Full-stack financial services platform Groww became one of the most valued fintech companies in October last year after raising $251 million in a round led by Tiger Global at a valuation of $3 billion.

With recent reports on Groww’s profitability and financials doing the rounds, Fintrackr did a deep dive into the US-headquartered company to understand its operating structure and financial performance during last year.

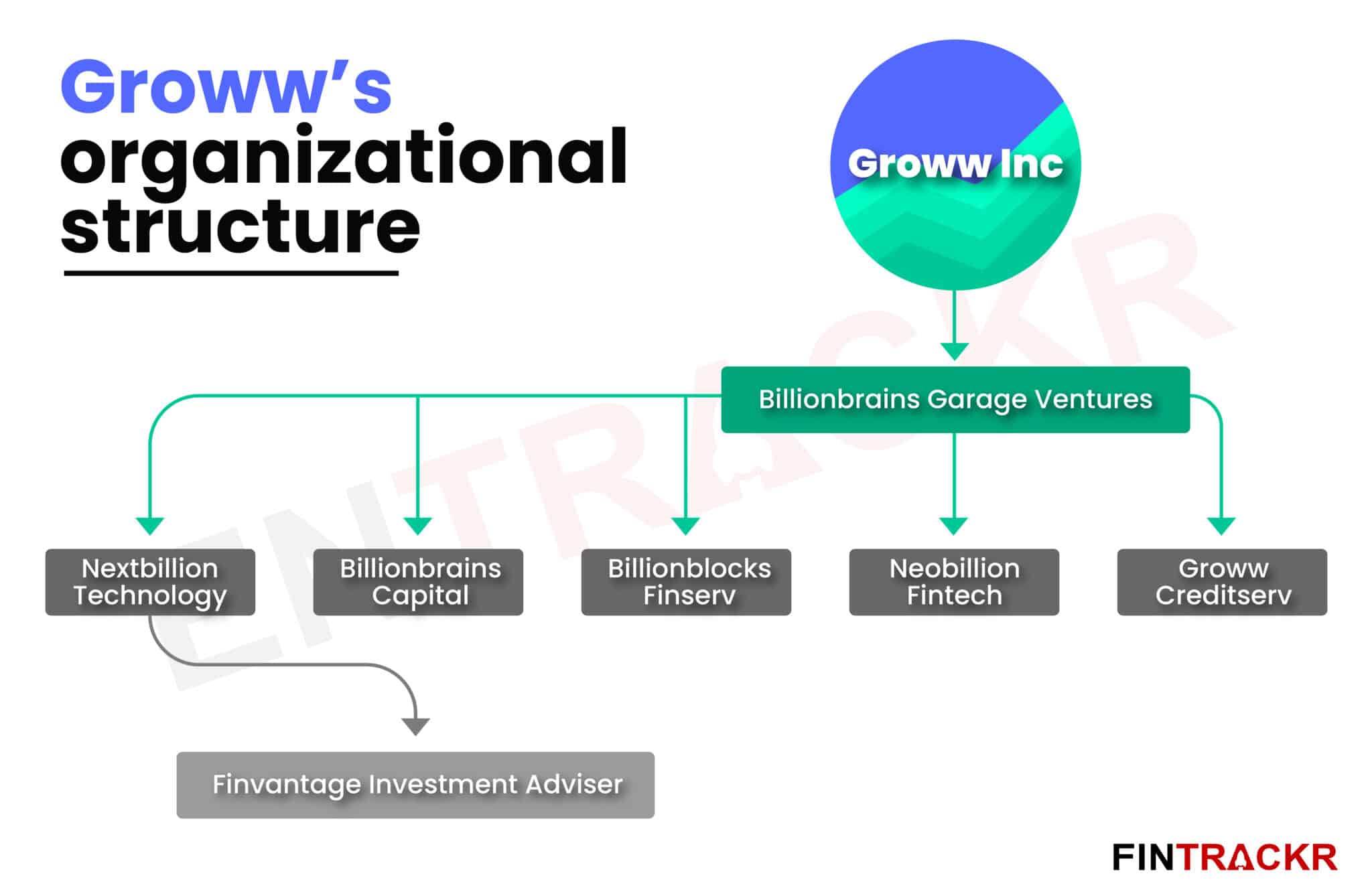

Groww’s share broking and investment platform is operated by Next Billion Technologies (NBT) which recorded revenues of Rs 40.41 crore and posted a profit of Rs 2.73 crore. But there is more to it: NBT is a subsidiary of Billionbrains Garage Ventures (BGV) which itself is a subsidiary of the ultimate holding company Groww Inc USA.

