Has cash made the resurgence in India post demonetisation?

A numerical reference point of the Reserve Bank of India (RBI) regarding the quantum of financial transactions done on automated teller machines (ATMs), affirms so.

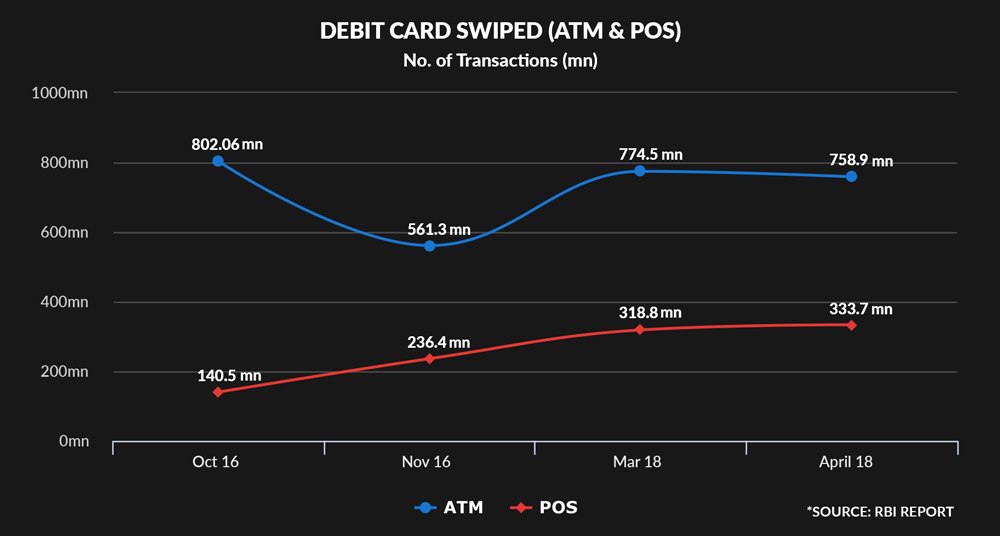

In April, cash transactions from ATMs rose 22 per cent to Rs 2.6 lakh crore, outlined an RBI report. The number of times debit cards were swiped at ATMs across the country stood at 759 million, up 26 per cent from 561 million in Nov 2016, when demonetisation was announced.

At the same time, debit card usage at Point of Sale (PoS) terminals went up as well, to 333 million in April, a 30 per cent from 236 million in Nov 2016.

It also showed that cash circulation was at a record high. The Currency with the Public (CwP) had more than doubled to Rs 18.5 lakh crore from a low of nearly Rs 7.8 lakh crore in post-demonetisation months.

The Currency with the Public (CwP) has been 7% higher at Rs 18.25 lakh crore in April end as compared to Rs 17 lakh crore at the start of November 2016.

This is a big blow to the government, which kicked of demonetisation on November 8, 2016. It had declared the pre-existing Rs 500 and Rs 1000 notes out of the ambit of legal tender.

In December 2017, the Union Cabinet had waived off the Merchant Discount Rate (MDR) on all debit cards, BHIM and UPI transactions up to Rs 2000. The govt had added that it will reimburse the banks for a period of two years, starting January 1, 2018.

Despite the government’s push for digital payment, there seems to be slow awareness of digital payment concepts in rural regions. People are still scared to make payments through digital modes in Tier-II and Tier-III cities.

According to a Paypal report, cash remains the preferred mode of payment across Asia. It noted that that 57 per cent of people in India preferred using cash despite the push for a cashless economy.

The ‘no cash movement’ has forced many non-digital transactions to convert but has failed to promote the tectonic shift the government had expected.

In April 2017, the total Volume of Digital Payments touched about 1.9 billion as compared to 1.4 billion in April 2016 registering a growth of 37%, according to NITI Aayog data.

There is hardly any doubt that digital payment has a long way to go before it can claim to have ‘arrived’ in India. As per industry experts, despite double-digit growth, cash withdrawal will go up in coming months.

The Central Bank report emphasised, that both cash and digital as modes of payment might simultaneously exist for a few more decades.

There is no doubt that obscene amounts of black money had been generated in the past few decades. The questions remain whether most of it was lying as cash in India? Did DeMo achieve the objective it was meant to?

More importantly, Is digital payment ever going to be a reality in India?