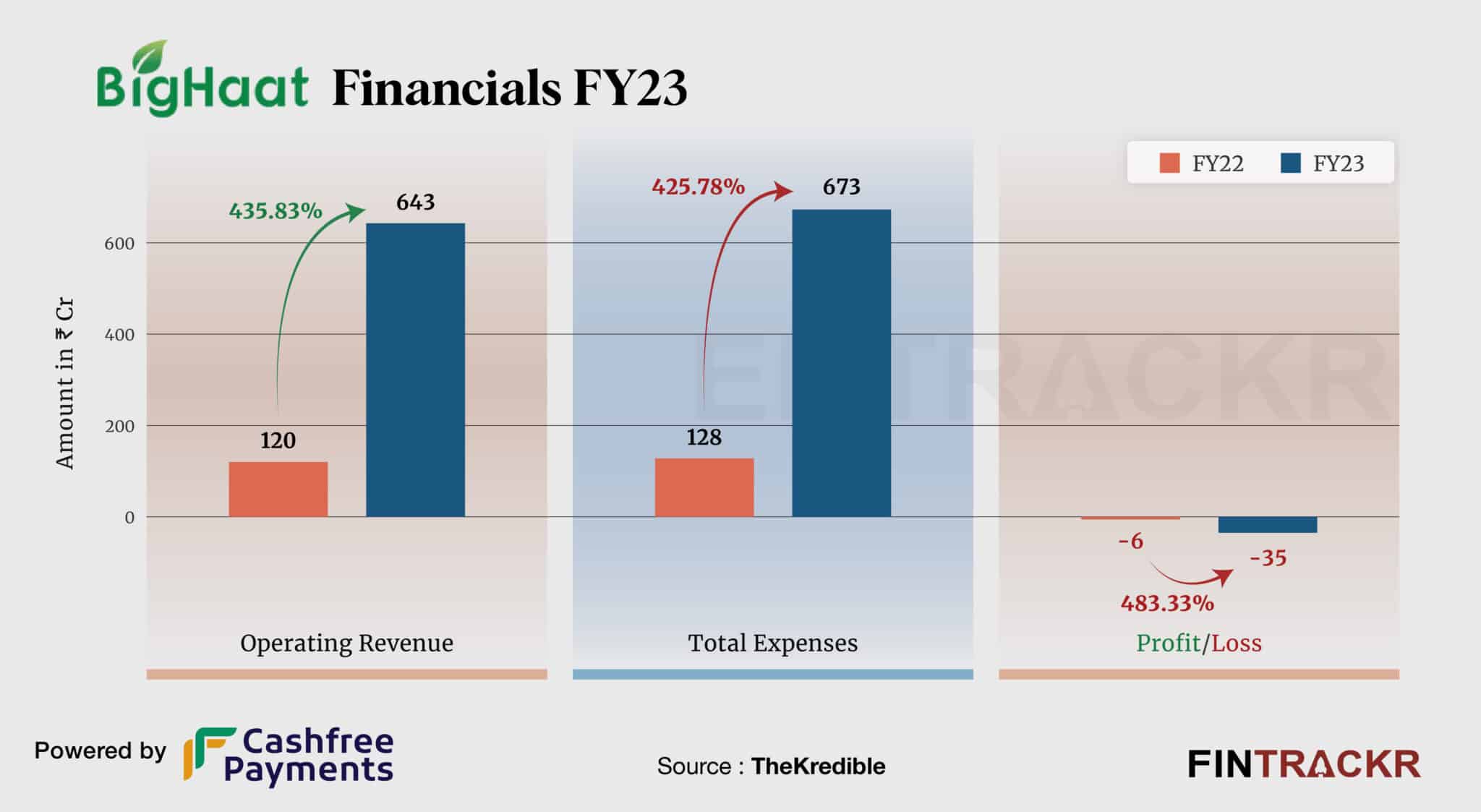

Agritech startup BigHaat registered over five-fold growth during the fiscal year ending March 2023. However, in pursuit of rapid scale its losses also rose in a similar proportion during the same period.

BigHaat’s gross revenue surged 5.3X to Rs 643 crore in FY23 from Rs 120 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Founded in 2015, BigHaat leverages technology to provide a wide range of solutions and services to farmers, helping them optimize their agricultural practices and increase productivity.

Market linkages formed 92% of the overall gross revenue which increased 6.6X to Rs 594 crore in FY23. The rest of the income comes from input business, exports, commission of marketplace, and others. See TheKredible for the detailed revenue breakup.

Revenue Breakdown

https://thekredible.com/company/bighaat/financials

View Full Data

In tune with growth in scale, its cost of procurement emerged as the largest cost center accounting for 92.5% of the total expenditure. This cost rose by 5.4X to Rs 623 crore in FY23 from Rs 115 crore in FY22.

Its employee benefits, selling cum distribution, legal-professional, information technology, fulfillment, and other overheads took the total expenditure to Rs 673 crore in FY23 from Rs 128 crore in FY22.

Head to TheKredible for the complete expense breakup.

Expenses Breakdown

https://thekredible.com/company/bighaat/financials

View Full Data

https://thekredible.com/company/bighaat/financials

View Full Data

- Cost of procurement

- Employee benefit

- Selling and distribution

- Legal professional

- Information technology

- Fulfilment cost

- Others

The spurt in procurement and employee benefits resulted in a significant increase in losses, rising 5.8X to Rs 35 crore in FY23 from Rs 6 crore in FY22. Its ROCE and EBITDA margin stood at -40% and -4.3%, respectively. On a unit level, it spent Rs 1.05 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -6% | -4.3% |

| Expense/₹ of Op Revenue | ₹1.07 | ₹1.05 |

| ROCE | -14% | -40% |

BigHaat has raised $29 million to date and was valued at $58 million in its last round. As per the startup data intelligence platform TheKredible, JM Financial is the largest external stakeholder with 27.29% followed by Ankur Capital and Beyond Next Ventures. Its co-founders Sateesh Nukala and Sachin Nandwana cumulatively command 23.29% of the company.

The numbers would indicate a business that is more about trading and arbitrage than anything else, unless BigHaat incurred some major one off expenses. But at this scale, it’s obvious that the firm has the ability and knowledge to make it count, which is what should make it an interesting agritech to track from here on.