While the financials for the US-based holding company are unavailable, we have analysed the results of Billionbrains Garage Ventures (BGV) which is the holding entity for the group in India — which, in fact, has posted a loss.

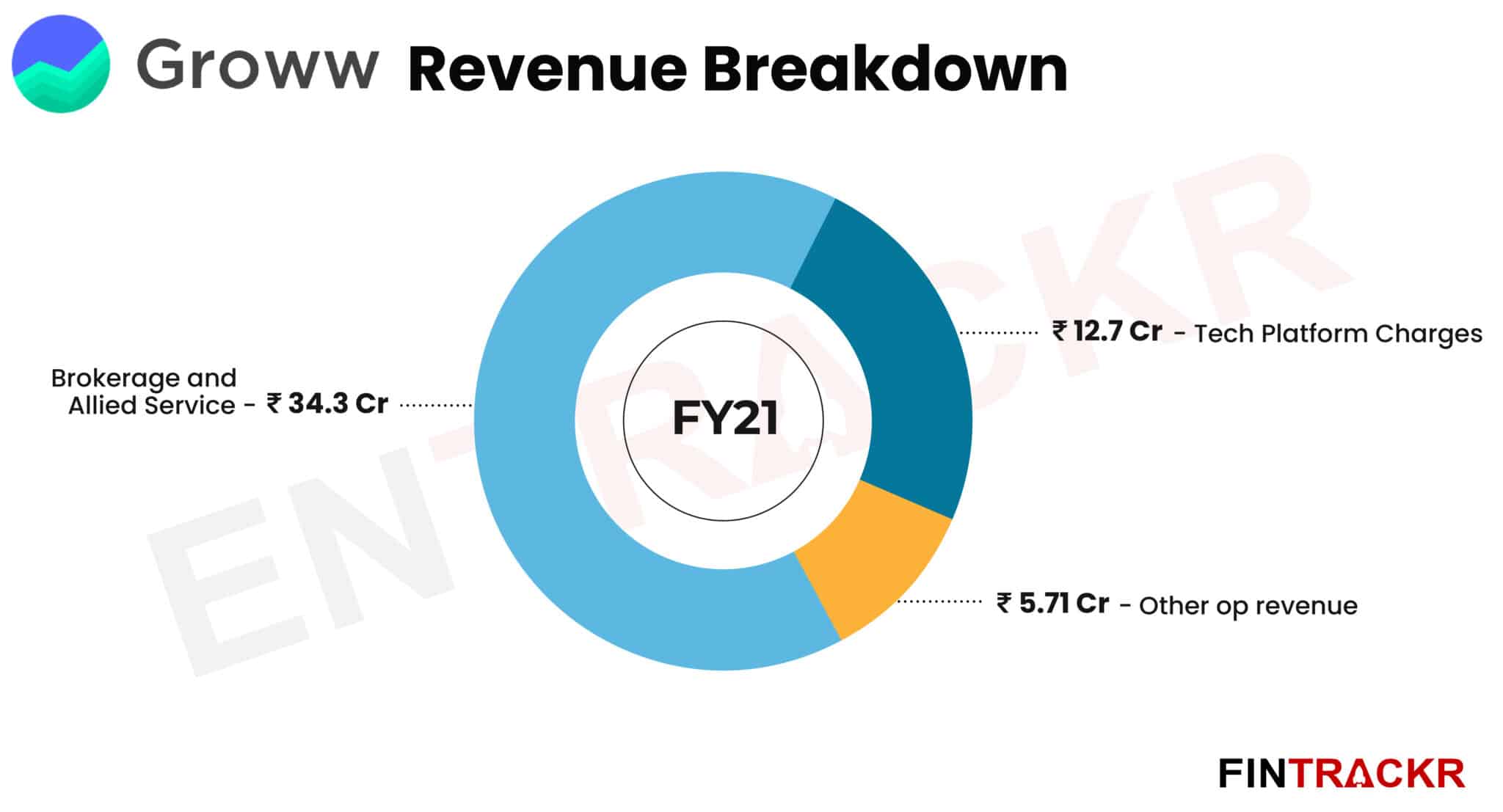

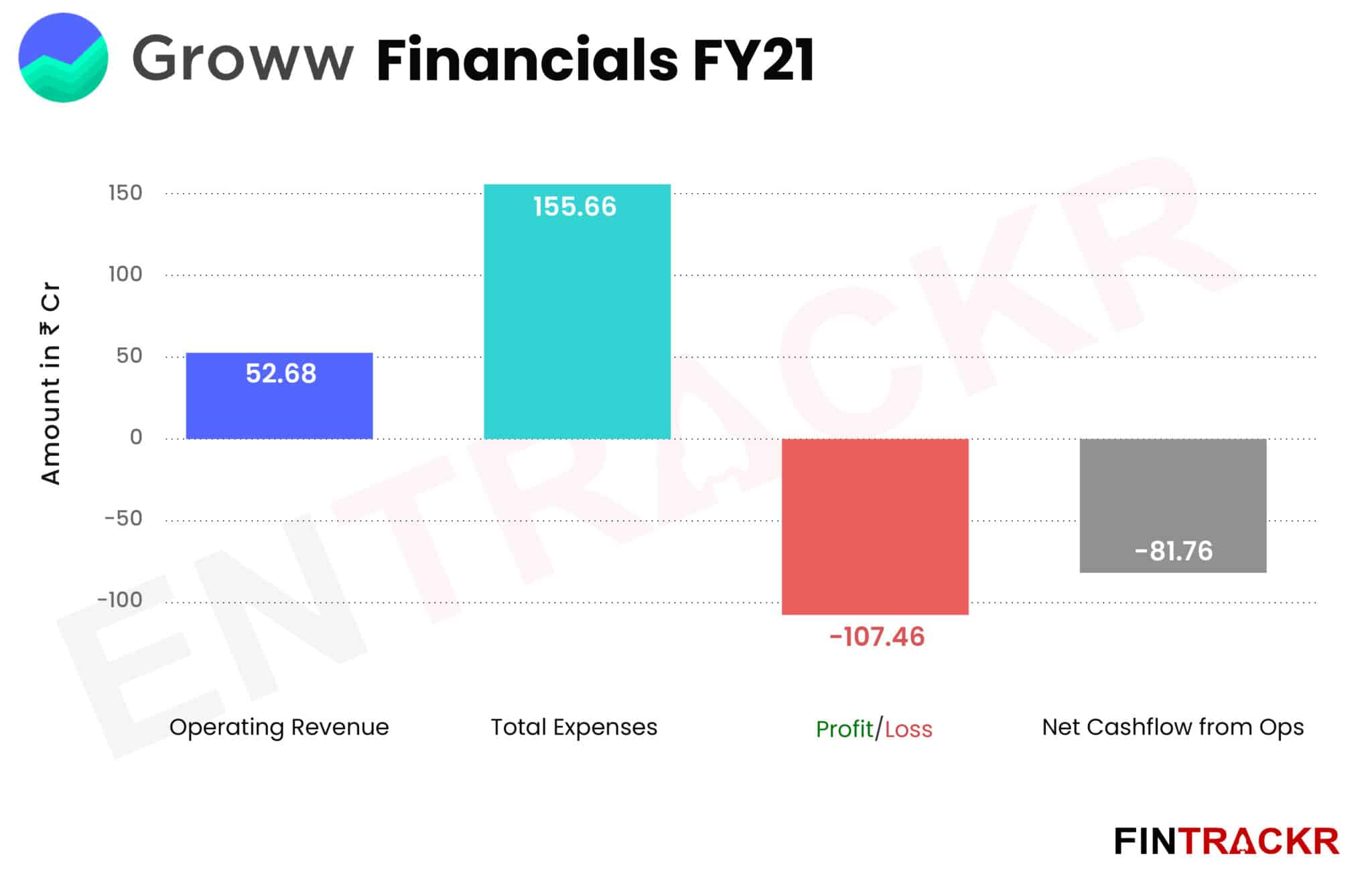

BGV recorded consolidated operating revenue of Rs 52.7 crore during the fiscal ended in March 2021 for its Indian operations. The company collected Rs 34.3 crore via the provision of brokerage and allied services, accounting for 65.1% of annual revenue while income from tech platform making charges and other operating revenues (interest on deposits) brought in Rs 12.7 crore and Rs 5.71 crore respectively.

