Early February this year, Beijing-headquartered Meituan-Dianping made headlines in India when it participated in Swiggy’s $100 million funding round with an investment of $40 million. In another $210 million round this month, Meituan was one of the key investors along with South Africa-based Naspers and Russia’s DST Global in the Indian food delivery major.

On the surface, this was a significant development for the Indian startup ecosystem as it marked the entry of $30 billion worth Chinese e-commerce juggernaut.

Far from being limited to food delivery, Meituan, provides a slew of services ranging from deals & coupons, grocery, movie ticket booking, handyman services, travel, and on-demand cab services.

In simple terms, Meituan is like an amalgamation of Bookmyshow, Mydala, BigBasket, Swiggy, Mobike, UrbanClap, and MakeMyTrip.

Origins of Meituan go back to 2010 when it started as a platform for deals & coupons – a clone of Groupon.

The founderWang Xing, the founder of Meituan, had started his journey as an entrepreneur with a replica of Friendster in 2003. Later he started various other websites such as Xiaonei (social media site) and Fanfou (a microblogging site). However, the former had to be sold keeping money exigencies in mind and the latter was forced shut by the government.

The first platform ever launched in 2003 was the replica of Friendster. In 2005, he founded Xiaonei, a clone of Facebook. This company, however, still exists and goes by the name Renren and is one of China’s top internet companies. Fanfou was a close appropriation of the microblogging site Twitter. Meituan is an approximate replica of Groupon.

Xing has earned the reputation of a cloner and copycat but he pays no heed to these references. He takes his critics sportingly. In his earlier interviews, he said, “Disruptive innovation is admittedly important, but having options is also important.” He admits that he is not trying to reinvent the wheel, just trying to perfect it.

His most successful venture Meituan, later expanded the services in other segments and became one of the most promising companies in China after Baidu, Alibaba, and Tencent (BAT).

Till 2015, the company, however, was known as a group-discount website which would sell vouchers from merchants as deals for customers. The business strategy of the company changed when it merged with Dianping, a Tencent-backed food delivery platform.

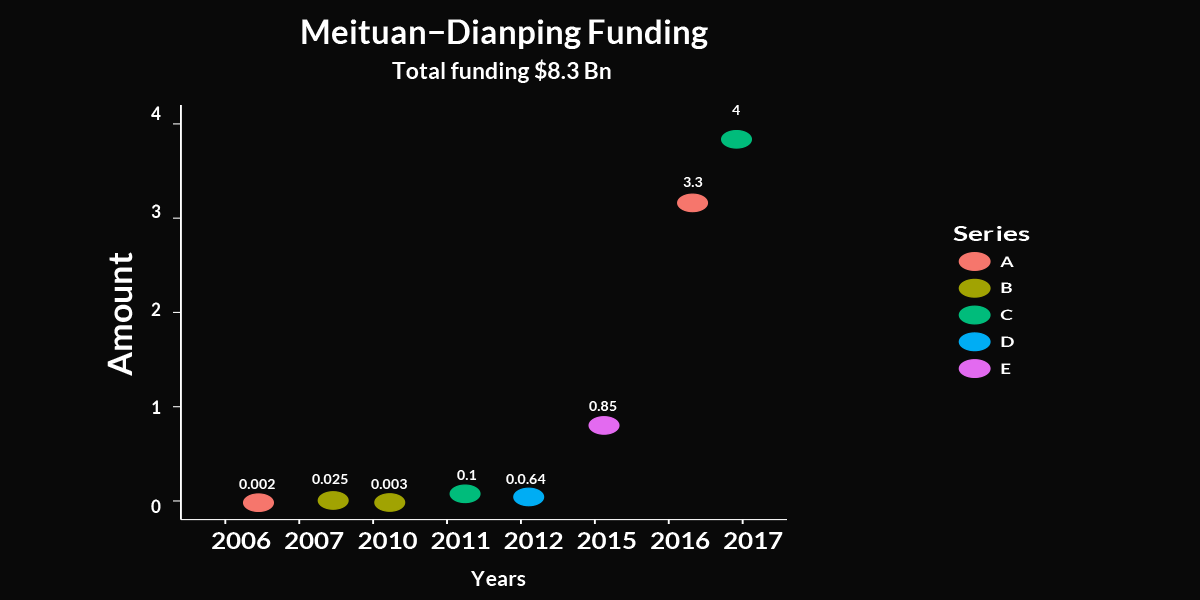

Following the merger in 2015, Meituan-Dianping, started exploring the food delivery segment. The company altogether raised funds through 9 rounds, ranging between a minimum of $2 million and a maximum of $4 billion led by Tencent.

Within a year of stepping into the vertical, it crossed 10 million daily delivery mark in around November-December 2016. With $4 billion in its pocket, next year, it had reached an impressive scale of at most 25 million orders per day and five million merchants selling their wares via the platform.

The magnitude of these numbers can be gauged considering the fact that all of India’s food delivery platforms, including Swiggy, Zomato, and Foodpanda do only 25 million deliveries a month, combined. This is a mere 3.3 per cent of the monthly business of Meituan-Dianping.

The food delivery segment has made a humongous growth in China and the clout of the company rose with a ferocity that made Alibaba, in a fear of losing the opportunity, decide to enter the space through the acquisition route.

In April, Alibaba acquired Ele.Me, a food delivery platform and a direct competitor of Meituan-Dianping, at a whopping price-point of $9.5 billion.

Meituan-Dianping, looking for a chance to enter the on demand conveyance segment, recently made the move (similar to Didi Chuxing). Currently, it’s conducting a trial of the ride-hailing services in two Chinese cities, counting on its large active consumer base.

In April 2018, the company acquired China’s largest bicycle-sharing system, Mobike for US$2.7 billion. With 200 million registered users, Mobike clocks 30 million daily trips. The company claims to have 8.65 million daily active users on its platform.

According to market research firm iResearch, the potential prize at stake is an industry worth about 24 billion yuan (US$3.8 billion) by 2019.

Meituan-Dianping, with its total funding of $8.3 billion, generates an estimated $5.4 billion worth of annual revenue—more than Groupon ($2.84 billion) and Yelp ($847 million) altogether.

The firm reported a 19 billion yuan ($2.9 billion) loss for 2017, steeper than in the previous two years.

But its adjusted net loss – which excludes the impact of fair value changes of convertible redeemable preferred shares and other items – was 2.85 billion yuan, smaller than losses of 5.35 billion yuan in 2016 and 5.91 billion yuan in 2015.

Its revenue rose to 33.9 billion yuan in fiscal 2017, sharply higher than the 12.99 billion yuan made in the previous year.

According to media reports, the company is aiming for a $60 billion valuation with the IPO.