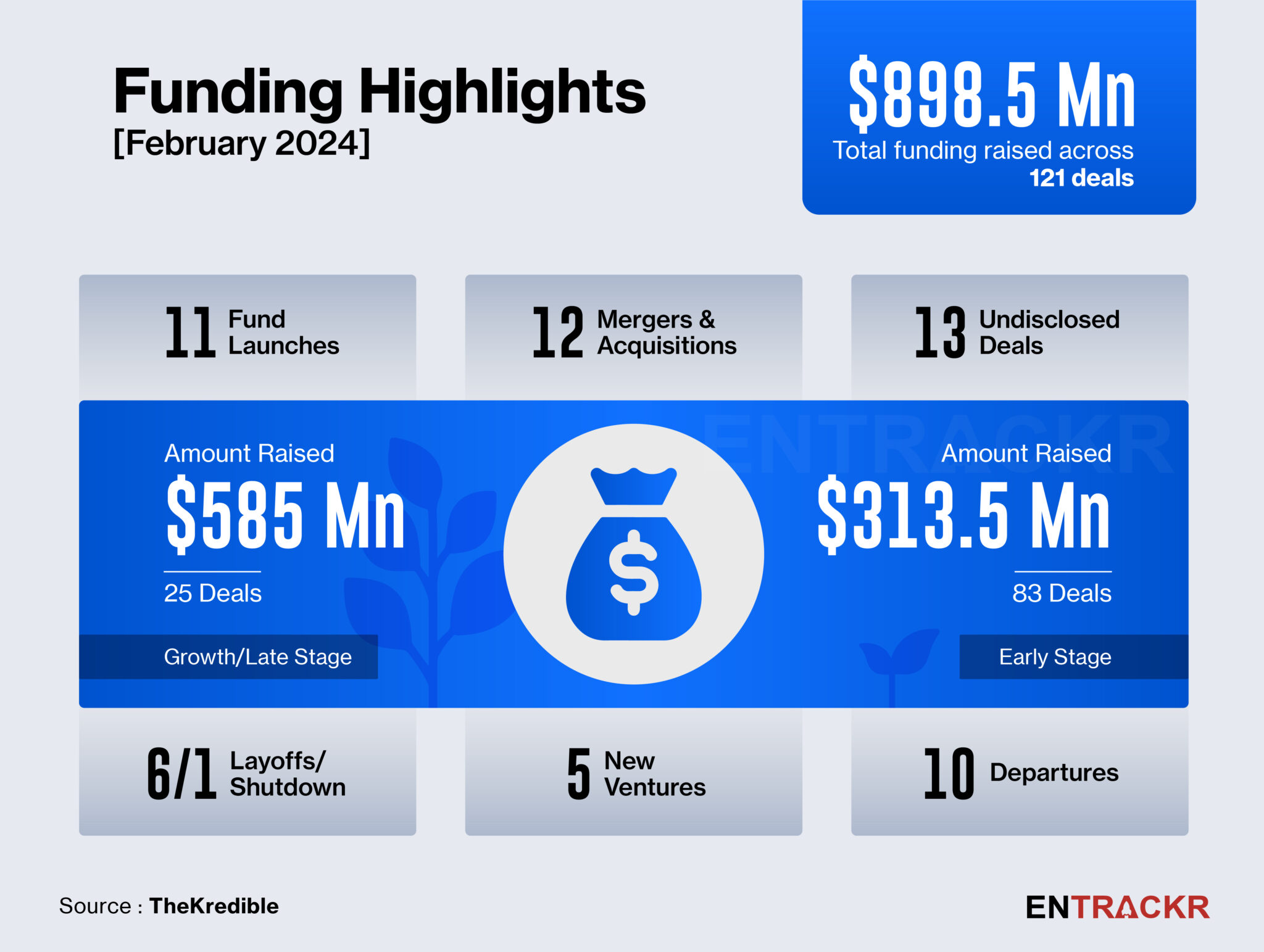

Funding inflow improved in February on the back of a couple of large rounds of growth-stage firms. Some early-stage startups also received decent traction. At the same time, the Indian startup world continued to battle with ongoing challenges like layoffs and departures of key executives.

