Cash burning is not a metric for e-commerce companies and investors do not worry about it, according to Flipkart’s chief executive officer (CEO), Kalyan Krishnamurthy.

“We are comfortable on the burn that we have today. Burn is not a metric that anybody worries about anymore. And with the fundraise, burn is almost irrelevant,” said Kalyan Krishnamurhty in an interview to Mint.

Flipkart, whose cash reserves have gone up to more than $4 billion after SoftBank, Tencent Holdings and eBay put around $2.8 billion into the company this year, thinks now that profitability is not the highest priority. Is that the ground reality for investors looking to invest in startups? Or is it the huge funding in home-grown e-tailer speaking through now?

“We are seeing entrepreneurs, who are planning to build businesses that are both growing and profitable. Burn rate is more of a question of what you are burning for- if the product is built in right manner and start-ups continue to grow then they would not mind”, said Rahul Chowdhri of Stellaris Venture Partners.

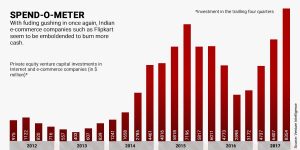

In 2015-16, the startups ecosystem in the country had witnessed the similar surge in cash burn but it did not expand as expected.

“Few months ago, Flipkart was not talking like this. The reason is, they have excessive funds now and it is in direct competition with Amazon. By burning more cash they want to retain more market share, said Satish Meena, forecast analyst at Forrester Research to Entrackr.

Flipkart in order to stay ahead of its arch-rival, the world’s biggest e-commerce company Amazon, is not leaving a stone unturned. Whereas Amazon has access to an endless pool of wealth, has already committed as much as $5 billion in investments.

Earlier, Flipkart had halved its monthly spend to USD 20 million from USD 45 million as it prepares to raise USD 500-800 million in fresh capital, according to ET report. Indian etailer’s monthly cash burn right now is about Rs 260 crore ($40 million), Amazon India is losing about Rs 600 crore per month as it eyes market leadership.

“Excessive burn will not give kind of scale you are looking for. Because there is time factor for consumers as well. Flipkart should invest more in infra and generate customer loyalties,“ Meena added.

Flipkart bears daily losses of over Rs 14 crore in the last financial year as it fought to stave off competition from arch-rival Amazon in one of the world’s fastest growing markets for online retail. The company spent aggressively to attract talent and customers thereby increasing losses, was successful in boosting revenue to Rs 15,403 crore in fiscal 2016.

Flipkart raised last investment for a valuation of $10-12 billion, marking down round from a high of $15.2 billion when it last raised capital in 2015. Flipkart does a large part of its business from mobile business.

Startup scenario in the country has witnessed a lot of churning in past decade. Given the rise in numbers of internet users and shoppers, next ten years is going to be more interesting. For start-ups sustainable growth is still a concern, even Flipkart CEO will have to show sales growth to investors to attract funds.