Travel booking app ixigo has filed its draft red herring prospectus (DRHP) with India’s markets regulator SEBI to raise Rs 1,600 crore through an initial public offering, joining a host of Indian consumer tech startups that are lined up to go public this year.

From the total size of the IPO, the company is looking to raise Rs 750 crore through a primary fundraise and Rs 850 crore via an offer for sale or OFS from existing investors.

As far as the secondary sales of shares are concerned, co-founders of the company Aloke Bajpai and Rajnish Kumar are both selling Rs 50 crore each worth of their shares in the company as part of the IPO. Elevation Capital (formerly SAIF Partners) is looking for a partial exit from the company and will sell shares worth Rs 550 crore whereas Micromax Informatics would offload shares to the tune of Rs 200 crore.

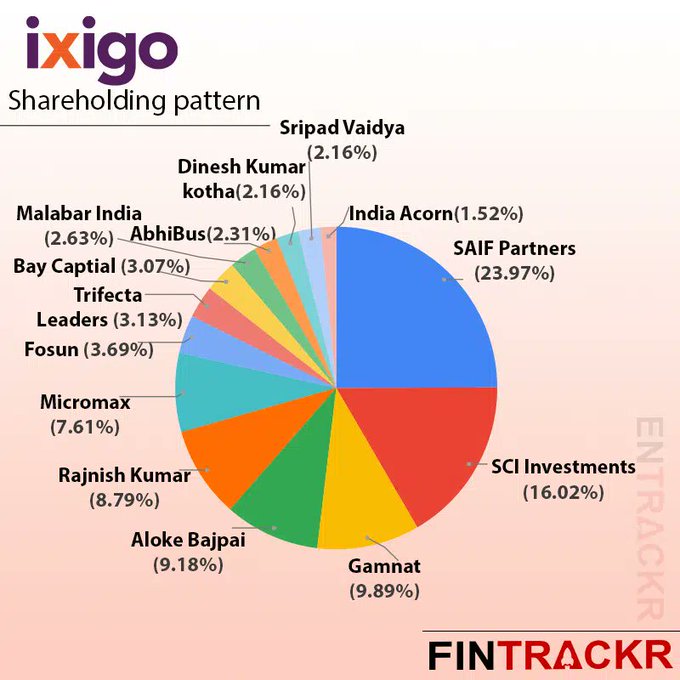

Elevation Capital owns a stake of around 24% in ixigo making it the biggest shareholder in the travel booking company, followed by SCI Investments which owns a 16.02% stake in ixigo and Gamnat which has a 9.89% stake. Co-founders Bajpai and Kumar own 9.18% and 8.79% of the company respectively.

The company has issued bonus shares in the ratio of 399 equity shares for each equity share held to existing shareholders of the company.

A key highlight of ixigo’s IPO was the exit of its old investor MakeMyTrip which made a handsome 8X return on its investment of $4.8 million in the company through a secondary sale.

In its DRHP, the company said that proceeds from the IPO will be used primarily in organic and inorganic growth initiatives along with some parts apportioned to general corporate purposes.

As per related party transactions reported in the DRHP, both Bajpai and Kumar took out Rs 72.6 lakh as salary each for FY 21 as compared to Rs 63.5 lakh in FY20.

ixigo said it was the second-largest online travel aggregator in India after MakeMyTrip in terms of gross bookings in 2021. According to the company, EaseMyTrip and Yatra were third and fourth respectively in that metric in 2021.

In the online flight booking market, ixigo commanded a 12% market share in terms of volume in FY21. In the online trains market, the company along with Confirmtkt—which it acquired in February 2021—had a 42% market share in FY21. In the online bus booking segment, Abhibus—which ixigo acquired in August 2021—had a 10% market share in FY21, as per the DRHP.