Indian startups mopped up nearly $900 million across 121 deals in February, as per data compiled by TheKredible. This included 25 growth-stage deals worth $585 million and 83 early-stage deals amounting to $313.5 million. There were 13 undisclosed rounds.

[Month-on-Month and Year-on-Year trend]

February registered a modest jump in funding from $732.7 million in January. Even on a year-on-year basis, February 2024 surpassed the February 2023 funding mark of $845 million. Unlike January, February saw three-digit funding as Shadowfax raised $100 million in a new round. The M-o-M and Y-o-Y trends can be seen below.

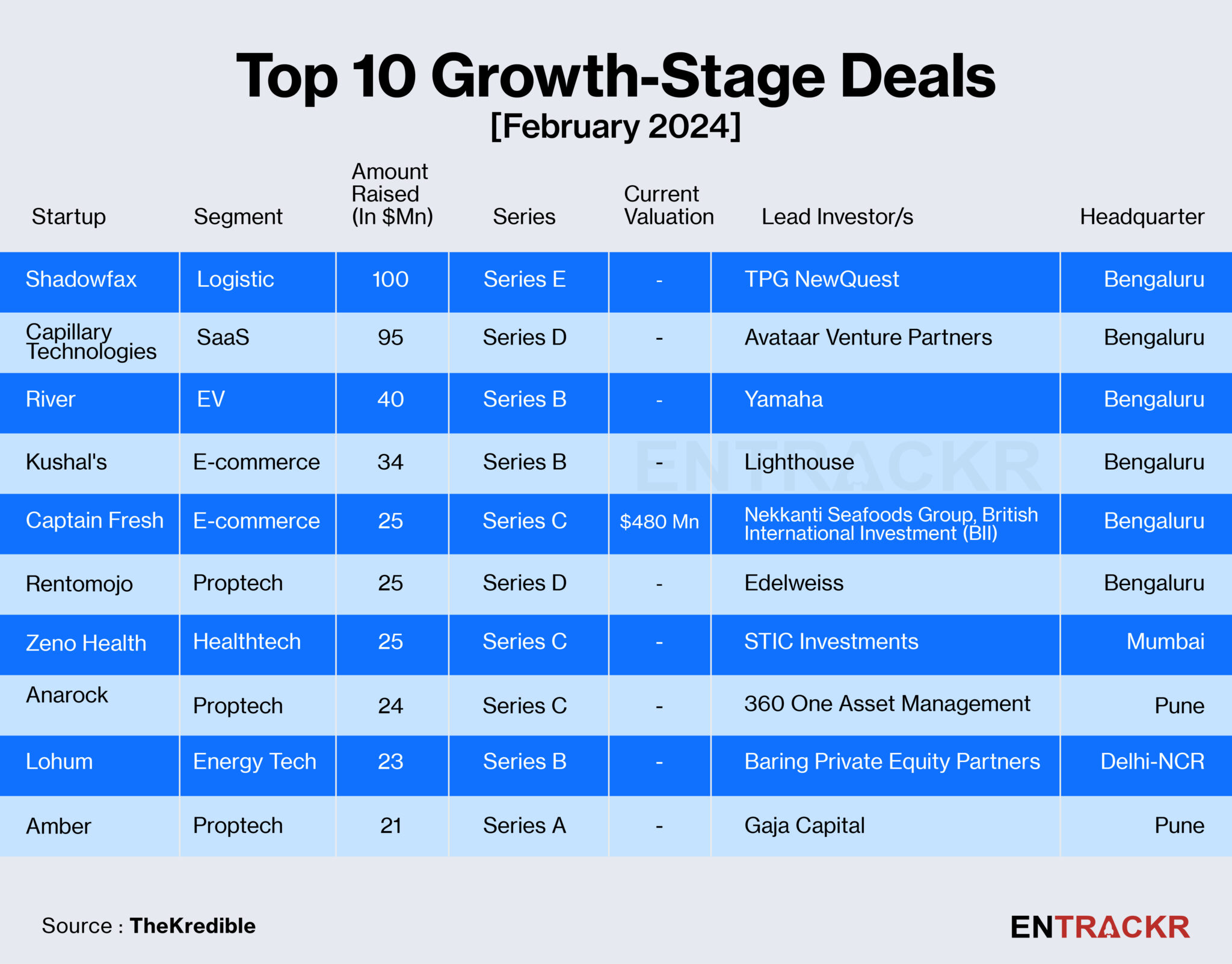

[Top growth stage deals]

