Many Indians keep their valuable assets, including gold or important documents, by storing them in cupboard lockers or traditional home safes. However, this exposes these items to several risks like theft or disasters. Some choose bank lockers for added security. Yet, this has its own set of challenges, including issues related to transparency in locker allotment, security apprehensions, ambiguous liability clauses, and more.

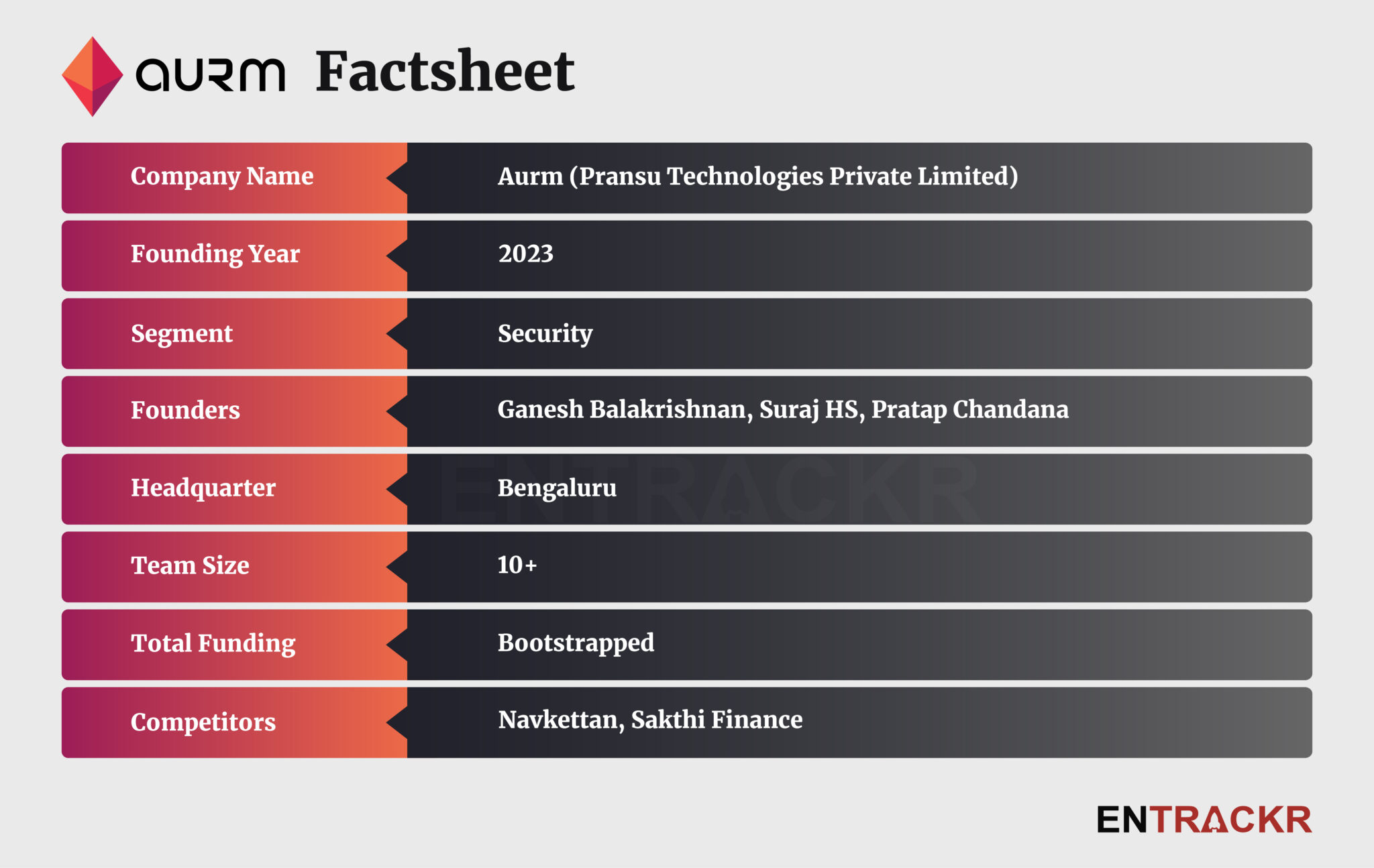

Bengaluru-based Aurm is trying to bridge this gap in the country with its unique safe solution, which focuses on easy availability and access, high-end security, privacy, and even an insurance up to Rs 25 lakh. Aurm has partnered with banks and real estate companies to provide these safe deposit lockers.

We spoke to Aurm co-founder and head of marketing Ganesh Balakrishnan to learn more about his startup, how it operates, and lots more. Here are the edited excerpts:

We don’t often hear much about startups in such sectors. How did you come up with this idea?

I and our co-founders, who have been working together at MyGate for some time now, were brainstorming on ways to add value to urban affluent Indians beyond what MyGate was doing for residential security. I joined them in the brainstorming sessions, and soon built a camaraderie with the team.

Together, we zeroed in on the problem of safely storing valuables like gold, jewellery and important documents. Most affluent Indians have tried to get a bank locker at some point, but have been unsuccessful due to the unavailability of lockers in their nearby bank branches. The problem is becoming more acute as they are moving into urban clusters with high-rise apartments and gated communities, where the density is high and banks are unable to set up enough branches and provide lockers to cater to the demand.

Aurm is envisioned as a solution to provide secure, easily accessible safe deposit storage for the affluent urban Indian population.

Please help understand how Aurm operates, and what is its business model?

The company partners with banks to offer state-of-the-art safe deposit storage facilities that are fully automated, and available 24 hours a day, 365 days a year. Aurm vaults are equipped with military grade security infrastructure, active surveillance and intrusion detection systems. All safes provided by Aurm are adequately insured. The vaults are fully automated, with a luxurious dressing room experience. Aurm vaults can be located in bank branches, corporate offices, malls or in residential communities.

Our revenue model is based on annual subscriptions from end users, who pay an annual subscription fee to access and utilise our safe deposit storage services. We partner with banks and real estate builders through revenue and cost sharing arrangements.

How has your platform grown since inception, and what are your near-term targets?

Since inception, we have expanded our presence to three societies and gained over 600 active subscribers. In the short term, we aim to establish our presence in three cities by the year-end, with plans to expand our reach to ten cities within the next three years. Leveraging strategic partnerships with banks, will enable us to reach 400,000 subscribers.