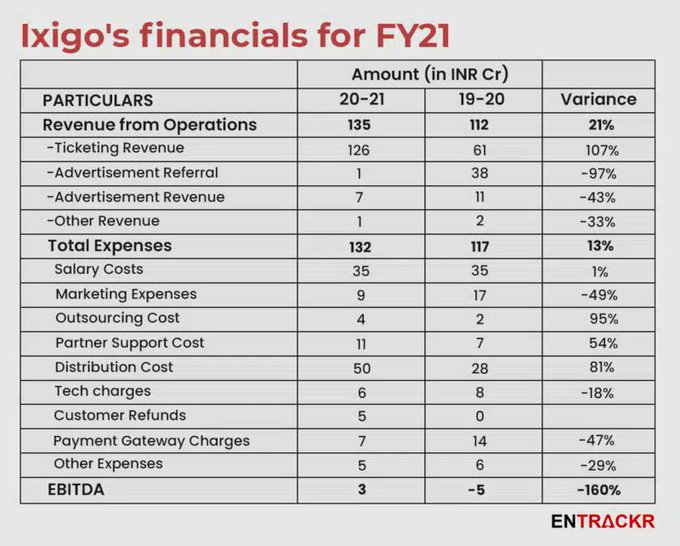

The travel booking firm which was founded in 2007 reported a 21% increase in revenue from 112 crore in FY20 to 135 crore in FY21. Its restated loss turned into a profit in FY21 of Rs 2.7 crore, from a loss of Rs 26.6 crore in FY20. The company reported earnings per share at Rs 98.14 per share on a fully diluted basis.

Investment banks ICICI Securities, Axis Capital, Kotak Investment Banking, Nomura Financial Advisory are the book managers of the IPO.

ixigo also had a cash burn of Rs 15 crore for operational activities in FY21 as compared to a positive cash generation of Rs 34 crore in FY20. It reported outstanding criminal, tax and civil litigation of an amount involving Rs 2.23 crore made by the company and Rs 5 crore against the company.

Earlier this month, ixigo had acquired Hyderabad-based bus ticketing and aggregation platform AbhiBus for an undisclosed amount. It was the second acquisition for the Gurugram-based company in 2021. In February, it acquired 100% stake in the train booking app Confirmtkt.

As per DRHP, AbhiBus has 2.31% stake in ixigo.

ixigo also raised $53 million in a round led by Singapore-based GIC. The company also appointed six new independent members to its board which includes Pratap Mall, Arun Seth, Rajesh Sawhney, Shubha Rao Mayya, Frederic Lalonde, and Rahul Pandit ahead of the IPO.

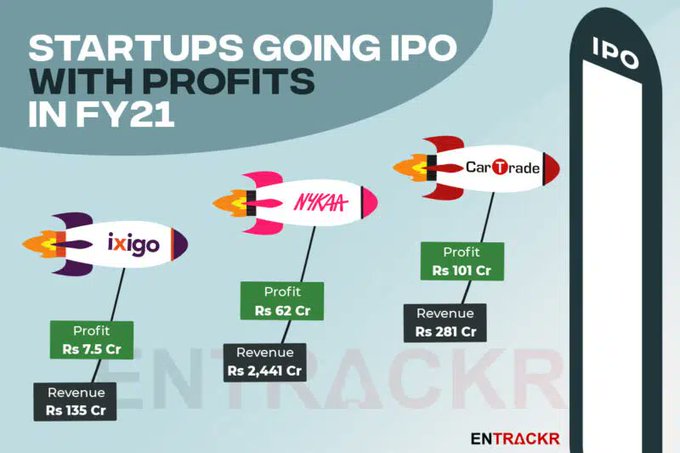

ixigo will be the third tech startup from India to go public with profits to show in its P&L for FY21. Omnichannel beauty and lifestyle retailer Nykaa had posted a profit of Rs 62 crore whereas automobile classifieds portal CarTrade recorded Rs 101 crore profit during the last fiscal year.

In the previous financial year i.e. FY20, another travel tech company EaseMyTrip went public. The company also posted a net profit of Rs 61 crore for FY21. According to the company, it has been profitable since its inception.

Update: The story has been updated to reflect EaseMyTrip’s financials.