Flipkart-backed logistics company Shadowfax topped the charts with $100 million in a Series E funding round led by TPG NewQuest. While the company did not disclose its valuation, it is estimated to have reached closer to entering the unicorn club. SaaS firm Capillary Technologies saw $95 million in funding via a secondary round.

Other funding rounds in the growth stage were below $50 million which included EV startup River, e-commerce company Kushal’s, and seafood company Captain Fresh. Rentomojo and Zeno Health also raised $25 million each.

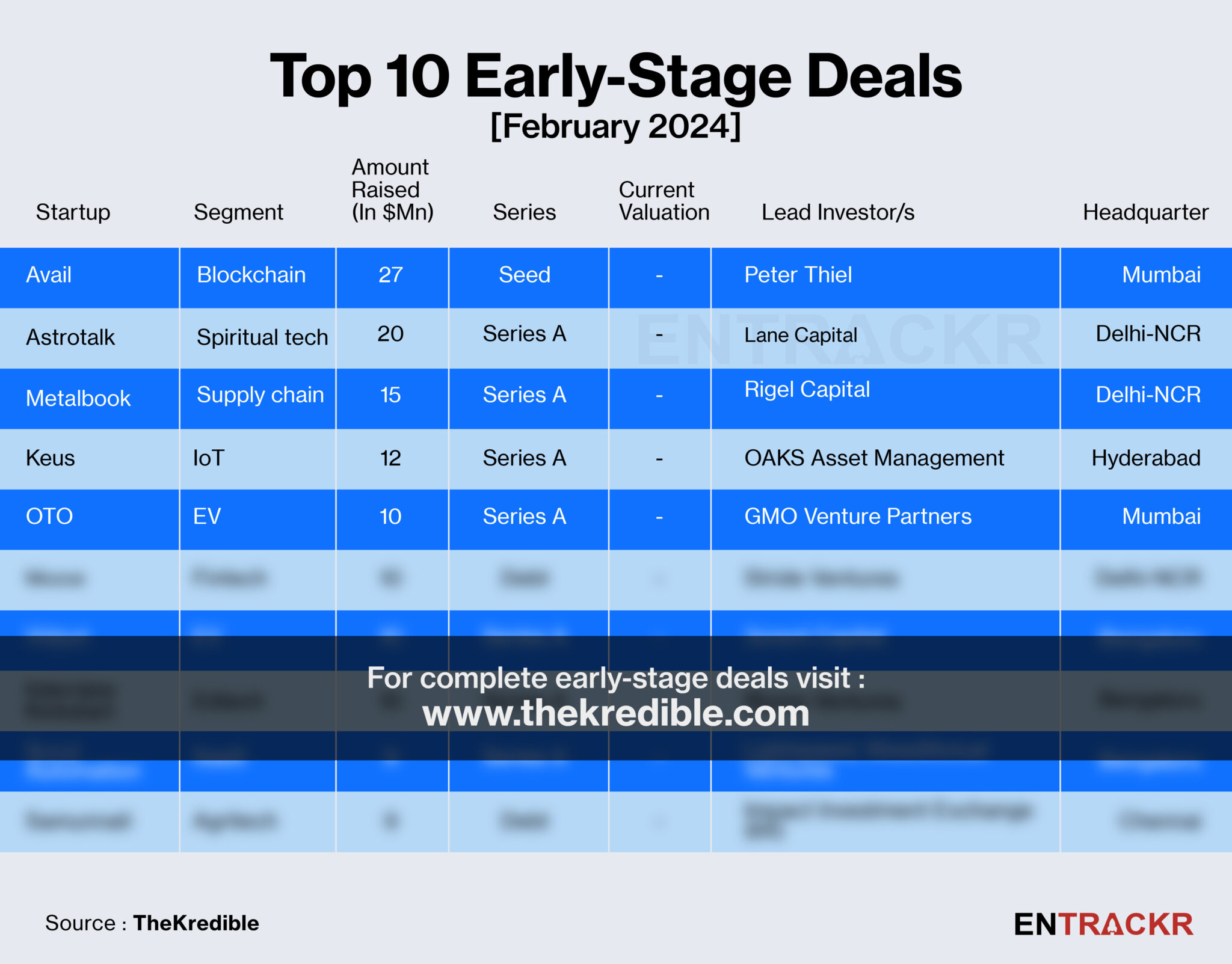

[Top early-stage deals]

Blockchain startup Avail, spiritual tech startup AstroTalk, and metal supply chain company Metalbook led the chart with $27 million, $20 million, and $15 million in funding, respectively.

Notably, the top eight startups in the early stage raised at least $10 million each in their new fundraise. The list counts Keus, OTO, Moove, Vidyut, and Interview Kickstart.

