For the past couple of years, Chinese investors have been heavily focussing on India, especially the tech startup segment.

Fosun RZ Capital, a Beijing headquartered company that invests in sectors ranging from education, real estate, TMT – technology, media, and telecom – all across the world.

Entrackr sources revealed that the VC is ramping up its TMT investment team in India. “Fosun is hiring Managing Directors and Analysts to escalate their TMT investments in India,” outlined one of the sources on the condition of anonymity.

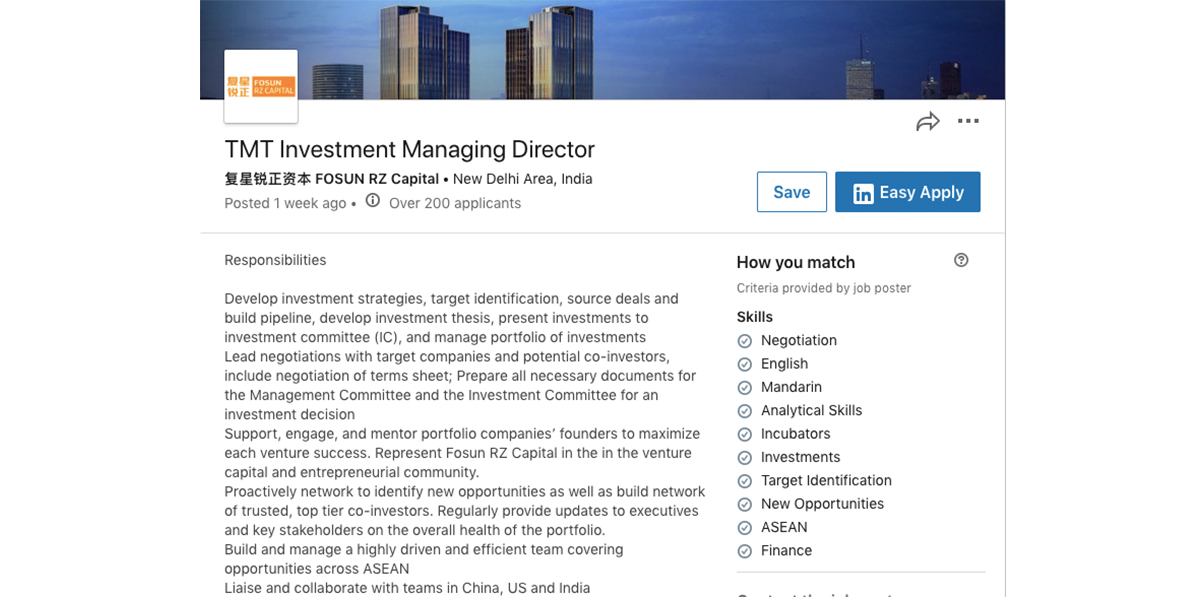

We confirmed this independently and found out that the job opening for TMT Investment Managing Director is listed on Fosun’s LinkedIn page.

Six years since inception, Fosun has invested in tech startups like ixigo, Delhivery, LetsTransport, Mylo, Kredily etc. Interestingly, Fosun invests in all stages – early to late – in its portfolio startups. Where ixigo and Delhivery have seen Fosun investing at a late stage, Mylo and LetsTransport onboarded Fosun as an investor in the early stages itself.

The transition from investing in mid to late stages to investing in early stages as well for the Tej Kapoor led investment firm happened last year April when the VC turned a sharper eye towards investments in India.

“This is interesting as the group doesn’t compete with large investors such as SoftBank, Alibaba, Tencent, Naspers etc as it doesn’t issue large ticket sizes and largely stays away from investing in segments such as fintech where there is SoftBank, Alibaba (Alipay), foodtech where there is Naspers, Tencent,” pointed another source.

The exception in fintech being its recent investment in Kissht.

This means that if Fosun plans on continuing this trend, it will target other rising sectors in Indian TMT space. But it also seems to be opening up to fintech if we look at the aforementioned exception. In general, fintech, healthtech, agritech, electric mobility space, co-living and other such segments attracting the interest of investors in recent days.