This week, as many as 17 Indian startups raised $125.13 million in funding. These deals include seven growth-stage deals and nine early-stage deals. These deals also include one early-stage startup which did not disclose the amount raised.

Last week, about 23 early and growth-stage startups collectively raised around $447 million, including two undisclosed deals.

[Growth-stage deals]

Among the growth-stage deals, seven startups raised $103.43 million in funding this week. Vernacular social media platform ShareChat led the list with $49 million debt funding. The list was followed by three fintech firms namely Aye Finance, Sindhuja Microcredit, and KreditBee which raised $16.5 million, $14.5 million, and $9.4 million funding, respectively.

Further, adtech startup AdOnMo, IPO-bound MobiKwik, and cybersecurity startup TAC Security also secured funds this week.

[Early-stage deals]

Subsequently, nine early-stage startups scooped funding worth $22.71 million during the week. Sustainable packaging startup Bambrew spearheaded the list followed by branded franchised retail chain SuperK, AI security and risk management startup SydeLabs, crypto exchange Nomoex Global, and proptech firm Aeria.

The list further includes logistics solutions provider JustDeliveries, agritech startup Elevate Foods, AI-powered deep tech startup Daakia, and B2B footwear marketplace Kaarigar Mandi.

The list of early-stage startups also includes edtech startup Aviotron Aerospace which kept the funding amount undisclosed. For more information, visit TheKredible.

[City and segment-wise deals]

In terms of the city-wise number of funding deals, Bengaluru-based startups led with 5 deals followed by Delhi-NCR, Mumbai, Hyderabad, Patna, Kolkata, and Agra.

The complete breakdown of the city and segment can be found at TheKredible.

[Series-wise deals]

