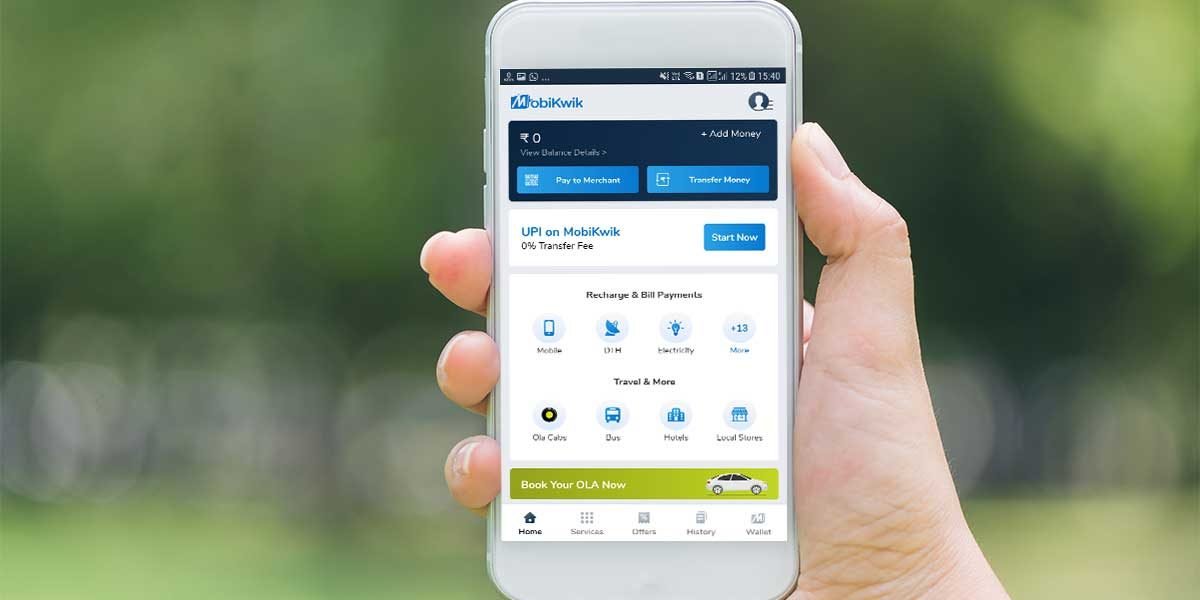

One of the latecomers in UPI league, Mobikwik has finally integrated its platform with government-owned unified payment interface. Amidst quick adoption of UPI and strict KYC norms, the move was but obvious for the digital wallet company.

Now, Mobikwik UPI facility will be available via its own virtual payment handle @ikwik.

Last month Entrackr had exclusively reported about the Gurugram-based company’s testing of UPI-powered payment feature.

Besides UPI, Mobikwik app will also offer payments via BharatQR, UPI QR, and intent functionality for three million merchants base, reports ET.

Like other UPI-enabled payments platforms such as Paytm, PhonePe, Google Tez and newly entrant FreeCharge, Mobikwik also enables its customers to create virtual payments address (VPAs) through their mobile numbers and link multiple bank accounts through the VPA.

Like Paytm, the Sequoia Capital-backed company is also planning to take transactions down the route of interoperability across wallets and virtual cards. In future, it may allow its consumers to do bank to bank direct fund transfers using UPI.

Notably, Paytm offers these services at zero cost.

With Mobikwik’s entry, the competition in the UPI ecosystem is going to intensify amongst digital payment companies including Google Tez and WhatsApp UPI.

As far as the monthly transactions is concerned, Paytm had claimed to lead the show with 33 per cent share for the April month, followed by PhonePe.

Importantly, the aforementioned companies have been able to dethrone government-promoted BHIM supremacy in terms of UPI transactions volume.

WhatsApp, which has been facing a tough time before its full-fledged launch on NPCI-owned payment interface also shows a little growth in UPI transaction. Recently, Mobikwik had launched a SaaS-based B2B product Magic to expand its horizons and aims to clock a revenue of Rs 100 crore in the next 18 months.

The company also claims to have about 100 million users base and it does $2 billion worth of transactions a year. It aspires to reach $10 billion GTV by the end of this year.

Moreover, Mobikwik’s founder and CEO Bipin Preet Singh also said that the company is not looking to raise any capital for the next six months. It would be interesting to see how it competes with deep-pocketed Paytm and PhonePe.

Last month, Mobikwik’s Chief Business officer Vineet Singh had resigned from the company.