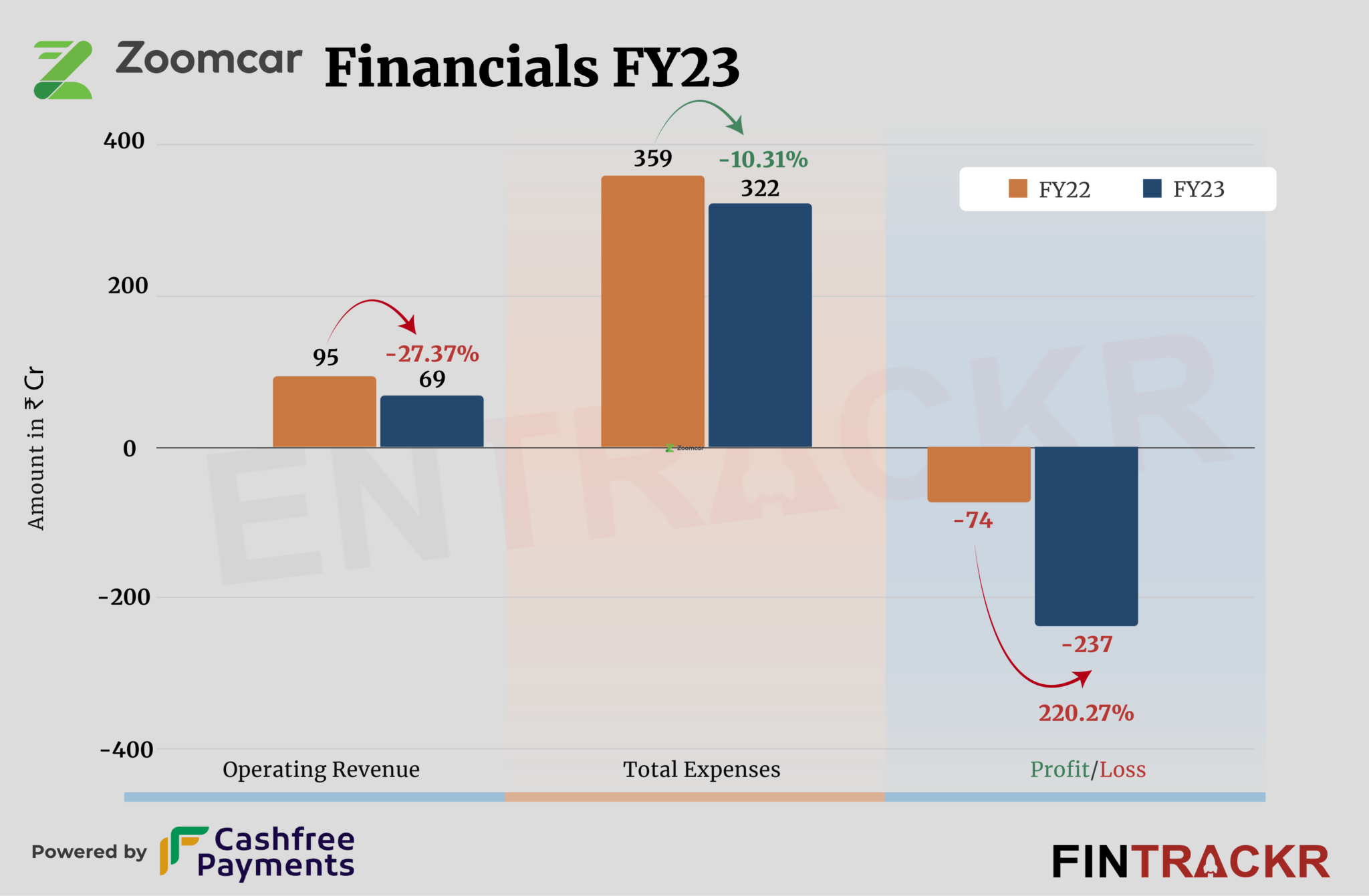

Zoomcar is confident that it will turn profitable in FY24. If that happens, it would indeed be one of the stories of the year, if we consider the company’s financial performance in the fiscal year ending March 23: Revenues of the India arm of the car-sharing platform declined by 27% in FY23, whereas losses jumped 3.2X to Rs 237 crore.

Zoomcar India’s revenue from operations declined to Rs 69 crore in FY23 from Rs 95 crore in FY22, its standalone financial statements sourced from the Registrar of Companies (RoC) show.

While the company claims to make money from commission on short-term rentals, subscriptions, as well as facilitation services, Zoomcar India didn’t provide revenue break-up for FY23. The firm also made Rs 15.6 crore from non-operating income during the same period. This income stood at Rs 135.2 crore in FY22.

While Zoomcar India’s standalone balance sheet might not present its true financial health in FY23, the company declined to comment on a detailed questionnaire sent by Entrackr which included specific queries on its structure, and revenue recognition among others.

As far as expenses go, the cost of employee benefits emerged as the largest cost center accounting for 39% of the overall expenditure. This cost increased 6.7% to Rs 127 crore in FY23 from Rs 119 crore in FY22.

Expense Breakdown

https://thekredible.com/company/zoomcar/financials

View Full Data

https://thekredible.com/company/zoomcar/financials

View Full Data

- Employee benefit expense

- Finance costs

- Information technology expenses

- Legal professional charges

- Advertising promotional expenses

- Others

Its advertising cum promotional, finance, legal-professional, information technology, and other overheads took Zoomcar’s total expenses to Rs 322 crore in FY23 from Rs 359 crore in FY22.

Even though the company managed to keep spendings in check, a relatively large dip in revenue and other income pushed the company’s losses 3.2X to Rs 237 crore in FY23. In contrast, its losses stood at Rs 74 crore in FY22. On a unit level, it spent Rs 4.67 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -11% | -242% |

| ROCE | -41% | N/A |

| Expense/Rupee of ops revenue | ₹3.78 | ₹4.67 |

Recently, Zoomcar inked a merger agreement with Innovative International Acquisition Corp and subsequently became a publicly listed entity on Nasdaq. The decade-old company currently operates across more than 50 cities globally (majorly in India) and has over 3 million active users and over 25,000 vehicles registered on its marketplace.

Terming itself the largest emerging market focused car sharing platform, Zoomcar is present across India, the MENA region and SE Asia. The decade old firm has suffered setbacks like the pandemic linked disruption, but done well to travel this far. Even while offering a service that most consider relevant to these markets, the firm has seemingly struggled to get the balance right in terms of cost versus customer service, going by reviews across social media. The high losses would preclude any major investments into brand building one would think, making one wonder just what the firm has in the works to deliver the kind of results it has promised. Watch this space to know!