Rapido had raised $180 million from Swiggy, WestBridge, TVS Motor, Shell Ventures, and Nexus Ventures at the beginning of FY23. The substantial funding helped Rapido scale up 3X and gave additional flexibility to control costs.

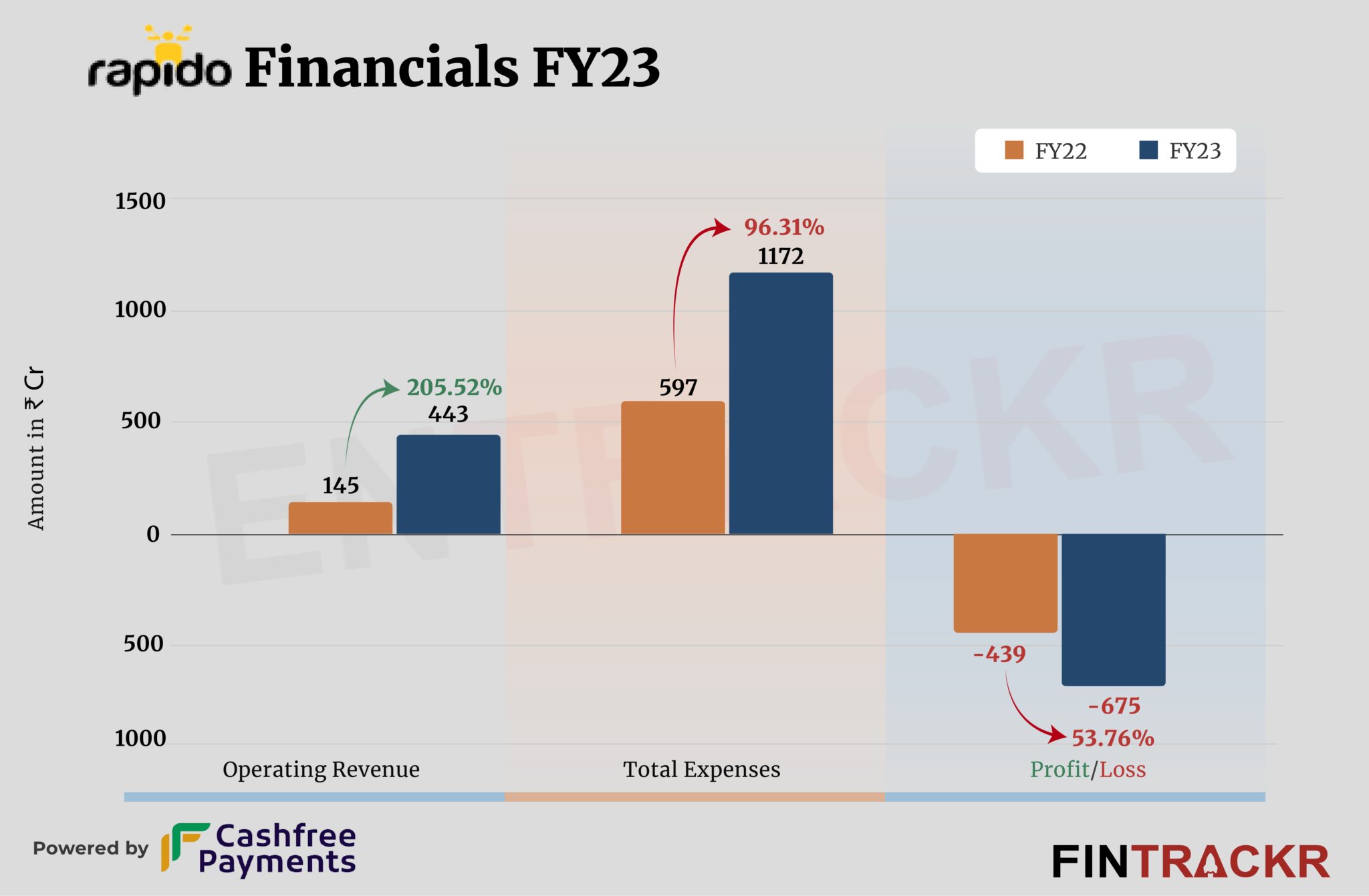

Rapido’s revenue from operations surged 3X to Rs 443 crore during the previous fiscal year ending March 2023 from Rs 145 crore in FY22, its annual financial statements sourced from the Registrar of Companies show.

Rapido generates revenue by providing bike taxis, autos, and delivery services, along with its subscriptions and marketing income. Income from the delivery services is the primary source of revenue for Rapido.

The company has more than 25 million downloads with over 1 million captains (riders) and 10 million customers. The company has a presence in more than 100 cities across India.

The company also has another income (non-operating) of Rs 54 crore from the interest of current investments which tally its total income to Rs 497 crore during FY23.

Moving towards its cost side, incentives and charges paid to captains (riders) accounted for 44% of the overall expenditure. In the line of scale, this cost surged 2.4X to Rs 517 crore in FY23 from Rs 214 crore in FY22. Its employee benefits also saw a surge of 93.5% during the previous fiscal.

Expense Breakdown

https://thekredible.com/company/rapido/financials

View Full Data

https://thekredible.com/company/rapido/financials

View Full Data

- Employee benefit

- Advertising promotional expenses

- Infrastructure and software charges

- Support services cost

- Riders incentives and fees

- Others

The advertisement cum promotion, software & infrastructure, support service, legal fees, and other overheads catalyzed the total expenditure up by 96.31% to Rs 1,172 crore in FY23 from Rs 597 crore in FY22.

A notable jump in riders’ cost, IT, and employee benefits pushed rapid0’s losses by 53.76% to Rs 675 crore in FY23 as compared to Rs 439 crore in FY22. Its ROCE and EBITDA margin stood at -88.5% and -134.6% respectively. On a unit level, it spent Rs 2.65 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | -275% | -134.6% |

| ROCE | -1021% | -88.5% |

| Expense/Rupee of ops revenue | ₹4.12 | ₹2.65 |

In the ongoing fiscal year, Rapido has also forayed into cab aggregation space with the launch of ‘Rapido Cabs’. The firm has initiated pilots in Hyderabad, Bengaluru and Delhi-NCR.

Instead of a commission-based system like Ola and Uber, Rapido Cab is approaching the SaaS model wherein drivers will have to pay a dynamic subscription fee based on their earnings through the platform.

While the ban on bike taxis in Maharashtra and Delhi circles would have impacted the earnings of Rapido, the move to take on Ola and Uber via cab services may help the company to improve its balance sheet.