The board of Paytm Payments Bank, which was launched in May has approved a Rs 60 crore rights issue for its existing shareholders, including its founder Vijay Shekhar Sharma, as per documents filed with Registrar of Companies (RoC).

Company’s founder and CEO Vijay Shekhar Sharma, who owns 51% stake in the payments bank has put in Rs 30.6 crore while one97 Communications and One97 communications India have pumped Rs 23.4 crore and Rs 6 crore, respectively.

This takes the total capital being put in the payments bank to Rs 278 crore.

The bank has started its operations from Noida offering an interest rate of 4 percent. Sharma holds the majority share in Paytm Payments Bank (51 percent), with the rest being held by Alibaba-backed One97 Communications. However, the Chinese entity does not have a direct shareholding in the payments bank.

Noida-based Paytm, which is run by One97 Communications, created two separate entities -Paytm E-commerce and Paytm Payments Bank.

The company has said it will open 31 branches and about 3,000 customer service points in the first year. The bank is focused on driving financial inclusion with a target of opening 500 million bank accounts by 2020.

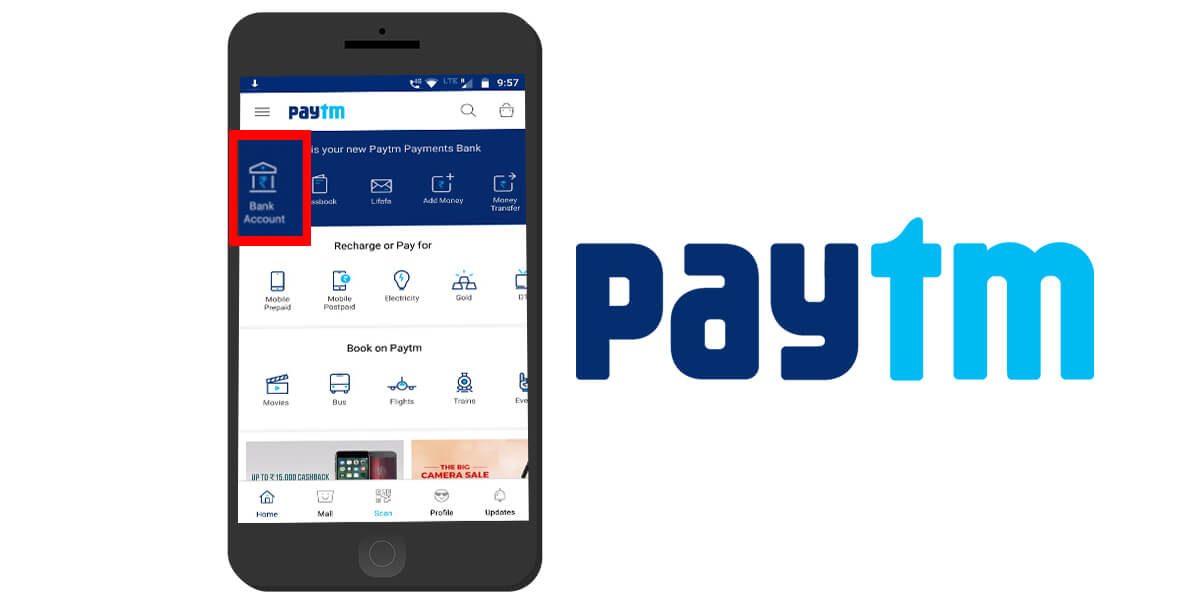

Presently, the company aims to get its users to the bank with its Payments Bank, and transact, P2P, online or offline, using Paytm. It claims to have 211 million users on its platform.

Also Read: Paytm launches payment bank on iOS, eyes long-term dividends

Due to RBI regulatory restrictions, the firm cannot offer certain services as of now. It can take savings deposits and remittances but are not permitted to lend. It is looking at retail & SME loans and consumer credits currently.

To offer services like loans and term deposit, Paytm Payments Bank will partner with full-service banks, announces Renu Satti, Payment bank CEO.

As per announcement on twitter by Sharma, his company is also planning to launch its own debit card in partnership with RuPay.

The RuPay debit card for your

Paytm का ATM ! pic.twitter.com/KUTgXcX4uW— Vijay Shekhar (@vijayshekhar) September 4, 2017

The Paytm Payment bank will offer an interest of 4 per cent per annum for savings accounts, which is lower than what Airtel and India Post are offering. Airtel offers the highest interest rates of 7.25 per cent, while India Post is offering interest rates between 4.5-5.5 per cent.

Besides the three, Aditya Birla Nuvo and Reliance Industries are also set to launch payments bank operations soon.

Last year, the Reserve Bank of India had allowed 11 entities, including Paytm for setting up payments bank operations with the objective of deepening financial inclusion in the country.