Agritech platform Ergos has managed to grow its scale by two-thirds in the fiscal year ending March 2023 with sound economics as the Bengaluru-based company kept losses in check during the period.

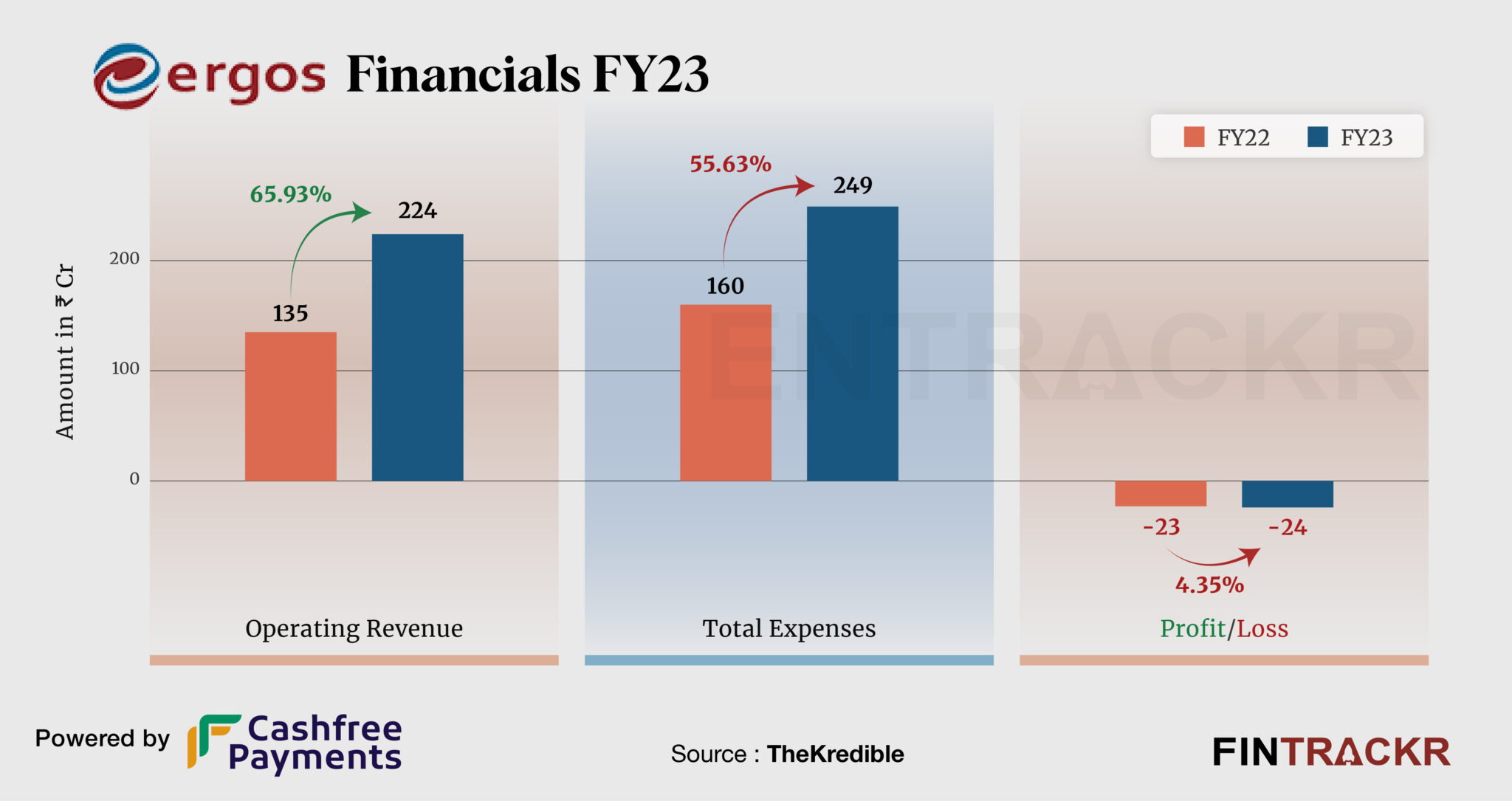

Ergos’ gross revenue grew 66% to Rs 224 crore in FY23 from Rs 135 crore in FY22, its annual financial statements (FY23) filed with the Registrar of Companies show.

Ergos enables farmers to convert their grains into tradable assets, access credit against stored produce, and make better yields. It also provides harvest supply chain solutions by leveraging technology.

The sale of commodities to the customer was the primary source of revenue for Ergos contributing to 96% of overall operating income. Wheat turned out to be the largest revenue driver followed by maize, paddy, and others. Rest of the revenue came from warehousing management fees. Visit TheKredible for a detailed revenue breakup.

Revenue Breakdown

https://thekredible.com/company/ergos/financials

View Full Data

On the expenses side, procurement costs formed 64.8% of the overall expenditure which spiked 65% to Rs 211 crore in FY23. Other costs such as employee benefits, rent, professional, vehicle and traveling costs took its overall expenditure to Rs 249 crore in FY23 from Rs 160 crore in FY22.

Head to TheKredible for a complete expense breakup.

Expenses Breakdown

https://thekredible.com/company/ergos/financials

View Full Data

https://thekredible.com/company/ergos/financials

View Full Data

- Cost of procurement

- Employee benefit

- Rent

- Others

The decent growth in scale and effective cost mechanism helped Ergos to control its losses which stood at Rs 24 crore in FY23 as compared to Rs 23 crore in FY22. Its ROCE and EBITDA margin stood at -69% and -8.9% respectively. On a unit level, Ergos spent Rs 1.11 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -16% | -8.9% |

| Expense/₹ of Op Revenue | ₹1.19 | ₹1.11 |

| ROCE | -44% | -69% |

As of now, Ergos has raised around $32 million across several rounds and was last valued at around $55 million. According to the startup data intelligence platform TheKredible, Aavishkaar Capital is the largest stakeholder with 48% followed by Chiratae Ventures and CDC Group. Currently, its founder and chief executive officer Kishor Kumar Jha commands 11.84% of the company.

Operating to provide farmers avenues beyond MSP procurement one assumes, Ergos ses to be on a good pitch to leverage inefficiencies in the supply chain. However, one has to wonder just how far and high the model can take the firm. Perhaps a move into other crops will follow once enough of a network and learnings have been built in.