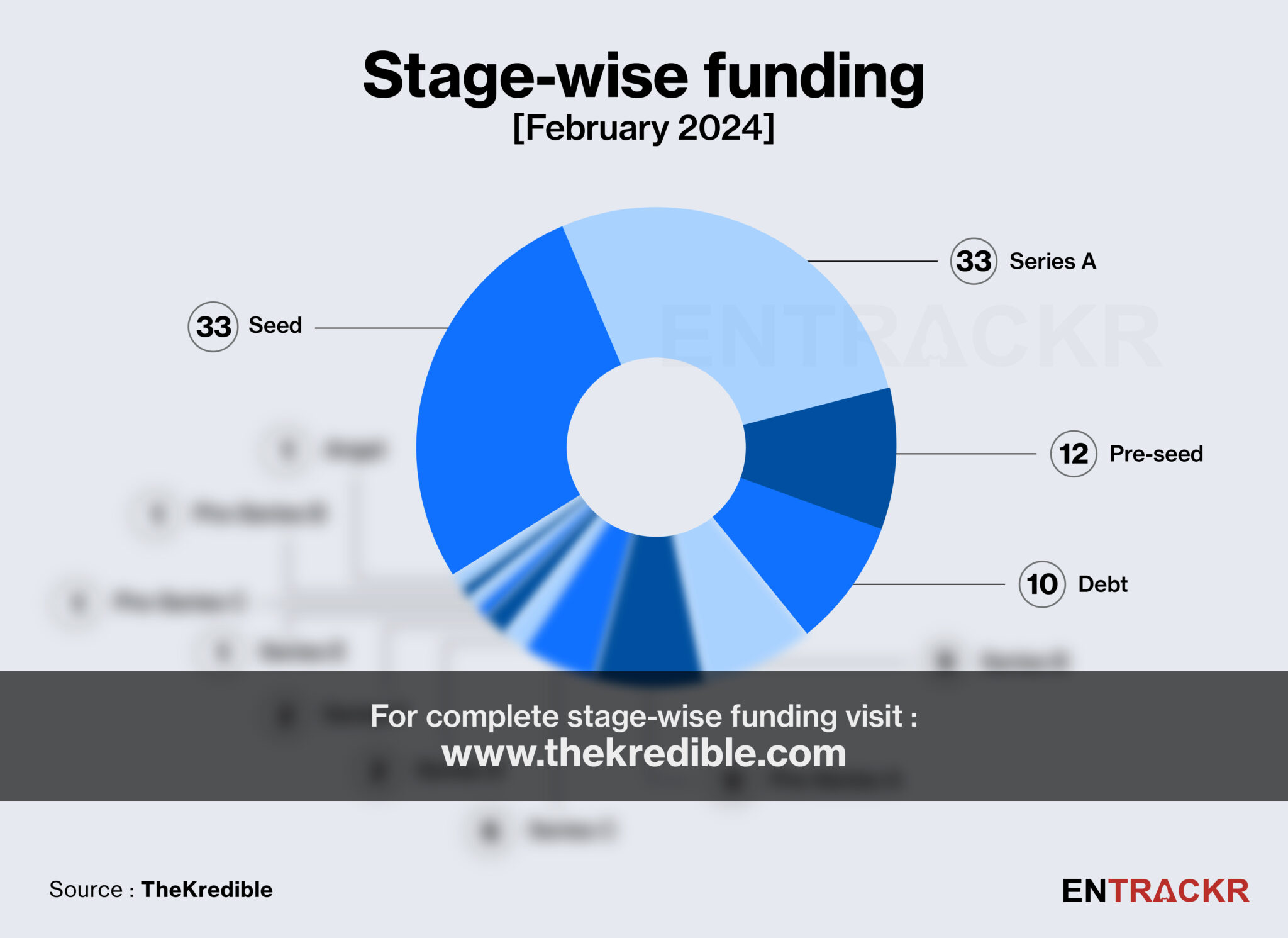

[Stage-wise deals]

Series-wise, Seed and Series A startup funding deals co-led the list with 33 deals each during February. Pre-Seed and Pre-Series A deals stood at 12 and 10, respectively. Among growth stage deals, Series B, Series C, Series D, and Series F are next on the list while as many as 10 startups raised debt funding during the month.

[City-Segment]

In terms of city-wise deals, Bengaluru retained the top spot with 45 deals worth around $482.6 million, or close to 54% of the total funding raised during February. Delhi-NCR and Mumbai-based startups were the next with 26 and 25 deals, respectively, collectively amounting to $311 million. Pune saw 9 deals followed by Hyderabad, Chennai, Jaipur, and Ahmedabad among others.

E-commerce startups re-captured the top position this month in terms of segment-wise number of deals with 27 deals. This was followed by healthtech (12), fintech (10), and SaaS (10). EV, proptech, AI, edtech, and food tech startups also made it to the top 10.

