Tech upskilling platform Scaler Academy secured $55 million led by Lightrock India just before the commencement of FY23. The capital helped the Bangalore-based startup leap 4.9X during the previous fiscal year ending March 2023. Despite the growth though, the losses of the firm saw a surge of 90% during the same period.

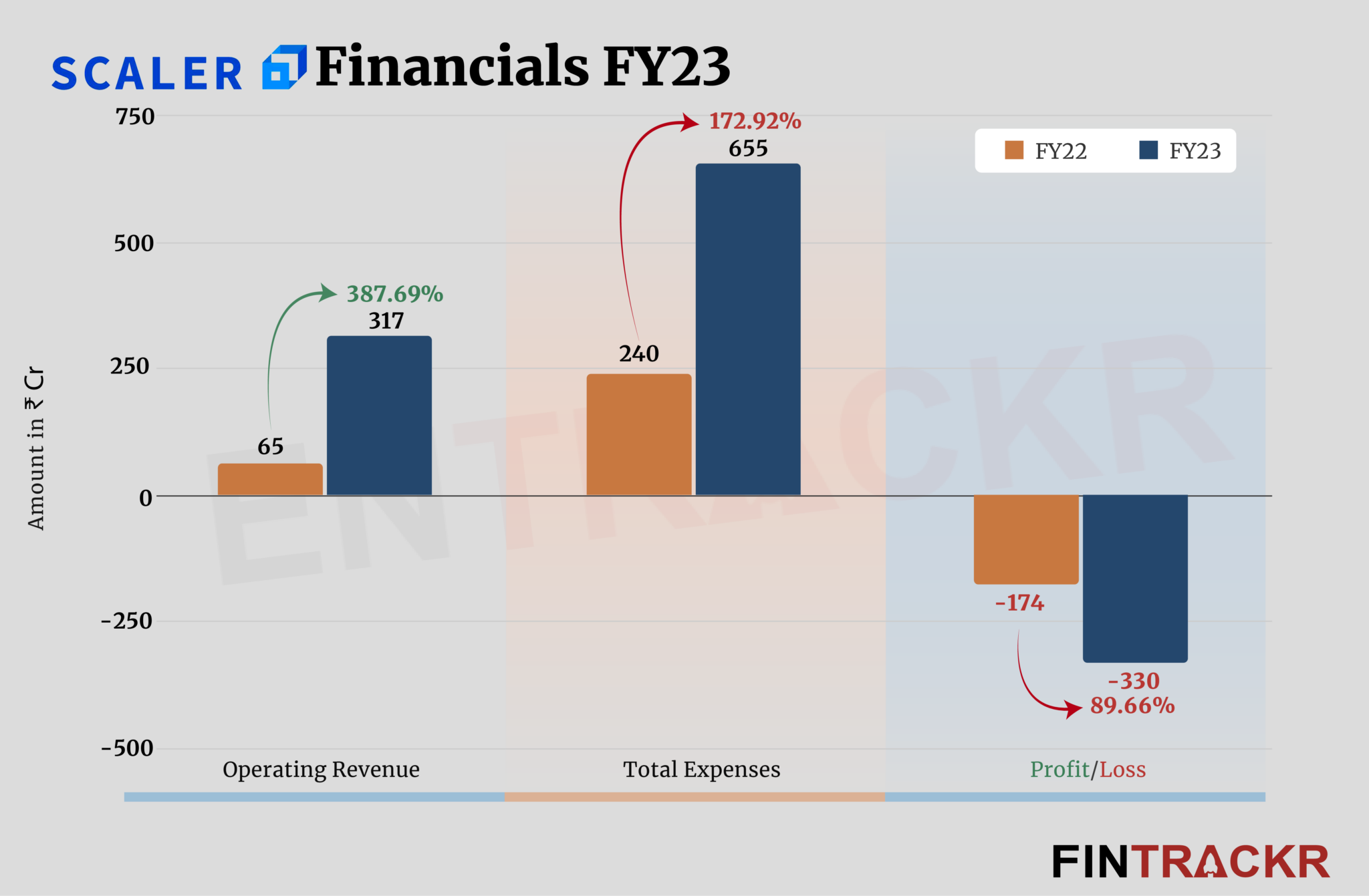

Scaler’s revenue from operations increased 388% to Rs 317 crore in FY23 from Rs 65 crore in FY22, its consolidated financial statements filed with the Registrar of Companies show.

Launched in 2019, Scaler focuses on upskilling college students and tech professionals. The company offers an intensive six-month computer science course through live classes delivered by tech leaders and subject matter experts.

The sale of educational services is the sole source of revenue for Scaler. The company also has a non-operating income of Rs 7.6 crore which took its total revenue to Rs 324 crore in FY23.

In line with fellow ed-tech startups, employee benefits emerged as the largest cost center, accounting for 49% of the overall expenditure. This cost rose 2.7X to Rs 322 crore in FY23 from Rs 119 crore in FY22.

Its rent, advertising cum promotional, information technology, legal and other overheads took the overall expenditure up by 2.7X to Rs 655 crore in FY23 from Rs 240 crore in FY22.

See TheKredible for the detailed expense breakup.

Expense Breakdown

https://thekredible.com/company/scaler-academy/financials

View Full Data

https://thekredible.com/company/scaler-academy/financials

View Full Data

- Employee benefit

- Rent

- Information technology

- Advertising promotional

- Legal professional

- Others

An increase of 2.7X in employee benefits and 2.2X in advertising costs led Scaler to record a loss of 330 crore in FY23, a 90% surge from Rs 174 crore in FY22. Its EBITDA margin stood at -96.9%. On a unit level, it spent Rs 2.07 to earn a rupee in FY23.

Scaler has raised over $75 million across rounds and was valued at $710 million during its last round.

According to the startup data intelligence platform TheKredible, Peak XV (formerly Sequoia Capital) is the largest external stakeholder with 22.52% followed by Lightrock India and Tiger Global. Its co-founders Abhimanyu Singh and Anshuman Singh cumulatively command 58.1% of the company.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -256% | -96.9% |

| Expense/₹ of Op Revenue | ₹3.69 | ₹2.07 |

| ROCE | -791% | N/A |

The high promoter holding augurs well for the medium and long term ambition of the firm, as it continues to tap into the huge upskilling opportunity in tech for engineers. With a thrust on individuals rather than corporate selling, the firm has also taken a different approach from some others, and will hope that marketing costs temper gradually as the brand builds a stronger case with strong word of mouth. FY24 numbers will be the real pathway to profitability for the firm, as they define its growth momentum and costs that are relatively more sticky.