Startups and press are inseparable. And, only a handful of them misses an opportunity to score brownie points, which are often vanity metrics with a little relevance to actual business fundamentals.

After GMV abuse in the online retail parlance, the number of transaction appears to be replacing it in digital payment space.

Following a quick adoption of UPI-enabled payment option, digital wallet business are on the verge of being oblivion. Since UPI is having a ball, digital payment majors seem to be embroiled in a serious blame game.

Almost a week after Paytm’s claim to drive the largest number of transactions in February, its rival PhonePe has hit back to Alibaba-backed company’s claims. The Flipkart-owned company has alleged that media narrative around Paytm lead in UPI has been narrowly focussed on volumes not value.

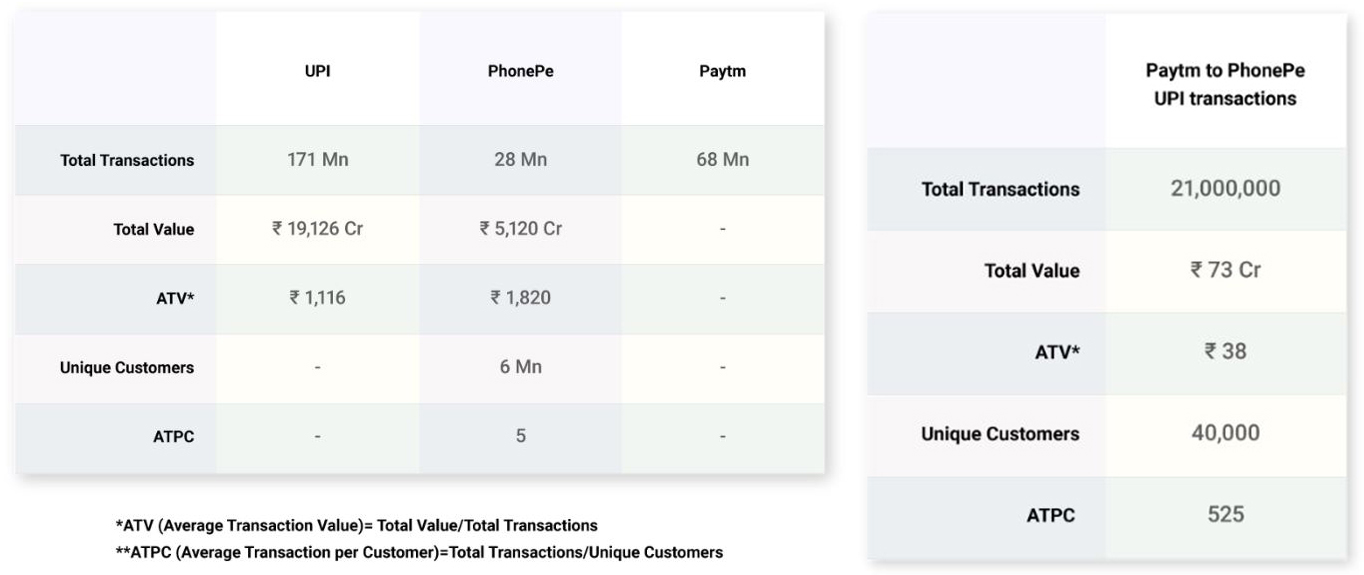

In a blog post, PhonePe explains that besides volume, a balanced scorecard of UPI should also include the number of unique customers as well as the implied metrics of Average Transaction Value (ATV) and Average Transactions per Customer (ATPC).

The UPI-based metrics for February given by NPCI reveals that Paytm had facilitated 68 million transactions in February while PhonePe accounted only 28 million.

Meanwhile, the total value of UPI transaction by all apps stood at Rs 19,126 crore out of which PhonePe has a share of 5,120 crore.

Importantly, the above figure signifies that over 25 per cent of total UPI value in February was facilitated alone by PhonePe. Besides PhonePe and Paytm, Google Tez, government-owned BHIM, and PayU are other prominent players of UPI ecosystem.

Also read: Paytm claims 68 Mn UPI-based transaction in February

“At a cursory glance, Paytm definitely seems to be leading the market. 40 per cent of market share on transactions is no mean feat,” mentions the blog post.

Notably, PhonePe claims that 21 million transactions out of Paytm’s total 68 million UPI-enabled transactions were money transfers made by Paytm customers sending money to PhonePe customers.

According to the blog post, the average transaction value (ATV) for Paytm is about Rs 38 while for PhonePay it’s Rs 1,800. Indeed, it’s a huge difference and Vijay Shekhar Sharma-led company seems to be playing volume card without considering key metrics such as ATV.

“The only logical explanation for this huge difference in ATV and Paytm’s startlingly high ATPC (525/user/month) is that Paytm’s transaction volumes are clearly influenced by significant per-transaction cash back incentives that appeal to a very small population,” explains the blog post.

ATPC stands for average transaction per customer in a month.

This isn’t the first instance of PhonePe claiming a logical lead over Paytm in overall UPI ecosystem. Last month, it had claimed that it will takeover Paytm by crossing Rs 80,000 crore in terms of total payment volume (TPV) annual run rate by next month.

Also read: Paytm sold 52 Mn entertainment tickets in 2017, claims 6X growth but how

After strict KYC enforcement by apex banking body RBI, wallet business is facing severe heat and Paytm, of course, has been at receiving end. The battle in UPI ecosystem is slated to get intensified as WhatsApp is slated to open its UPI-enabled payment soon to its 250 million user base in India. Besides, Google has also thrown its dice with Tez.

Indeed, the ongoing rivalry for winning smartphone based UPI ecosystem is really exciting and going forward it would certainly be a worthwhile fight to watch out for.