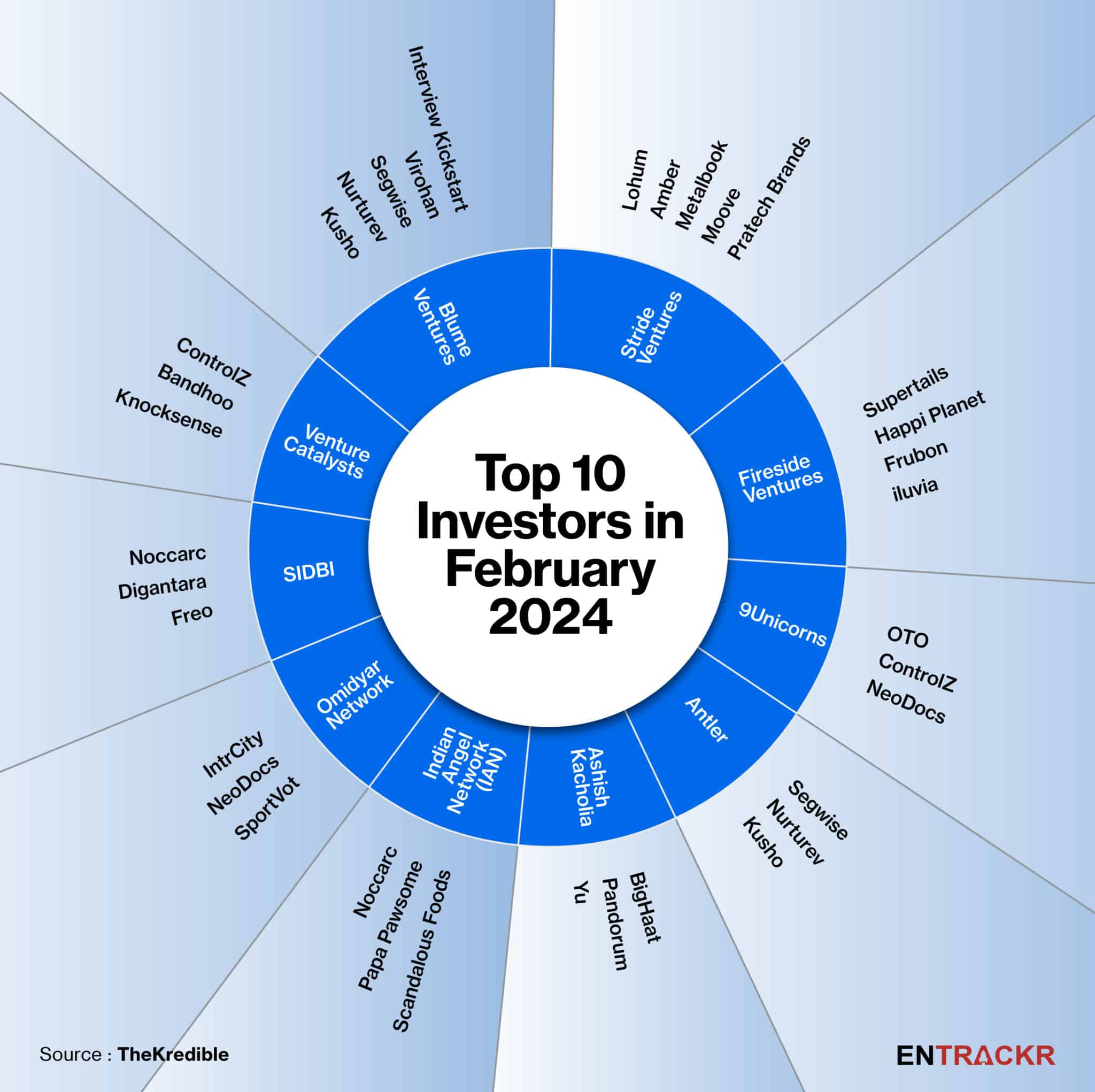

[Most active investors]

Early stage venture capital firm Blume Venture and venture debt firm Stride Ventures have emerged as most active investors in February with 5 investments each. Fireside Ventures was next on the list with four deals followed by 9Unicorns, Antler India, IAN, Omidyar, and others. The full list can be found at TheKredible.

[Mergers and acquisitions]

February witnessed 12 mergers and acquisitions deals. Acquisition of investing platform Kuvera by CRED, LotusPay by Juspay, cybersecurity startup Difenz by Signzy, gaming firm Ninja Global FZCO by Nodwin, and seafood platform CenSea by Captain Fresh were some of the notable deals during the period. In comparison, January saw nine mergers and acquisitions deals.

[Layoffs, Shutdowns, and top-level exits]

Like January, the layoffs spree continued in February as more than 350 employees were let go of across six startups. Log9 Materials topped this list with 115 employees followed by Licious, Waycool, and Polygon.

Meanwhile, Indian startups also saw 10 top-level exits. Flipkart alone saw three departures including senior vice presidents Amitesh Jha, Dheeraj A, and Bharat Ram. Paytm Payments Bank also saw the exits of two independent directors and the surprising exit of Vijay Shekhar Sharma who was the part-time non-executive chairman and board member of the company. The full list can be found here.

[Conclusion]

It might be early signs, but we would venture to say that the situation is actually improving steadily, as over a year of relatively tough market conditions have ensured a higher focus on resilience in startups. A booming stock market has also meant that amidst all the gloom of a shrinking job market, investible funds do exist for the right idea, and newer segments like Proptech that are riding the real estate boom are set to make a splash with a few big deals sooner than later. As expected, the AI rush is not getting anywhere in a hurry, and the impact will be visible over a much more extended period of time. Climate tech can also be expected to make a serious play for investor funds soon, with new opportunities in carbon markets and more. Global realignments that are underway across manufacturing and soon, services as well, augur well for India in the medium to long term, and we will soon see the first, early bets on these shifts being placed soon. While many will see the upcoming elections as a crimp for the coming quarter, we believe it will be a good time to see just how far investors have moved away from counting on favourable policies, and looking instead at stable and consistent policies to base their thesis on.