Kunal Shah’s much-awaited venture Cred has started onboarding early users. Our team at Entrackr has used the iOS and Android versions of the app. Currently, the app is in beta stage and one can register through feeding mobile number. Individuals who have CIBIL score of over 750 are only eligible for the access.

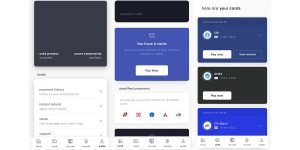

The app certainly impresses with its design and user experience. It barely takes two minutes to download, register, verify and make payments. It also rewards users with cred coins, the same number their CIBIL score. The CIBIL score calculation is being powered by consumer credit reporting agency – Experian.

Cred has partnered with Urban Ladder, ixigo, CureFit, Furlenco, FreshMenu, Flyrobe and many others where Cred Coins can be redeemed. Entrackr was first to report the details regarding Cred two and a half weeks ago.

With a team of about 50-60 people based out of Bengaluru, Cred already had raised $30 million from Sequoia Capital, Chinese VC firm Morningside and others.

While the app is in beta stage and may roll out several important features later, its offerings are plain, simple and not something out of the box. Importantly, offers by Cred’s partners aren’t as premium as anticipated.

If we look at Shah’s previous venture – Freecharge and factor in its core DNA, Cred seems to be similar but the target audience is completely different (in fact, reverse). Freecharge used to position as a marketing platform for brands through recharge for masses while Cred looks to build a layer of services on top of credit card payment for the premium customer base.

Unlike Freecharge, Cred is focusing on high ARPU cohort as American Express does in credit card segment. AmEx deals with premium customer and charge merchant/brand partners for accessing them. To a large extent, Cred is following a similar strategy.

Although there is no parallel of Cred in India, it looks similar to Credit 51 that has emerged as successful personal financial services for personal credit management in China. It’s a Unicorn and listed company on the Hong Kong Stock Exchange.