Homegrown over-the-top (OTT) platform Ullu has been growing at a brisk pace in the last few fiscals and the firm maintained an upward trajectory in FY23 as well. The firm’s income grew around 2X in FY23 while its profit soared nearly 4X.

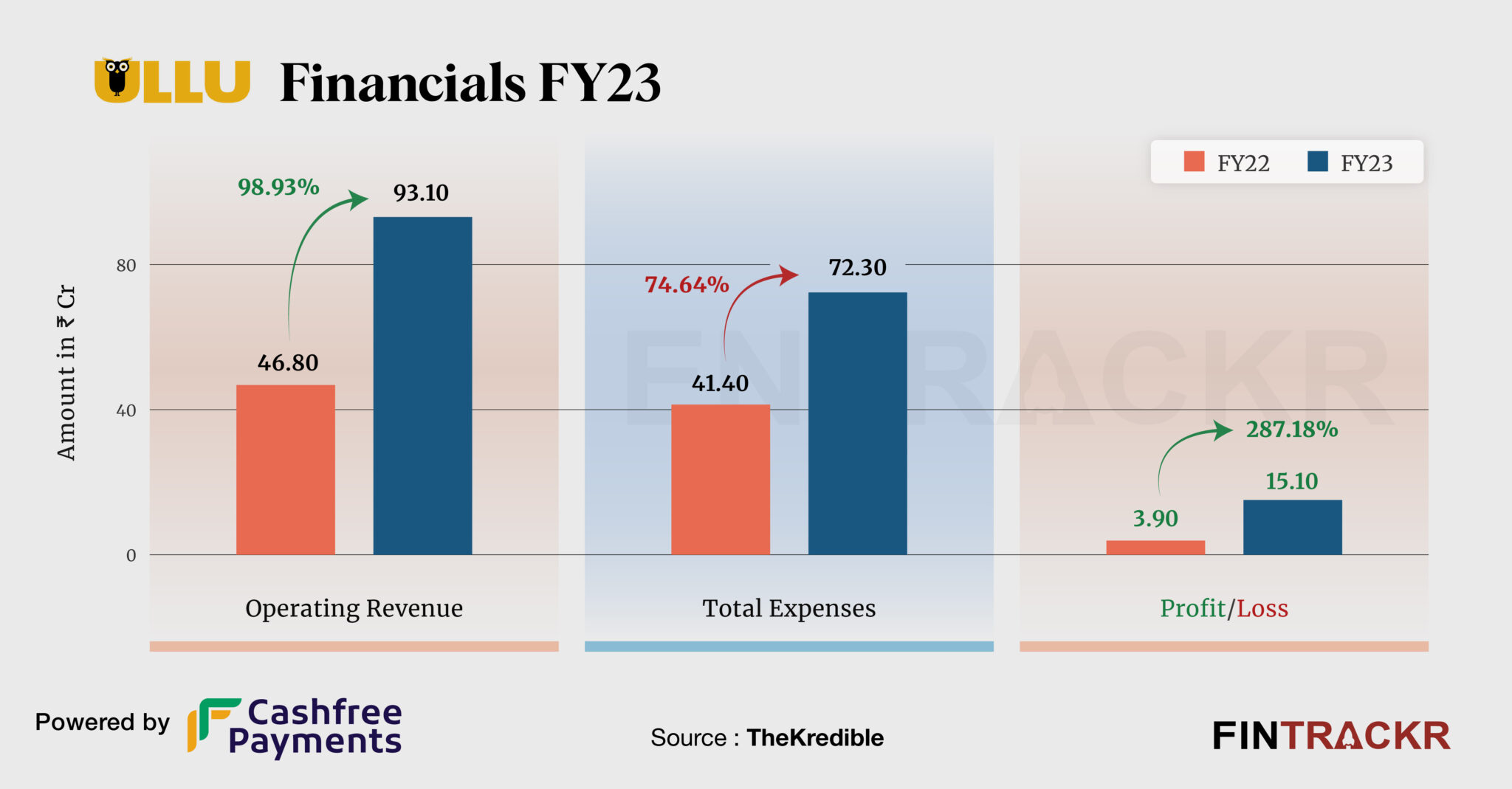

Ullu’s revenue from operations grew two-fold to Rs 93.1 crore in the fiscal year ending March 2023 from Rs 46.8 crore in FY22, its annual financial statements filed with the Registrar of Companies show.

Ullu is a membership-led platform which streams web series, movies, and other forms of content. Income from the sale of subscriptions was the sole source of revenue for the Vibhu Agarwal-led firm.

Akin to other OTT platforms, the cost of production accounted for 50% of the company’s total expenditure. This cost increased by 87% to Rs 35.9 crore in FY23 from Rs 19.2 crore in FY22. Its advertising cum promotional cost saw a surge of 300% and flew to Rs 20 crore in FY23.

Expenses Breakdown

https://thekredible.com/company/ullu/financials

View Full Data

https://thekredible.com/company/ullu/financials

View Full Data

- Cost of production

- Employee benefit expense

- Advertising promotional expenses

- Legal professional charges

- Rent

- Others

Its employee benefits, legal cum professional, rent, information technology, and other overheads took the firm’s overall expenditure up by 74.64% to Rs 72.3 crore in FY23 from Rs 41.4 crore in FY22.

The growing scale and prudent cost mechanism helped Ullu to increase its profits 3.87X to Rs 15.10 crore in FY23 as compared to Rs 3.90 crore in FY22. Its ROCE and EBITDA margin improved to 91% and 24% respectively. On a unit level, it spent Rs 0.78 to earn a rupee in FY23.

FY22-FY23

| FY22 | FY23 |

| EBITDA Margin | 14% | 24% |

| Expense/₹ of Op Revenue | ₹0.88 | ₹0.78 |

| ROCE | 66% | 91% |

According to the startup data intelligence platform TheKredible, Ullu’s founder and CEO Vibhu Agarwal holds a 65% stake in the company while his wife Megha Agarwal commands 35% of the holding.

For the firm based on the simple dictum “sex sells”, the good times have certainly been on an extended run so far this decade. During this time, the firm has not just skirted around the law in India but managed to build some sort of a brand for er…sleaze. The sex certainly seems to have addled the mind of many of its subscribers, who don’t seem to know that it is one commodity whose price has only gone one way on the web, down. Ullu, we fear, will be one of those firms remembered by a small but loyal section of its users as one of those strange online expenses they acquired in the 2020s. Survival beyond that will take a lot more than the titillating videos the firm reels off currently.