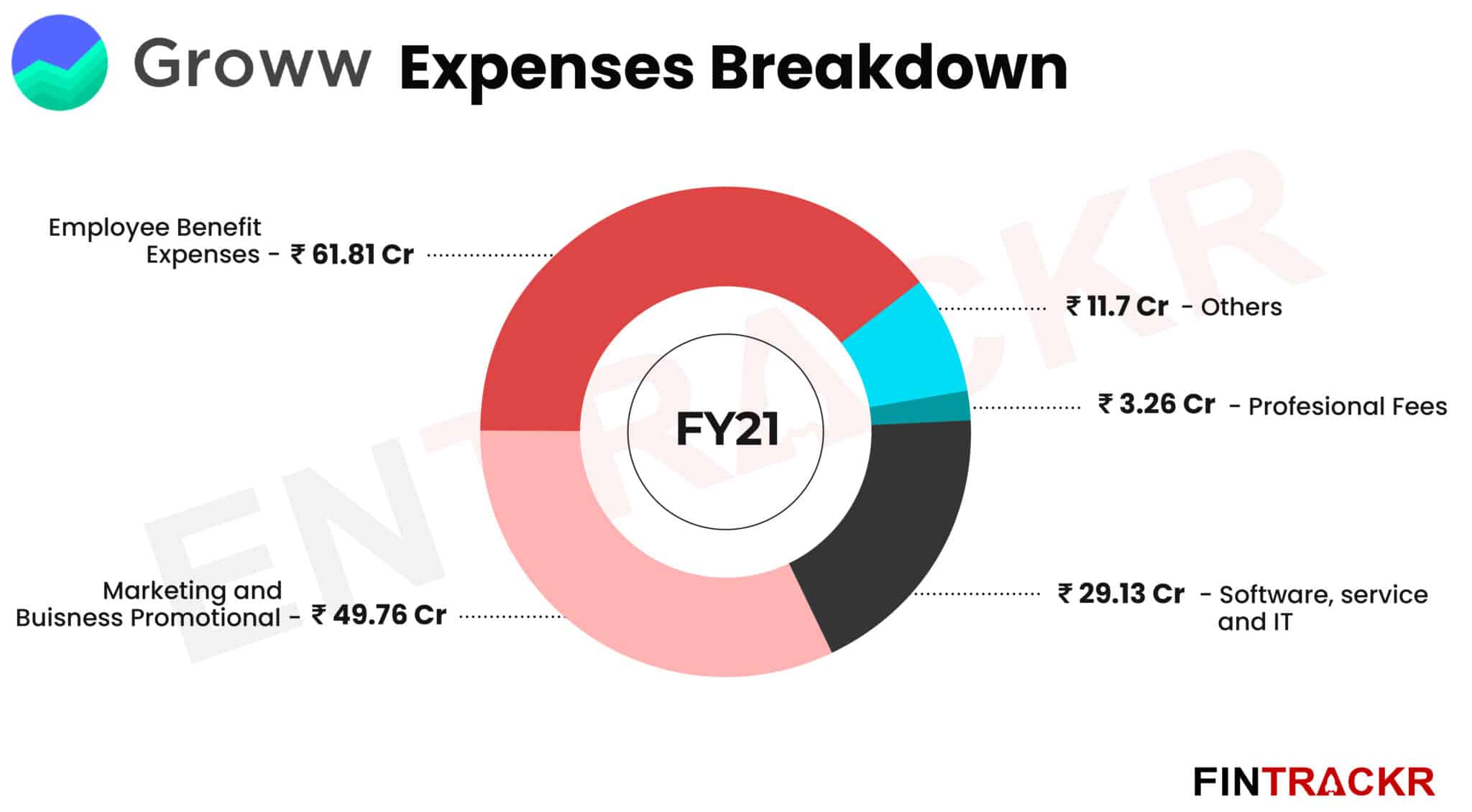

On the expense side, money spent on employee benefits was the single largest expense booked by Groww, accounting for nearly 40% of annual costs incurred during FY21. At Rs 61.891 crore, the staff costs stand at 117.3% of the revenue earned by the company during FY21.

