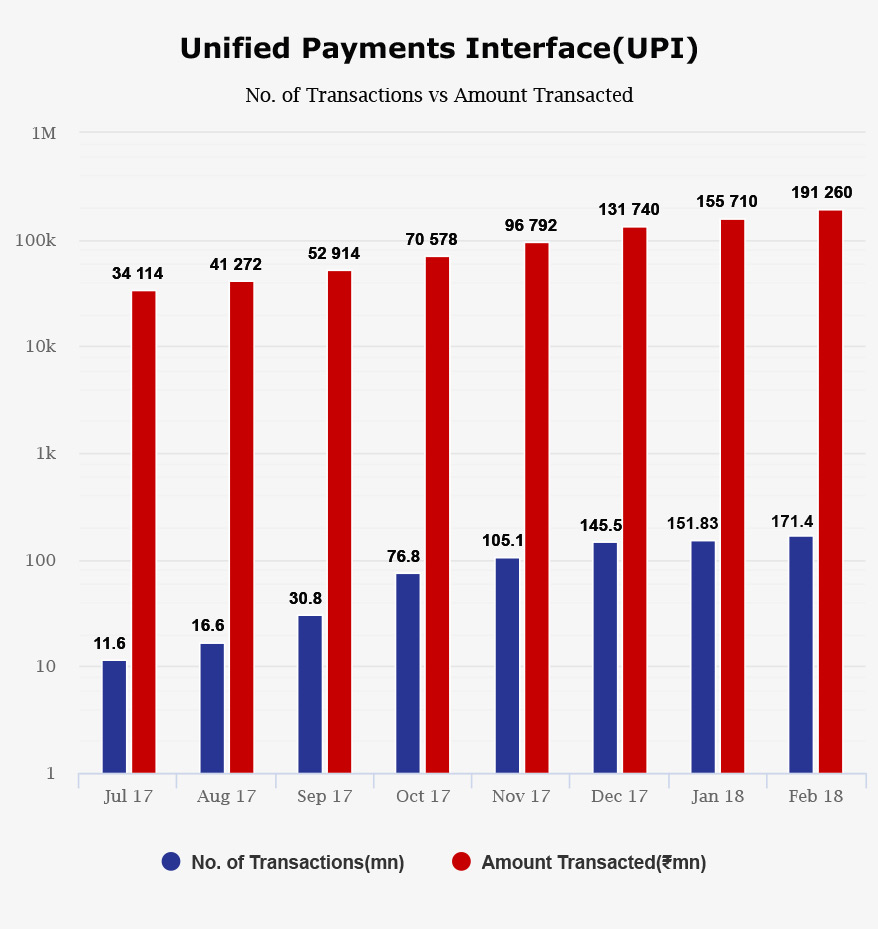

After showing a slowdown in growth during January this year, UPI transactions (Unified Payments Interface) have bounced back in the month of February.

The flagship product of National Payments Corporation of India (NPCI), UPI seems to be back on track in terms of month-on-month growth as it witnessed about 13 per cent (12.89 per cent) growth in total transaction volume.

UPI-based payments recorded 171.40 million transactions last month. The UPI transactions were 151.83 million in the month of January, which was a mere 4.2 per cent growth. Whereas in the preceding month of December, UPI transactions witnessed a staggering 38 per cent growth.

Cashless transactions have now become simpler and convenient thanks to BHIM UPI. #DigitalIndia #InstantPayments #HighOnUPI @dilipasbe pic.twitter.com/6GaWf88BoW

— BHIM (@NPCI_BHIM) March 1, 2018

As far as transaction value is concerned, February month saw a 22 per cent growth. The transacted value grew from Rs 15,571 crore in January to Rs 19,126 crore in February.

Interestingly, the Bharat Interface for Money (BHIM) UPI app also showed a slight increase in growth. The number of transactions on BHIM app was only 9.6 million in the month of January 2018, and the total value of the transactions stood at Rs 3,647.2 crore. This was marginally up from transactions of 9.1 million worth Rs 3,083.2 crore in December 2017.

BHIM transaction data in the month of February is not available yet, however, Vijay Shekhar Sharm led Paytm seems to emerge as the winner in UPI transaction. It claims to have clocked 68 million transactions in February. The total UPI transactions record a 33 per cent rise for Paytm as it stood at 51 million in January.

Currently, there are 67 banks live on Unified Payments Interface platform. Besides, government-run BHIM, Paytm, Flipkart’s Phonepe and global players including PayU and Google’s Tez, among others contribute a major chunk of transactions.

Recently, NPCI has given its consent to roll out WhatsApp’s UPI beta launch with the limited user base of 1 million and low per transaction limit. Four banks will join the multi-bank BHIM UPI model in phases (in the coming weeks) and full feature product shall be released after the beta test is successful.

Multi-bank model offer advantages such as transaction load distribution between banks and helps to integrate popular apps easily with BHIM.

For payment integration, WhatsApp has already partnered with banks including State Bank of India, HDFC Bank, ICICI Bank, and Axis Bank. WhatsApp will become one of the easiest ways to send and receive money via the freeware platform, who recently crossed 1.5 billion monthly active users mark.