Foodtech has turned out to be an opportunity that no one wants to miss. Be it Kishore Biyani’s Future Group, shuttle service Shuttl or OYO – they all aspired to get a pie of fledgling food delivery segment that is set to grow up to $29 billion by 2021.

To strengthen its aspiration in the segment, OYO is currently in advanced talk to acquire Bengaluru-based cloud kitchen – Freshmenu. Meanwhile, in a surprising move, OYO has opened over 20 cloud kitchens in Gurugram and Bengaluru to deepen its foodtech play.

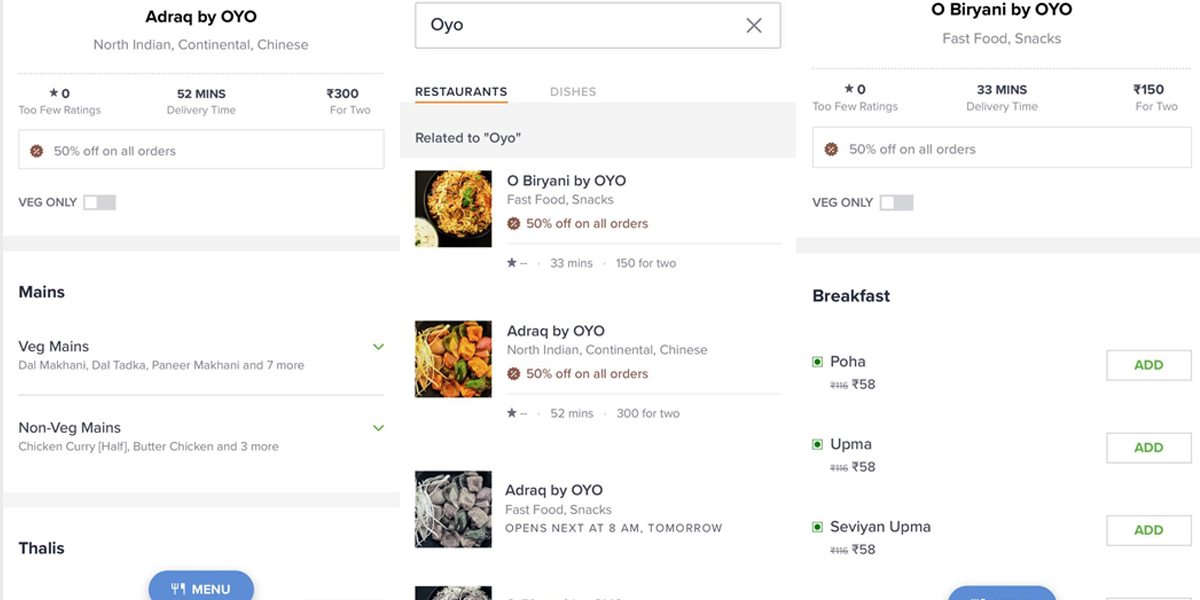

Currently, these cloud kitchens are leveraging Swiggy, Zomato and UberEats to rake in orders. Entrackr has ordered yesterday from one of these kitchens. The kitchens named Adraq by OYO and O Biryani by OYO cater to a wide range of genres including Indian, Mughlai, Chinese, and continental among others.

OYO’s full-fledged aspiration in foodtech (except delivery) via cloud kitchens has come at a time when it’s finalising FreshMenu’s acquisition in about $60 million. It eyes a larger reach through the Lightspeed-backed firm.

“OYO’s involvement is not limited to being a distribution partner or just providing the infrastructure. The kitchens are fully operated by the company,” outlined two sources to Entrackr who’re aware of the plans on condition of anonymity.

Besides listing on aggregators, the firm is also serving Townhouse and Keys Hotels through existing brands. “The idea is to understand the demand and push expansion and launch more brands if the company observes decent traction,” added sources.

Notably, this is not the first attempt of OYO at foodtech market. In September 2015, it piloted aggregating platform OYO Cafe for a brief period.

“As the largest hotel chain in India, operating franchised and lease assets, we do have an active play in the F&B business with an average of about 25% of our revenue coming through the kitchens we operate in our some of our hotels and hence culinary design and good food experience are valuable to us. We have nothing further to announce at the moment,” said OYO Spokesperson in an email response.

Over the past year, the food delivery market has been witnessing an intense competition between Swiggy, Zomato, and UberEats. Backed by conglomerates such as Ant Financials, Naspers and SoftBank, the trio have been bleeding in a tune of $80 million every month.

To consolidate the segment, Swiggy is reportedly acquiring UberEats Indian biz in about $330 million. While the deal doesn’t appear significant for the Meituan backed firm, several analysts outline that Swiggy is eyeing proximity with SoftBank by folding up UberEats’ operations.

Uber had executed such consolidations with Grab (SEA region), Didi-Chuxing (China), and Yandex (Russia) in its core transportation as well as food delivery business.

Given that OYO is acquiring FreshMenu and already launched about 20 cloud kitchens, its shot at foodtech market appears serious. Looking at the recent forays by the company, several observers are concerned that OYO is expanding with a quick pace and diluting focus from its core business.

Recently, it also acquired Innov8 to mark its entry in coworking space. Entrackr had exclusively reported about the deal last month.

With foodtech and co-working, OYO’s undoubtedly demonstrates lofty aspirations. How would these fructify? Only, time will tell.