API Holdings, the parent company of online drug dispenser PharmEasy which incurred heavy losses during FY22, has managed to improve its bottom line in FY23. But the Mumbai-based company has had to compromise on its speedy growth in scale in FY23 which was over 2X during FY22.

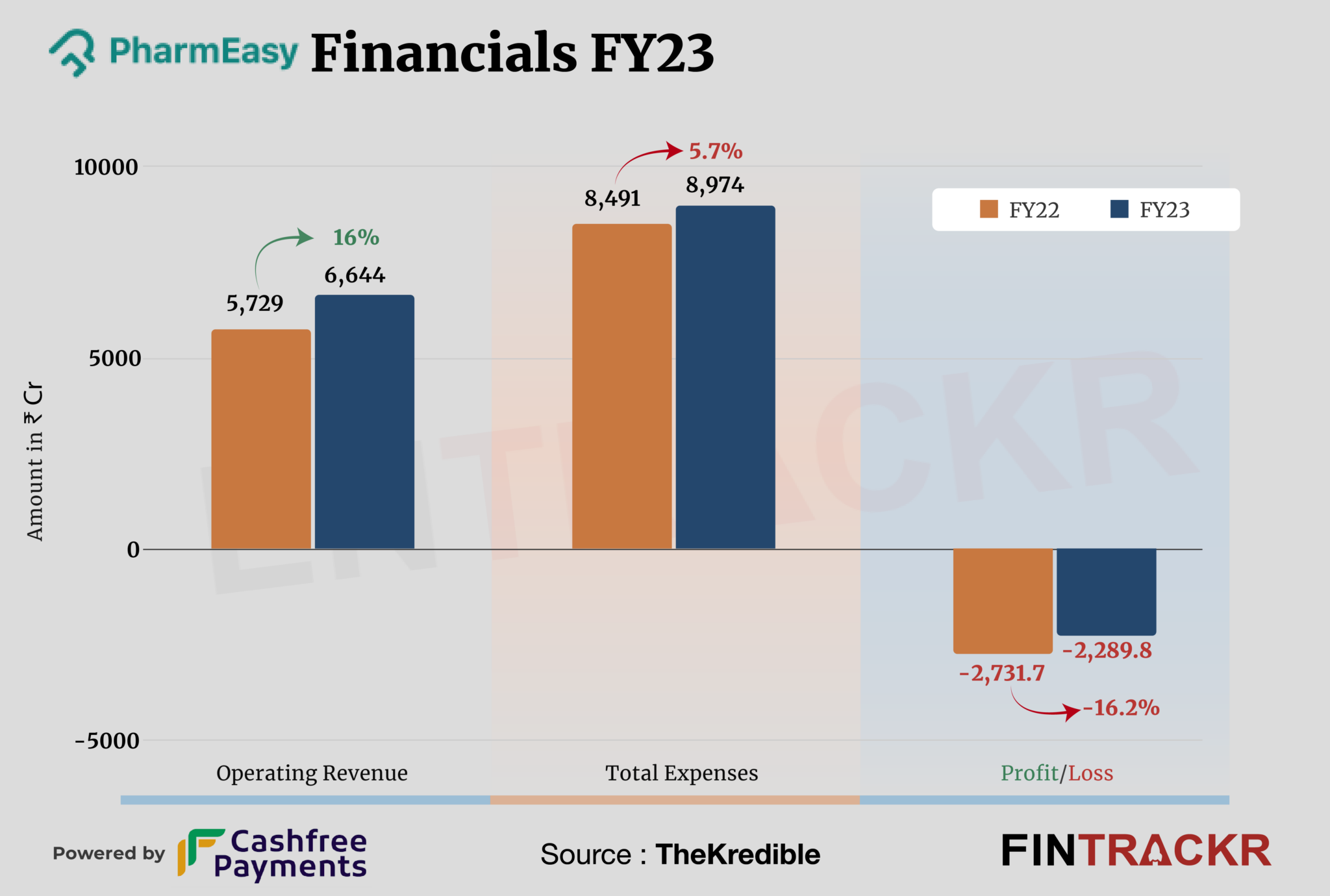

PharmEasy’s revenue from operations grew 16% to Rs 6,644 crore during the fiscal year ending March 2023 in contrast to Rs 5,729 crore in FY22, according to its annual financial statements sourced from its website.

