Microdelivery aka subscription commerce has been one of the most talked about verticals in the startup community for a couple of years. This can also be validated from Suprdaily’s acquisition by Swiggy, entry of largest e-grocer BigBasket and back to back rounds for segment leader – Milkbasket.

Until now fierce competition in the segment was playing out in Southern India primarily in Bengaluru and Hyderabad. However, it has changed with the entry of Dailyninja and Suprdaily in NCR.

While the Sequoia-backed company had launched in Noida three weeks ago and will be kicking off operations in parts of Delhi and Gurugram soon, Suprdaily made its debut a couple of months ago.

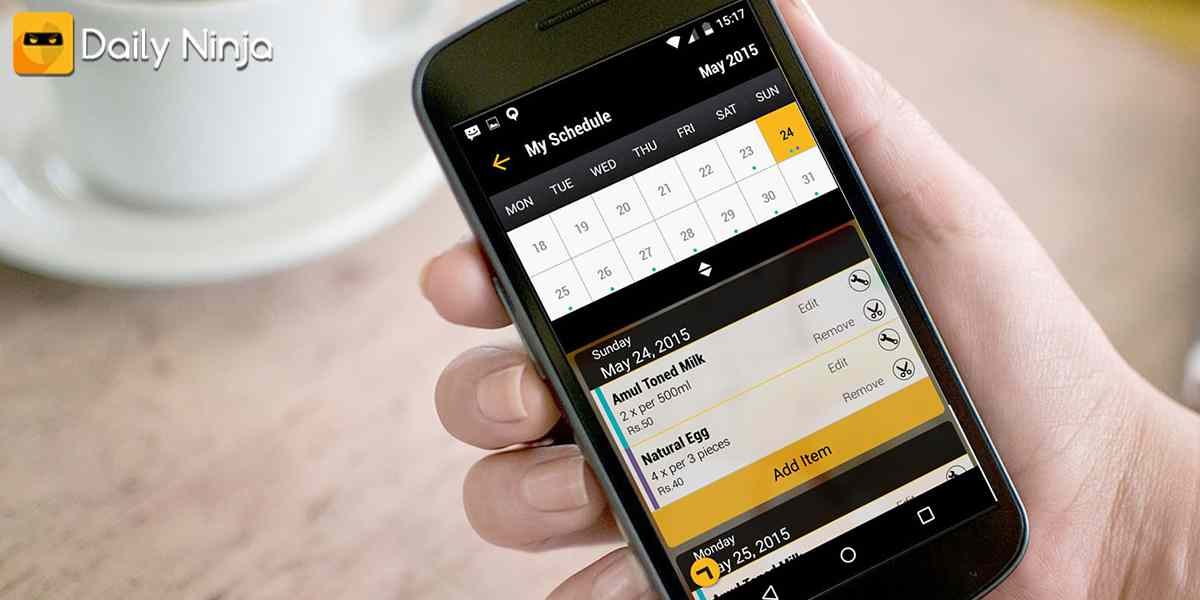

Entrackr has used the Dailyninja’s app and also spoke to a few customers using the service in Noida.

According to our sources, Dailyninja has been doing around 700-800 orders on a daily basis. Although when we contacted, the company declined to share any insights on its NCR launch.

“It has hired key people for operational roles in Gurugram, Noida as well as Delhi. The company will begin operations in Delhi and Gurugram by the end of next month,” outlined sources.

It’s worth noting that segment leader Milkbasket will now face serious competition in its local market – NCR. Early this year, Swiggy-owned Suprdaily already had launched in NCR region.

While Suprdaily and Dailyninja have launched in NCR, they will have to toil to attract Milkbasket’s customers as the Kalaari-backed company has a strong brand recall and loyal consumer base. On average, Milkbasket claims to receive 20 orders per customer in a month.

Dailyninja does about 70,000-75,000 orders a day while Milkbasket has been averaging over 45,000 daily orders. “As of now, Milkbasket has enjoyed a monopoly in NCR region. However, it will be changed if both Dailyninja and Suprdaily execute well across the tri-city,” added sources.

Bigbasket’s BBdaily has not shared any figure since its launch but as per industry estimate, it must be doing over 60,000-70,000 daily orders. Even with these numbers, Milkbasket remains the market leader due to its non-milk bigger basket sized orders. It wins in value rather than volume.

But now that all major micro-delivery platforms have made their debut in NCR, it would be interesting to see the competition amongst them, both volume and value wise. Meanwhile, customers are having a ball as they are being attracted by all these players via discounts and freebies.