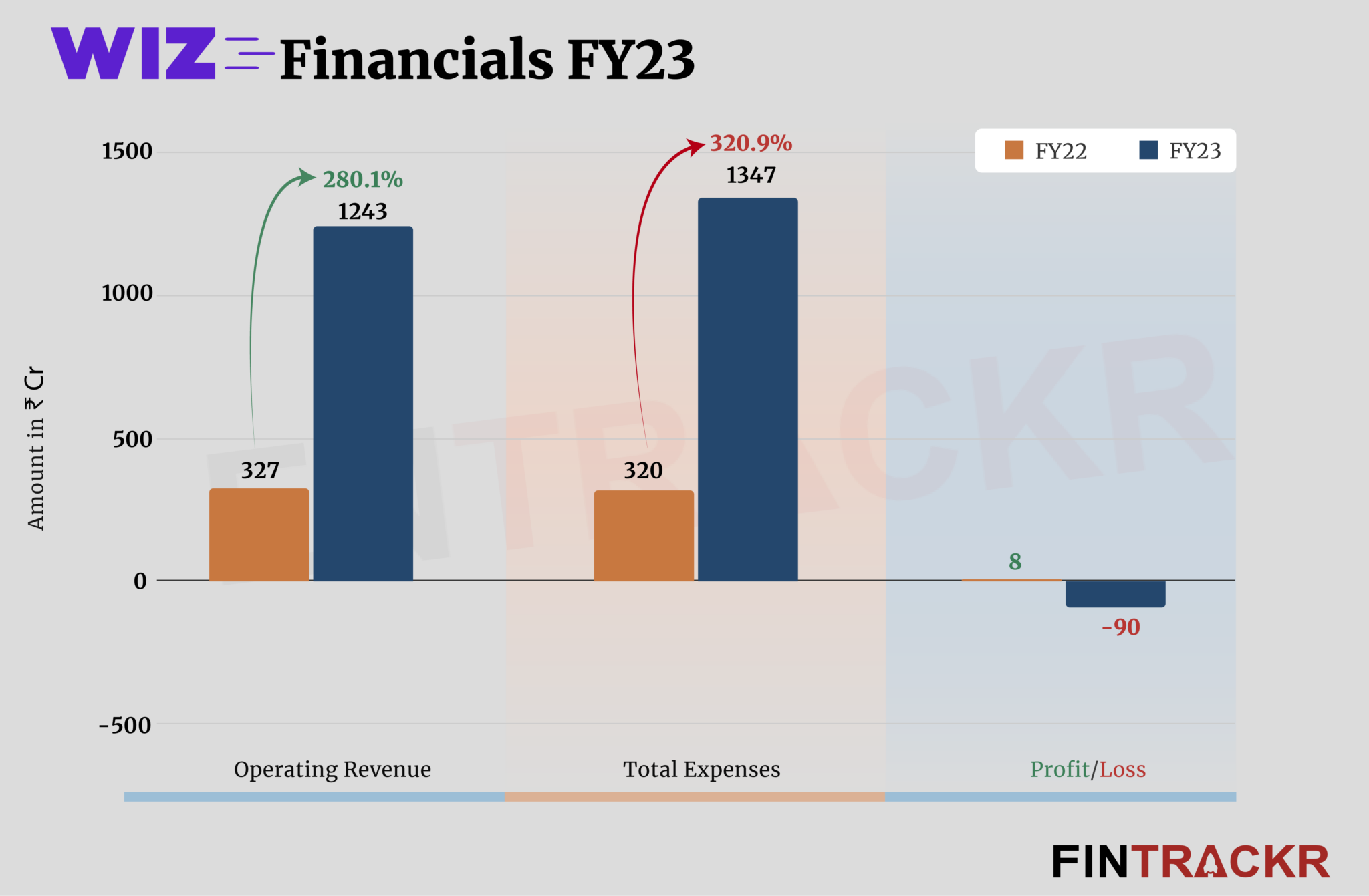

Digital supply chain startup Wiz Freight’s growth has been explosive in the last two reported fiscal years as its scale skyrocketed to Rs 1,243 crore in FY23 from Rs 18 crore in FY21. However, the Tiger Global-backed company needed to power it with higher expenses to chase scale and posted a loss of Rs 90 crore in FY23 against Rs 8 crore profits in FY22.

On a year-on-year basis, Wiz Freight’s revenue from operations surged 3.8X to Rs 1,243 crore in FY23 from Rs 327 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Founded in 2020, Wiz Freight provides a platform for exporters and importers to book and manage their cross-border shipments. Income from freight forwarding and warehousing was the sole source of revenue for the company. The firm also made Rs 18 crore from interest income tallying its total income to Rs 1,261 crore in FY23.

Wiz Freight’s direct cost which includes freight and warehousing charges formed 82% of the overall expenditure. To the tune of scale, this cost surged 3.8X to Rs 1,103 crore in FY23 from Rs 288 crore in FY22.

Its employee benefits, legal/professional, traveling, finance, advertising, and other overheads took the overall expenditure up by 321% to Rs 1,347 crore in FY23 from Rs 320 crore in FY22.

Check TheKredible for the complete expense breakdown.

Expense Breakdown

https://thekredible.com/company/wiz-freight/financials

View Full Data

https://thekredible.com/company/wiz-freight/financials

View Full Data

- Cost of material consumed

- Employee benefit

- Legal professional

- Travelling conveyance

- Finance cost

- Advertising

- Others

In pursuit of expansion, the Chennai-based company incurred a loss of Rs 90 crore in FY23, contrasting with profits of Rs 8 crore in FY22. Its ROCE and EBITDA margin stood at -21% and -2.3% respectively. On a unit level, it spent Rs 1.08 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 3% | -2.3% |

| Expense/₹ of Op Revenue | ₹0.98 | ₹1.08 |

| ROCE | 5% | -21% |

WizFreight has raised around $55 million to date including its $34 million round led by Tiger Global in March 2022. According to the startup data intelligence platform TheKredible, Tiger Global is the largest external stakeholder with 14.15% followed by Axilor and Foundamental. In January, Nippon Express Holding also acquired a minority stake in the firm, indicating the strong interest it has been able to generate and the possibility of ready access to future funding.

As we mentioned after their FY22 results, Wix Freight has a lot going for it in terms of experience of the team, their specific niche and potential market. The high growth has probably made losses acceptable for investors, even as the firm is probably not done with the fund raising yet. With a clear focus on using acquisitions to support growth where possible, it will want the dry powder to move where such an opportunity presents itself.