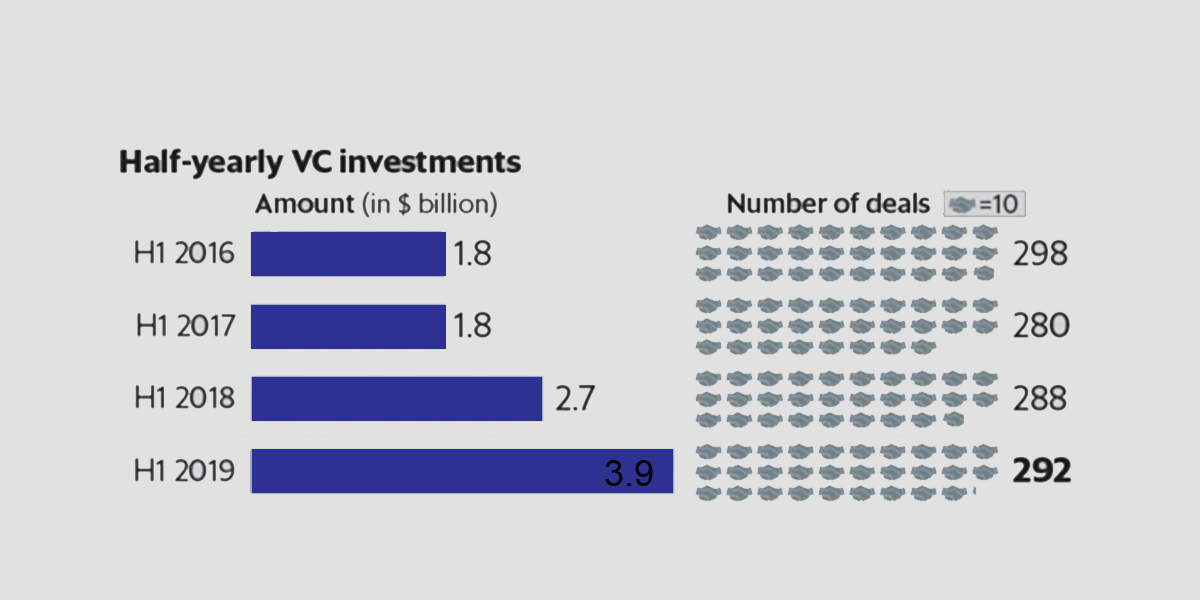

According to Venture Intelligence latest data, startups in India in the last six months raised about $3.9 billion from venture capitalists. Startups scored the abovementioned amount in about 292 deals. This is over 44% of jump in VC investment amount in comparison to the first half in 2018.

Looking at the last three consecutive years figure indicate rise capital inflow in the last six months.

The VC investment went into startups as seed, early investments and beyond Series D deals. The consumer startups continue to attract investment whereas B2B firms in logistics, software and marketplaces have also garnered a major chunk of investment, added the data.

In the first half of this year saw the emergence of Tier II and III cities and B2B models, which has been largely underinvested. Tiger Global renew focus and recent investments in B2B is a prime example.

Analysts observing the space see this as encouraging and the best time for startups in India.

Startups are now being rewarded with capital that will allow these businesses to continue to grow. Several deals of $100 million or more got reported in the first five months of 2019 than in the first half of the last two years.

Many of the analysts see Flipkart deal as ground-breaker one for startups in India. Last year, Walmart had acquired Flipkart in a deal worth $16 billion. The deal gave investors about double ROI.

Deal-making happened across sectors, and beyond giants startups such as Flipkart and Paytm, who for many years topped the investment charts, revealed the data.