SoftBank has always been positive about India being its largest potential market and now it is aggressively enhancing its focus in the country.

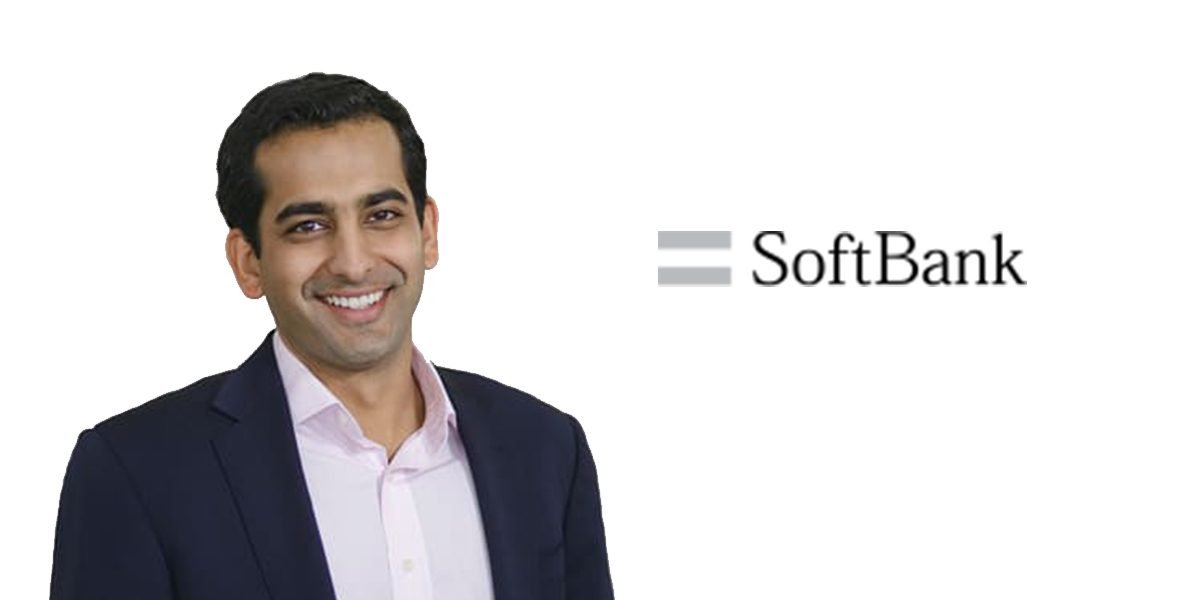

The Japanese investment giant last week had appointed Sumer Juneja to lead the investments into the country. The Masayoshi Son led-firm, through the appointment of the former director of Norwest Venture Partners (NVP), is planning to tap his past associations and ready insights into startups to make smarter and larger India investments.

The investment behemoth is also eager to realise its longing to invest in India’s food tech space, which has not been fruitful despite a couple of rounds of investment talks with Swiggy and Zomato in past.

And this is where Juneja’s appointment is expected to play a big role.

Three years ago, Juneja, as part of NVP team had led $20 million investment into Swiggy and had served as a board member in the food tech firm. With him being appointed as India’s head, SoftBank might once again approach Swiggy for investment talks.

As per early investors and experts observing the space, this is a deal that both the firms would be looking for as Swiggy is burning cash at a very fast rate and it needs deep-pocket backer like SoftBank to scale further and continue operating for a longer period.

Swiggy is reported to lead the food tech space with 22 million monthly orders. It has raised over $465 million so far.

Apart from food tech space, Softbank would also be looking to make bets across the biggest and fastest growing Indian startups across sectors including clean energy, logistics, and e-commerce.

SoftBank Investment Advisers, which invests through SoftBank Vision Fund, is also opening an office in Mumbai.

Further, SoftBank plans to invest $10 billion in 10 years in India. In the last four years, it has already invested about $7 billion in Indian firms including Flipkart, Ola, Paytm, Snapdeal, Policybazaar, Oyo Rooms, and Grofers. It is reportedly in the last leg to invest in Nykaa, Delhivery, and Firstcry.

For its second vision fund, SoftBank is in talks to raise $100 billion.