Several digital investment platform users like Zerodha, Groww, Upstox, and more saw a huge uptick in user base in the last couple of years, mainly driven by the stay-at-home-norms during the Covid phase. Beyond the stock markets, investment in digital gold experienced a turnaround, too. This could also be evident from Safegold’s exceptional financial performance in FY23.

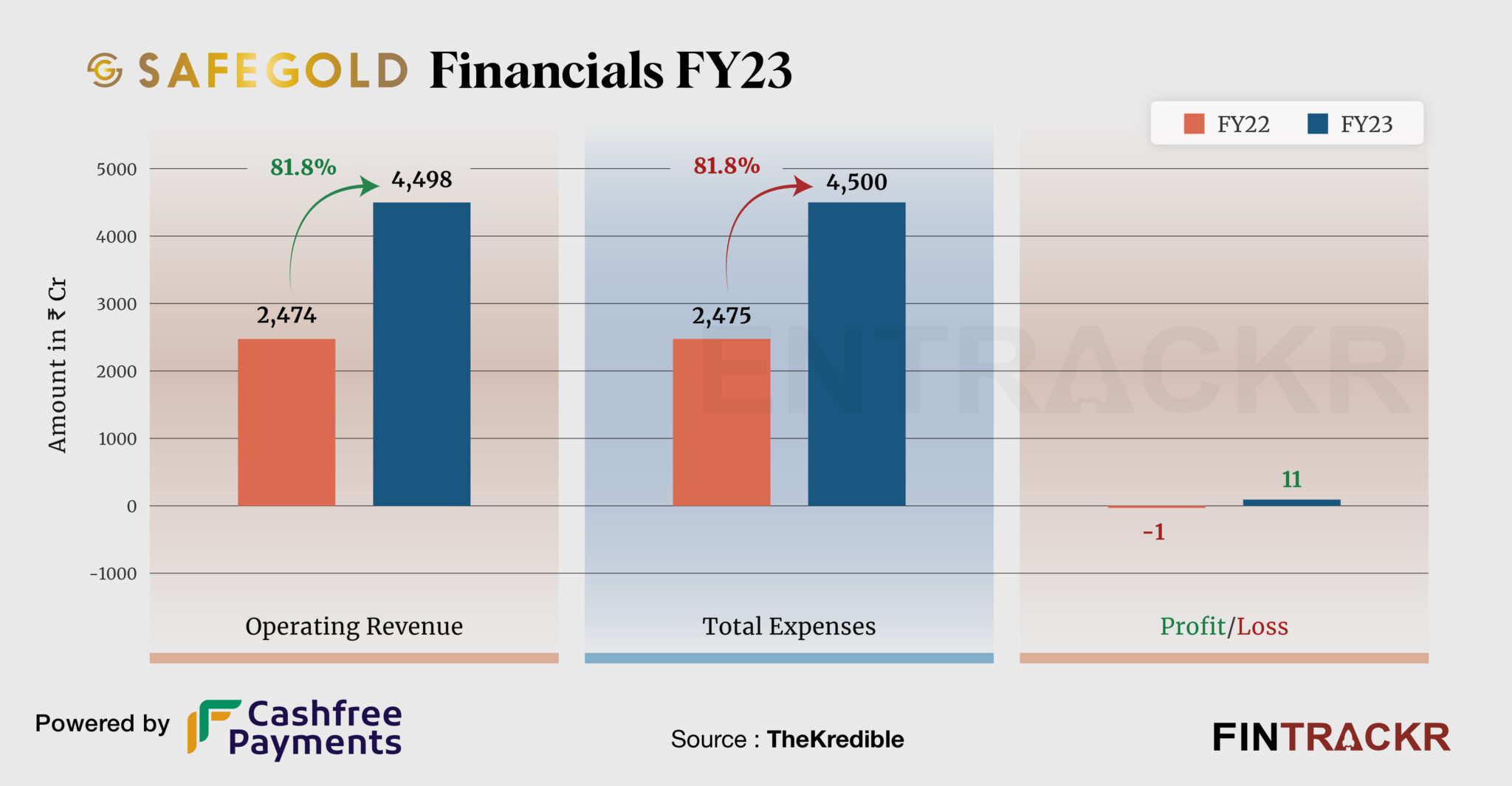

Safegold gross revenue surged by 81.8% to Rs 4,498 crore in FY23 from Rs 2,474 crore in FY22, its consolidated financial statements filed with the Register of Companies show.

Safegold is a digital platform enabling customers to effortlessly purchase, sell, and securely receive vaulted gold, even at minimal amounts. The sale of digital gold from online and offline platforms was the only source of revenue for the Delhi-based company.

Notably, 79.2% of Safegold’s trade comprises wholesale transactions, with the remaining portion falling under retail trade.

For the digital gold platform, the purchase of digital gold and related items accounted for 99.1% of the overall expenditure. In tune with scale, this cost grew 99.1% to Rs 4,459 crore in FY23 from Rs 2,443 crore in FY22.

Its employee benefits, legal/professional, advertising, distribution, and other overheads took the overall cost to Rs 4500 crore in FY23 from Rs 2475 crore in FY22. See TheKredible for the detailed expense breakup.

Expenses Breakdown

https://thekredible.com/company/safegold/financials

View Full Data

https://thekredible.com/company/safegold/financials

View Full Data

- Cost of procurement

- Employee benefit

- Legal professional

- Advertising promotional

- Transportation distribution

- Others

The 80% year-on-year scale and controlled expenditure helped Safegold to register a profit of Rs 11 crore in FY23 where the figures were at a loss of Rs 1 crore in FY22. Its ROCE and EBITDA margin stood at 46% and 0.2% respectively. On a unit level, it spent Rs 1 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 0% | 0.2% |

| Expense/₹ of Op Revenue | ₹1.00 | ₹1.00 |

| ROCE | -8% | 46% |

Safegold is backed by Pravega Ventures, Beenext, a Singapore angel network, and individuals like Rajan Anandan, Roshan Angrish, Prashant Malik, and Niraj Shah. Head to TheKredible for the complete shareholding.

In what is a business built on the finest of margins in a commodity as well established as gold, the company has done well to deliver high growth. But with margins set to remain slim, and profitability delivered on the back of interest income, the firm still needs work to ensure costs stay in check as volumes grow. That sounds possible in a category like Gold, especially in a bullish market for the yellow metal, making Safegold a firm to keep an eye on .