Marketing and Business Promotion is the second largest cost centre for the unicorn, making up around 32% of annual costs. These costs added up to Rs 49.76 crore (81.1% of revenues) during fiscal 2020-2021. The Tiger Global backed company spent Rs 29.13 crore on software, IT and related services which made up only 18.74% annual expenses of the fintech platform during FY21.

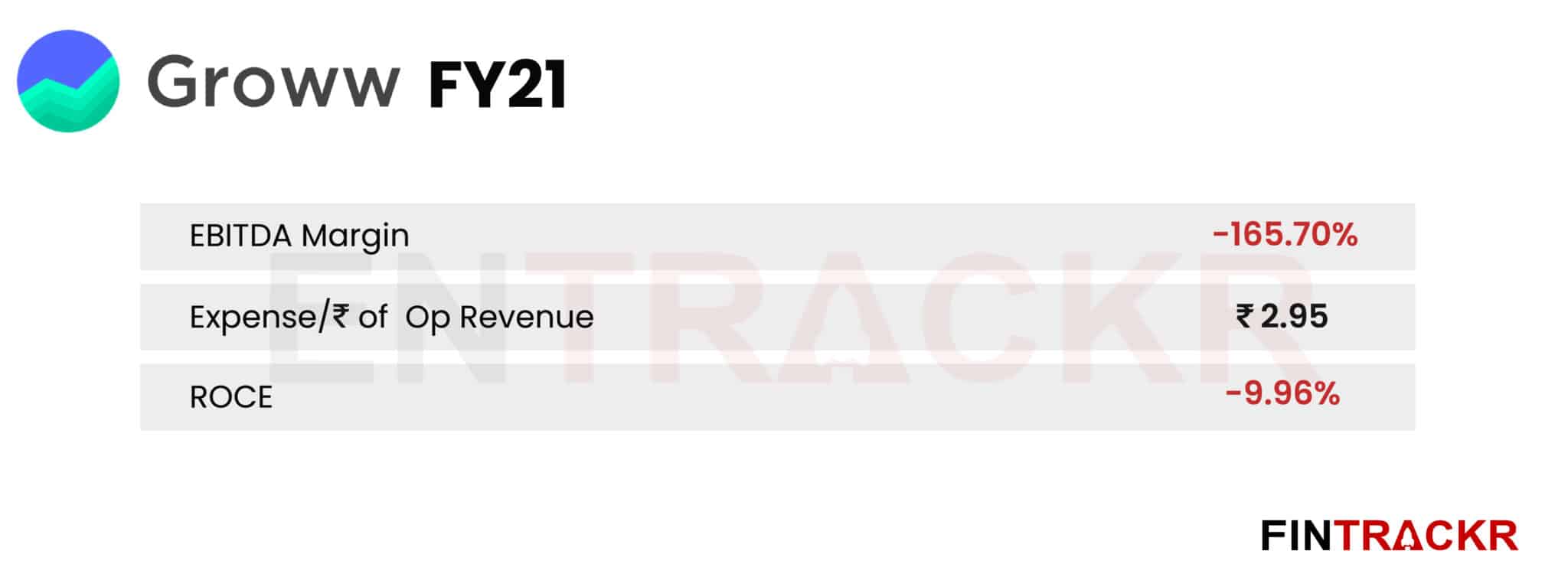

Overall the Indian holding entity Billionbrains Garage Ventures spent Rs 155.66 crore during the fiscal ended in March 2021. On a unit level, it spent Rs 2.95 to earn a single rupee of revenue.

With an EBITDA margin of -165.7%, Groww posted annual losses of Rs 107.5 crore for its Indian operations during FY21 while actual losses of the ultimate holding company Groww Inc are still unknown.

With an EBITDA margin of -165.7%, Groww posted annual losses of Rs 107.5 crore for its Indian operations during FY21 while actual losses of the ultimate holding company Groww Inc are still unknown.

While these numbers show that the company has posted a loss of over Rs 107 crore in FY21, its overall financial health can only be ascertained through its US-based holding entity. Entrackr has also reached out to Groww’s co-founder and chief executive Lalit Keshre for the article, but he declined to participate.

As the markets head into a long-awaited correction, as predicted by Zerodha co-founder Nithin Kamath among others, it should be interesting to see if the momentum towards break-even, and eventual profitability can continue at Groww, as users slow down their trading on the platform — a typical response to bear markets.