PharmEasy’s gross merchandise value (GMV), however, stood at Rs 14,351 crore in FY23.

API Holdings operates in diversified sectors, primarily engaging in the trading of pharmaceutical and cosmetic goods. This core activity constitutes approximately 90% of the company’s revenue. The remaining revenue streams include diagnostic services, licensing internet portals or mobile applications related to pharmaceutical and cosmetic goods sales, teleconsulting, sale and subscription of software services, among others.

Furthermore, API Holdings generates additional operating revenue through diverse services, including the leasing of software and hardware, warehousing, and commission earned by facilitating pathological diagnostic tests between customers and laboratories.

Revenue Breakdown

https://thekredible.com/company/pharmeasy/financials

View Full Data

As per the financial statement, out of the total revenue during FY23, Rs 775 crore pertains to four customers which contributed more than 10% of total revenue.

PharmEasy also earned Rs 55.8 crore via earnings from interest on current investments, deposits, and other non-operating revenue which drove the total income to Rs 6699.8 crore during FY23.

As per TheKredible, the cost of procuring the stock accounted for 63.9% of the overall expenses. This cost went up 12% to Rs 5,731 crore in FY23 from Rs 5,113 crore in FY22.

Employee benefits expenses of the company shrank 12% to Rs 1,283 crore in FY23 from Rs 1,459 crore in FY22. Significantly, this cost also includes Rs 623.75 crore as employee share based payment during FY23.

Overall expenses of the company increased 5.7% to Rs 8,974 crore in FY23 from Rs 8,491 crore in FY22. Head to TheKredible for complete expense breakdown and year-on-year financial performance.

Expense Breakdown

https://thekredible.com/company/pharmeasy/financials

View Full Data

https://thekredible.com/company/pharmeasy/financials

View Full Data

- Cost of procuring the stock

- Employee benefits

- Sales promotion and marketing

- Legal & professional

- Payment for delivery associates

- Others

Following the cost cutting measures, PharmEasy managed to bring down its losses by 16.2% to Rs 2,289.8 crore during the last fiscal against Rs 2,731.7 crore in FY22. It’s worth noting that the company also booked exceptional items (impairment of goodwill and investments) worth Rs 2,922 crore in FY23 and Rs 1,261 crore in FY22. Entrackr has excluded this from the losses due to its non-cash nature. Including this, PharmEasy’s losses rose to Rs 5,211.7 crore during the last fiscal.

Additionally, the company’s outstanding losses climbed to Rs 10,825 crore at the end of FY23.

The company effectively managed to keep the cash burn low, as a result, its cash outflows from operations slipped 71.3% to Rs 744 crore in FY23.

EBITDA margin and ROCE of the company improved to -20.38% and -27.12%, respectively which could be attributed to low cash burn during FY23. On a unit level, the company spent Rs 1.35 to earn a rupee of operating revenue in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -39.66% | -20.38% |

| Expense/Rupee of ops revenue | ₹1.48 | ₹1.35 |

| ROCE | -32.11% | -27.12% |

Amidst challenging market conditions, PharmEasy was reportedly planning to raise Rs 3,500 crore through the right issue from existing backers.

Temasek, TPG Growth, Prosus Ventures, CDPQ, Eight Roads Ventures, LGT Lightstone, ADQ (Abu Dhabi’s sovereign wealth fund), Amansa, OrbiMed, and Sunil Kant Munjal’s family office, expressed their interest to invest up to Rs 2,000 crore.

In May 2023, PharmEasy’s investor and global asset management company Janus Henderson reduced the unicorn’s valuation by nearly 50%. Prior to this, Neuberger Berman reduced PharmEasy’s valuation by 21.4% to $4.4 billion as of February 2023.

PharmEasy has raised over a billion dollars to date and turned unicorn in April 2021 after raising a $350 million round led by Prosus and TPG Growth.

On the other hand, its competitor Tata 1mg’s revenue from operations spiked 2.5X to Rs 1,627 crore while its losses jumped 2.2X to Rs 1,254 crore in FY23.