After the initial setback, the online retail market in India has been growing at the fastest pace in the world.

It has grown at 26.4 percent in last year in comparison to 39 percent in 2016 and more than 100 percent in 2014 and 2015, said online retail forecast report by Forrester.

Last year, the online spending went up across categories in 2017. Apparel, footwear, and grocery to continue to be a key focus for online retailers in 2018.

E-grocery is expected to witness huge investments this year, and account 7 per cent of grocery by 2022. Online retail is expected to grow at a CAGR of 29.2 per cent to go past $73 billion in next four years, added the report in possession of Entrackr.

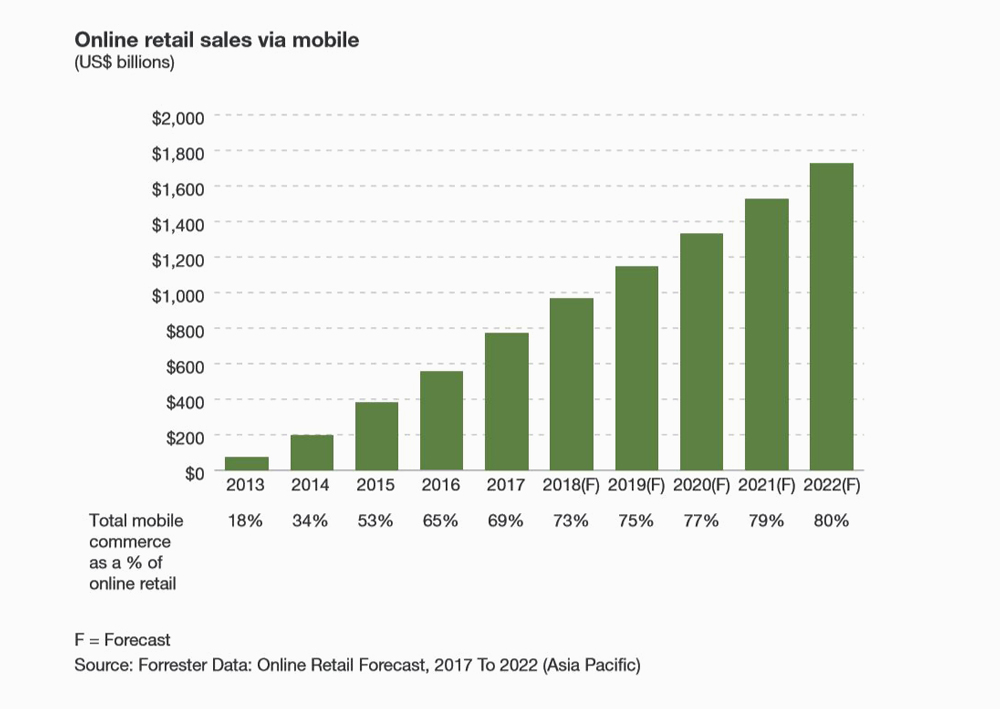

The online retail sector saw sales worth $19.6 billion in 2017 ($20.3 billion including movie and event tickets), as per Forrester, which is expected to grow to $27 billion in 2018. Mobile accounts for the most number of online retail sales. It will lead online growth, as it will grow at a CAGR of 17.64% to reach $1.7 trillion in 2022, up from $735 billion in 2017.

In the world, China will be the first market with $1 trillion in online retail sales in 2018, it added. China accounts for nearly 83% of online retail sales in Asia Pacific.

Amazon closes market share gap with Flipkart

US e-tailer Amazon, that has surpassed home-grown e-tailer in 2016, has almost closed gaps with its rival Flipkart. In terms of GMV market share, it has less than 1 per cent point to Flipkart. At present, Flipkart claims to hold 31.9 per cent market share whereas Amazon has 31.1 per cent market share.

According to the report, Amazon has strengthened its position in metros in terms of sales.

Flipkart, however, has reportedly rejected the claim by the report and said to have a leadership position with 60 per cent market share.

However, it is yet to respond to Entrackr queries regarding its leadership position.

Flipkart has an edge in fashion and smartphone categories. This week Flipkart had crossed $1 billion in sales in the segment, even beating its own group company Myntra.

Meanwhile, this is not the first time that Amazon has been reported to have been closing gap in on home-grown Flipkart.

In January this year, Amazon said that it did twice the order processed by Flipkart during recently concluded ‘Great India Sale’ (held during January 21-24). It also claimed to acquire the highest number of new shoppers in any single online event (except Diwali Sales) ever.

However, Flipkart also stated that it has maintained a leadership position with 60-65 market share during ‘Republic Day Sale’ (held January 21-23).

Amazon had also in December 2016, asserted that it has left local rival behind to become the leader in online retail space. At that time, it claimed 44 per cent customer share and 42 per cent order share on an overall market-base level.

Flipkart, which is under consideration of global retail major Walmart for a huge capital infusion, invested $257 million in its logistics arm eKart in January this year. The investment comes after it pumped in $147 million into the unit last September.

Amazon also invested Rs 1,950 crore into its Indian arm Amazon Seller Services in January this year. In November 2017, the Seattle-based company had invested $450 million (Rs 2,900 crore) into Amazon Seller Service.