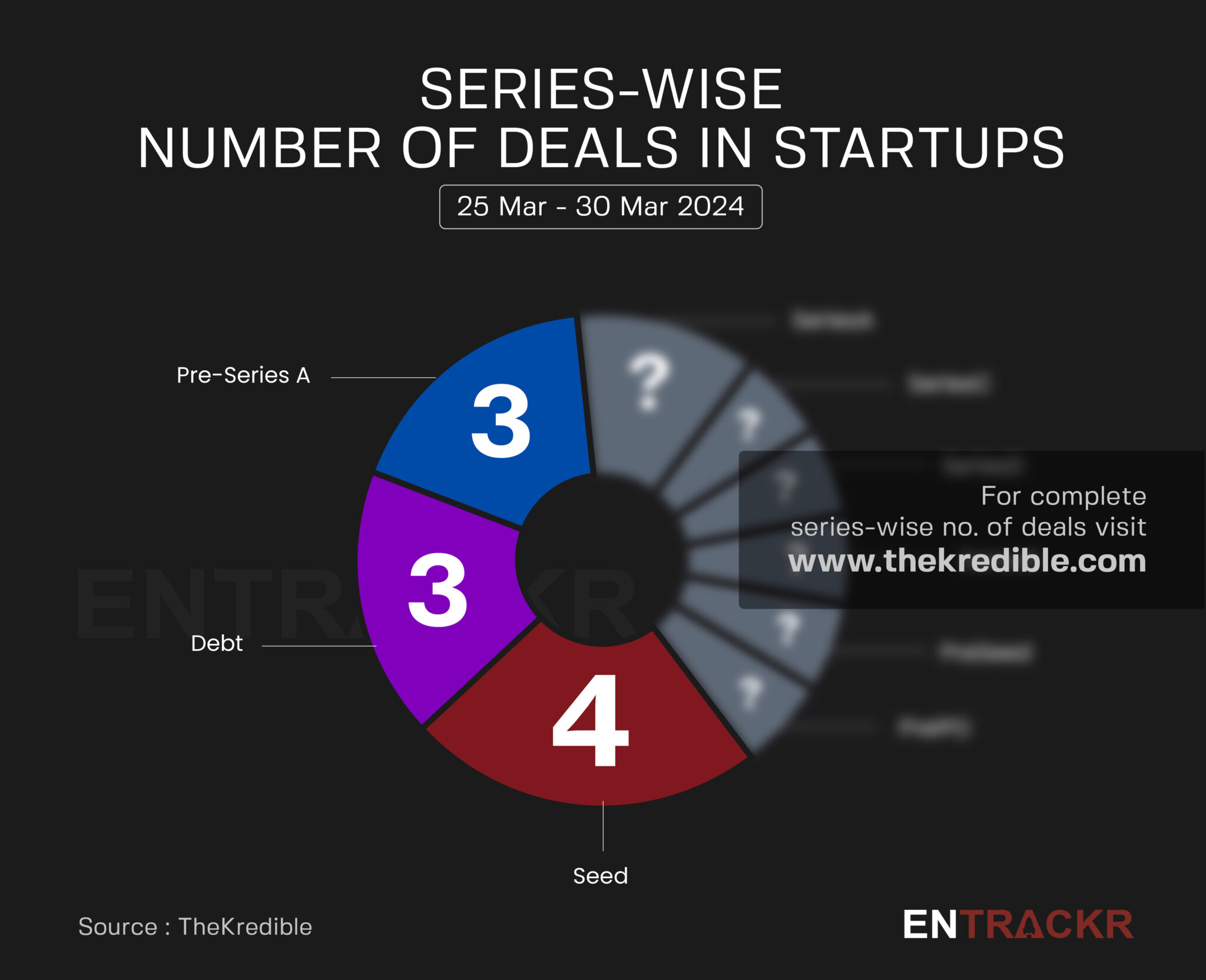

During the week, Seed funding deals are on the top spot with four deals while debt deals are in second position forming around 57% of the total funding. Further, Pre-Series A and Series A are next on the list among others.

[Week-on-week funding trend]

On a weekly basis, startup funding slipped 71% to $125.13 million as compared to $447.6 million raised during the previous week.

The average funding in the last eight weeks stands at around $259 million with 27 deals per week.

[Departure]

This week, Praveen Sharma, senior vice president of business at Paytm’s parent entity One 97 Communications, resigned nearly after over four years, the company said in an exchange filing. Sharma, in his resignation letter, said he intends to pursue “other opportunities” after his exit from the company.

[Fund launches]

The week saw only one startup-focused fund launch.

Mumbai-headquartered venture debt firm Alteria Capital has announced the final close of its third fund at approximately $186 million. The firm has backed startups such as Rebel Foods, BlueStone, OneCard, Ather, and Captain Fresh, and plans to continue its support for startups across various sectors including consumer brands, e-commerce, fintech, logistics, business-to-business platforms, rural and agritech, healthcare, and climate tech.

[Shutdown]

Investment tech startup GoldPe will cease to exist precisely one year after its inception on April 1, 2023. Co-founder Parth Shah stated that the decision was made due to the absence of a sustainable revenue stream, a flawed business model, and cash flow issues.

Visit TheKredible to see series-wise deals along with amount breakup, complete details of fund launches, and more insights.

[New launches]

▪️ Mamaearth parent Honasa launches Staze to foray into cosmetics space

▪️ Cars24 rolled out Autopilot service to get car drivers on demand

▪️ CarDekho Group’s fintech arm Rupyy forays into personal lending space

[Financial results this week]

▪️ Bounce’s revenue surges 6X to Rs 91 Cr in FY23; cuts losses

▪️ BillDesk records Rs 2,678 Cr revenue in FY23; profits fall 5%

▪️ Man Matters-parent Mosaic Wellness crosses Rs 200 Cr revenue in FY23

▪️ Myntra claims positive EBITDA in the last two quarters

▪️ IPO Prep: Swiggy paints a healthy financial picture in first 9 months of FY24

[News flash this week]

▪️ Ranjan Pai’s MEMG and 360 One get CCI nod to invest in API Holdings

▪️ ICICI Securities reiterated the ‘BUY’ rating on Zomato

▪️ Innoviti gets payment aggregator licence from the RBI

▪️ Chiratae Ventures sells stakes of portfolio startup to Madison India Capital

[Conclusion]

The weekly funding saw a significant drop in investment flow as compared to the last week when the funding crossed $440 million. This week only one VC firm Alteria Capital launched a startup-focused fund amounting to around $186 million. Additionally, the week also witnessed a shutdown as investment tech startup GoldPe shut down the shop within one year of its inception.

CCI has approved the subscription to CCPS B of API Holding by Ranjan Pai’s MEMG (Manipal Education and Medical Group) and 360 One. This decision follows CCI’s previous approval, where multiple combination proposals entailed investments by marquee investors such as Goldman Sachs, Naspers, Temasek, and CDPQ in API Holdings Ltd., the parent company of PharmEasy.

Brokerage ICICI Securities has reiterated a ‘BUY’ rating on foodtech giant Zomato and raised its price target (PT) to Rs 300 per share. This represents an upside of more than 67% from the stock’s last close of around Rs 182 on Thursday (March 28). The brokerage attributed the increase in PT to the company’s “sustained growth trajectory and sustained improvement in profitability metrics”.

Digital payments solutions company Innoviti has secured an online payment aggregator (PA) license from the Reserve Bank of India (RBI). Along with Innoviti, Navi Mumbai-based payment solutions provider Concerto Software and Systems also secured the PA license for its gateway ‘Vegaah’. This takes the tally of the number of entities to receive PA licenses in 2024 to 13. Earlier this month, Infibeam Avenues also secured final authorization from the central bank to operate as a payment aggregator via its payment gateway brand CCAvenue. Last month, Amazon Pay also received PA authorization. JusPay, Stripe, Tata Payments, and Mswipe are among the other players to receive the PA license this year.